Filter

Displaying 1-10 of 100

Virtual Roundtable

1 hour 30 minutes

How to Thrive in Adversity in APAC? Look to Procurement Leaders | LinkedIn Live

On-Demand LinkedIn Live

1 hour

2025 CPO Objectives: Facing Challenges, Achieving Business Goals, and Future Aspirations | Webinar

On-Demand Webinar

1 hour

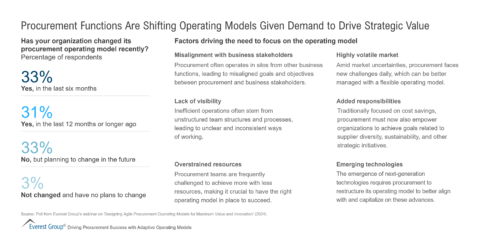

Designing Agile Procurement Operating Models for Maximum Value and Innovation | Webinar

On-Demand Webinar

1 hour

Mitigating Supplier Risks: The Power of Advanced Tools and Technologies | Webinar

On Demand Webinar

1 hour