Reimagine growth at Elevate – Dallas 2025. See the Agenda.

Filter

Displaying 11-20 of 100

Virtual Roundtable

1 hour 30 minutes

Sourcing Leaders’ Key Priorities: Accelerating Growth Through Global Services | Webinar

On-demand Webinar

1 hour

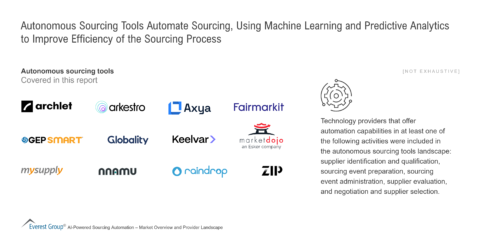

AI-driven Sourcing: Discover the Best-in-Class Features in Autonomous Sourcing Tools | Webinar

On-demand Webinar

1 hour