Reimagine growth at Elevate – Dallas 2025. See the Agenda.

Filter

Displaying 31-40 of 204

The Role of Technology in Advancing Member and Patient Engagement | LinkedIn Live

On-Demand LinkedIn Live

1 hour

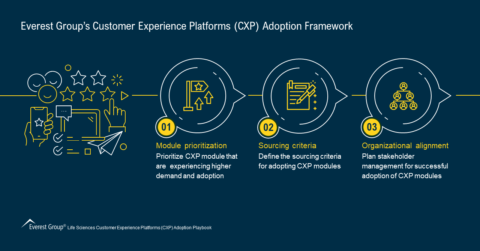

Efficient CX Delivery: A Tech-driven Approach | Webinar

September 26, 2024

9:00 AM PT | 12:00 PM ET

Webinar

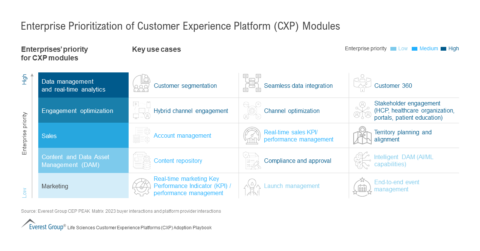

Elevating CX: Trends and Insights for a Unified CX Tech Strategy | Webinar

On Demand Webinar

1 hour