Reimagine growth at Elevate – Dallas 2025. See the Agenda.

Filter

Displaying 51-60 of 159

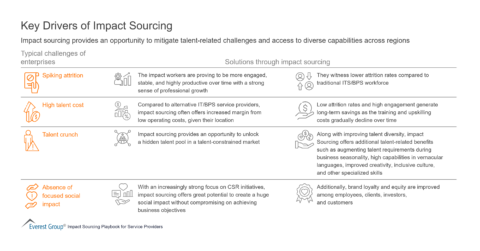

Delivery with Purpose: A Guide for Service Providers in Impact Sourcing | Virtual Roundtable

December 7, 2023

9 a.m. EST | 7:30 p.m. IST

Virtual Roundtable

1 hour 30 minutes

Global Supplier Diversity: A Path to Inclusive Procurement | LinkedIn Live

On-Demand LinkedIn Live

1 hour