The general insurance (GI) industry has largely remained silent in a world where conversations either begin or end with the word “digital.” Products and services from the traditional GI providers have failed to keep tempo with the rapid technological developments happening everywhere else. One reason for this is that GI offerings are low-touch products about which customers interact with the provider just once or twice a year. Another is that GI providers have traditionally not focused on customer experience or value generation for their clients. They lag the Ubers and Amazons of the world by many miles.

However, the landscape has started to change recently due to the entry of disruptive start-ups trying to bridge the gap between service delivery and customer expectations. Areas gaining traction include price comparison services and mobile-based services. The real standout is peer-to-peer (P2P) insurance. It has gained more market buzz because the business model is not as opaque as the traditional model and provides clear benefits for the customers.

The P2P insurance business model

P2P insurance is a novel model facilitated by social media. Customers form their own online networks, and each pools in money to build a corpus. They allocate some portion of the fund to the mutual pool and pay the balance to a traditional insurer. When a claim must be made, members pull money from the mutual pool. If a claim exceeds the mutual pool corpus, they approach the reinsurer. If the claim is less than in the mutual pool, the remaining amount is distributed back to the members.

What are the benefits?

- Risk reduction

- There is less likelihood of fraudulent claims, as the small group of members who know each other share the risk

- The members can select the risk level of their group, unlike in the traditional model

- Non-operating cost optimization

- Marketing and administration costs account for nearly 10-15 percent of policy premiums in the traditional model. These costs are nominal in the P2P model, as marketing is done by members personally. Hence, members pay less than usual premiums

- Savings generation

- Unclaimed insurance premiums are profits for traditional insurers. However, P2P insurance gives unclaimed money back to the members.

How does this disrupt the status-quo?

In the medium to long term, as this model gains maturity and acceptance, customers may switch to the P2P model. This will shrink the market share held by traditional players. Reduced demand for traditional insurance plans, coupled with increased supply, will drive down prices. Thus, customers are likely to benefit in the end.

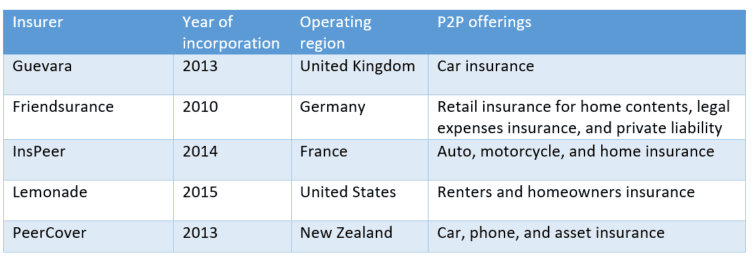

Who are the current prominent P2P start-ups?

These companies are the hot start-ups in this space for a number of reasons. First, they are the early movers that have leveraged cutting-edge technology tenets such as social media and mobility. Second, they are trying to tackle a real business problem and, in the process, are improving efficiency in the market. Finally, they are managing to raise substantial funding from prominent investors such as Sequoia Capital and Horizons Ventures.

An urge for innovation in the industry, coupled with high potential demand from the customers, will drive further disruptions in the GI market. Start-ups are likely to be the vanguard in this evolution, by introducing value generating products and services. Sooner than later, the traditional players will wake up to the new normal, and will try to catch up by either acquiring these start-ups or partnering with them. Ultimately, the end-customers will be the beneficiaries, as competition forces the prices down and innovation drives the quality of services up.