With no rest for the weary, a wave of regulatory overhaul and technological disruptions made the first half of 2015 very busy for enterprises in the banking, financial services, and insurance (BFSI) sector. Indeed, rather than being an enabler of efficiencies and operations, technology is now the fundamental differentiator for banks to grow their revenue and increase market share.

To keep up with all the activity, Everest Group in the past six months published a number of research reports examining the health of the market, the service provider landscape, and the digital effectiveness of BFSI organizations.

Following are some key insights and highlights from our research.

- Overall BFSI ITO sector

- The global BFSI ITO market size was estimated to be US$110-130 billion in 2014

- Increasing regulatory scrutiny placed higher cost pressures on BFSI buyers, leading to a reduction in the total ITO spend. This in turn resulted in a decline of 5 percent in the number of transactions, and a 43 percent decrease in total value of BFSI ITO contracts signed in 2014

- Banking

- Banking organizations globally are focusing on a triple mandate: run, manage, and change. This focus translates into efficiency, compliance, and transformation initiatives

- Our ITO in Banking Annual Report: Riding the Digital Wave report found that investment in digital channels (mobile, online, and social), disruption in the payments landscape, and the emergence of small and medium enterprises (SMEs) as a focus segment have raised demand in retail banking, cards and payments, and the lending lines of business. Against the backdrop of banking market characteristics, the report also identifies key initiatives banks are undertaking to address the industry headwinds

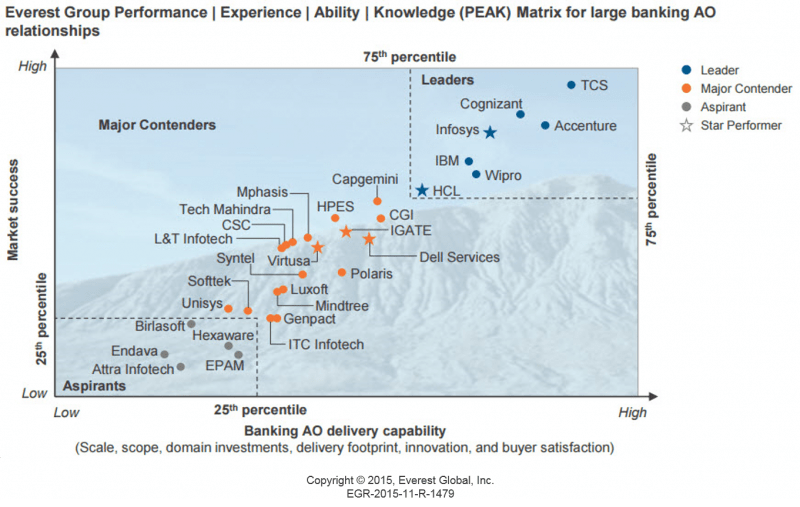

- Dell Services, HCL, IGATE, Infosys, and Virtusa were the 2015 Banking AO Market Star Performers in our ITO in Global Banking PEAK Matrix™ report: Rise of the Challengers, based on their Year-on-Year (YoY) movement in our annual assessment

- Retail banks are making significant investments to stay relevant to digital natives and the millennial generation. A seamless transaction experience, stronger customer engagement through higher penetration of digital channels, posting of richer content, and larger breadth of value-added services are some of the key attributes of digital leaders in the retail banking space, per our first-ever APEX Matrix™ that assesses leading retail banks in the United States and United Kingdom on their digital functionality and the business impact it generates

- Capital markets

- The capital markets industry is undergoing a technology revolution, and the landscape is transforming rapidly with financial technology startups disrupting the capital markets business model with nimbleness and adoption of agile development

- High cost pressures and market scrutiny plagued 2014, resulting in the lowest number of large (>US$25 million) AO transactions signed in the last five years. In fact, 58 percent fewer deals were signed in 2014 than in 2013

- Capital markets organizations increased their focus on SI/consulting and testing services in areas such as regulatory compliance, big data, automation, and platform integration, as discussed in our research report IT Outsourcing in Capital Markets – Annual Report 2015: Steering Through the Chaos, which analyzes capital markets ITO buyer trends and their implications for service providers

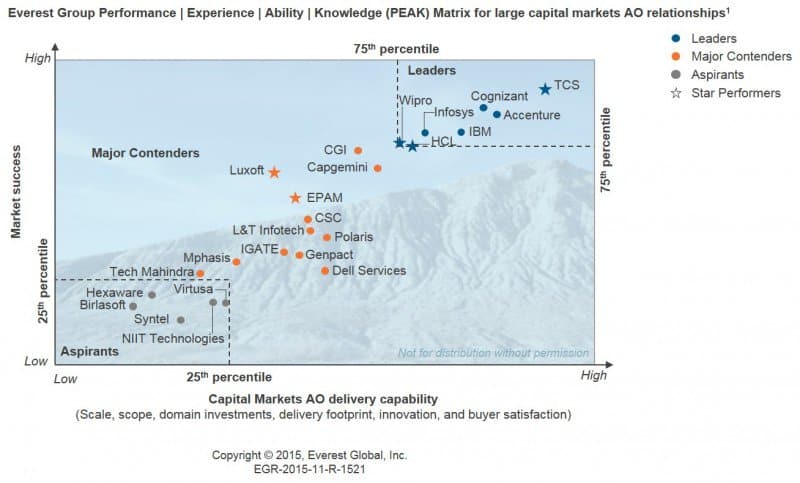

- As presented in our report IT Outsourcing in Global Capital Markets – SPL with PEAK Matrix Assessment 2015: A Crowded Marketplace, ITO in global capital markets scaled up to ~US$7.6 billion in revenue and ~110,000 capital markets AO FTEs spread across 20+ delivery countries. The 2015 Capital Markets AO Star Performers were EPAM, HCL, Luxoft, TCS, and Wipro

So what is in store for the next few months? Lots! Our upcoming reports through the end of 2015 include:

- Insurance – We’ll be exploring industry trends in our upcoming ITO annual report on the global insurance market (Life, P&C, and Re-insurance), and evaluating global insurance service providers in our global Insurance AO PEAK Matrix report

- BFSI in Europe – Europe is driving the financial services market in terms of new deal signings. Our upcoming Europe-focused PEAK Matrix assessments on Banking and Capital markets in Europe and Insurance in Europe will explore the European service provider landscape

- Digital PEAK Matrix assessments – Service providers’ offerings within the digital technologies umbrella are rapidly maturing. To cover the evolving excitement in the industry, we are significantly expanding our portfolio of published PEAK Matrix evaluations in 2015. New reports we will be publishing before the end of year are:

- Mobility in banking

- Mobility in insurance

- Big data analytics in banking

- Big data analytics in insurance

Everest Group’s goal is to help ensure enterprises and service providers achieve maximum success from their sourcing initiatives. Thus, we encourage you to reach out to us directly with your questions and comments.

Jimit Arora, VP and Global Head of IT Services Practice, [email protected]

Aaditya Jain, Senior Analyst, [email protected]

Archit Mishra, Senior Analyst, [email protected]

Ronak Doshi, Senior Analyst, [email protected]