Used to be that if you delivered against the SLAs in your CCO engagements service providers could count on a pretty stable book of business. The formula was to deliver consistently solid service and continue to drive a compelling business case for clients. In fact, adherence to SLAs was often one of the top criteria against which the buyers we spoke to would evaluate the success of their CCO engagement. But times are changing. Everest Group’s research shows that delivering on SLAs is now table stakes. And despite the fact that CCO providers typically do a solid job delivering on SLAs, over the past 2-3 years the rate of contract terminations has edged up from 50% in 2012 to 60% in 2014. What’s driving this ongoing shift?

There’s more to the story than meets the eye. While terminations are up, so too is the number of net new contracts and the scope and size of existing active contracts. In fact, total spending on CCO services continues to grow at 5% CAGR. While this may seem slow compared to other services markets, you have to keep in mind that the CCO market is huge at US$75 billion in annual revenues, so the absolute spending growth is not insignificant.

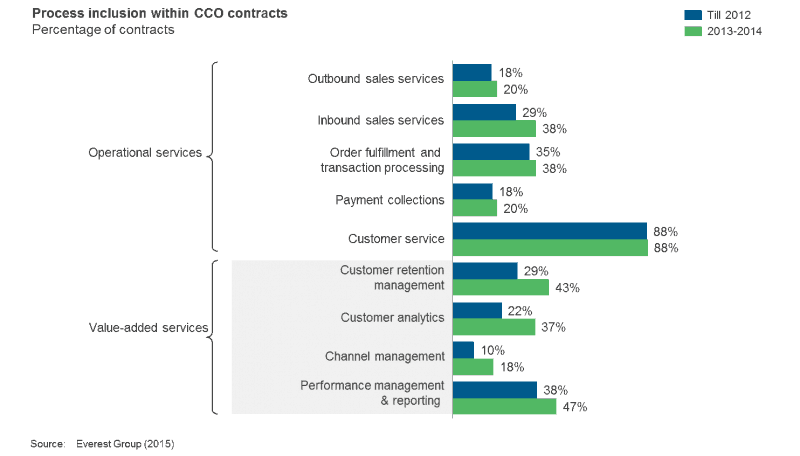

A key point here is that existing contracts are now contributing the larger share of net new spending in the CCO market, with average contract sizes growing from US$32 million in 2009-2011, to US$51 million in 2014. This growth in spending tends to come from a notable expansion in process scope. Not only have we seen growth in the total number of processes clients are asking their CCO providers to assume on their behalf, a bulk of the incremental processes fall into the category of value-added services. Growing from an aggregated inclusion rate of 42% to 61%, this could involve processes such as channel management, customer retention, analytics, or performance management.

At the same time, major CCO buyers tell Everest Group they are increasingly looking for opportunities to develop deeper working relationships with fewer CCO service providers – essentially consolidating their portfolio of work with fewer strategic partners. The expectation of these relationships is that CCO providers will meet a larger set of client requirements through a broader range of capabilities, including process scope, geographic coverage, and industry specialization. We have already seen CCO providers responding to this shift in buyer expectations as evidenced by the number of acquisitions taking place in the market, targeting both growth in scale/scope, but also in terms of vertical industry and technology capabilities.

For service providers to hold onto their client relationships they must continue innovating their approach to client relationships, the offerings in their portfolios, and their willingness to broaden the definition of customer care services.

For more CCO insights, download a complimentary preview of our CCO Annual Report.

Photo credit: Flickr