Subrogation’s Moment to Shine: The Profit Lever Insurance Enterprises Need Now

to discuss this topic in depth.

P&C enterprises face a challenging environment shaped by several overlapping forces. More frequent and severe catastrophes are driving higher claim volumes, while geopolitical tensions and supply-chain interruptions raise the cost and time needed to repair damaged property and vehicles.

Inflation, both economic and social (as reflected in larger jury awards), continues to push loss severity upward. These pressures are increasing overall claim costs and squeezing underwriting margins.

In response, enterprises are seeking practical ways to restore profitability, and a renewed emphasis on timely, data-driven subrogation recovery is emerging as one of the most effective levers.

Pain points in subrogation processes for P&C enterprises

While the trend seems to rise, P&C enterprises face a significant number of challenges to ensure effective recovery. As per the National Association of Subrogation Professionals, ~15% of insurance claims result in missed opportunities for subrogation identification.

-

- Gaps in technology adoption and automation: Subrogation has remained one of the most manual and under-optimized functions within P&C operations. Across global and U.S. enterprises alike, subrogation workflows continue to rely heavily on frontline adjusters, legacy claims systems, and static, rule-based flags to identify recovery opportunities. This approach is particularly inadequate for complex claims scenarios, where the liability may be shared, indirect, or obscured within unstructured claim narratives

-

- Process inefficiencies and fragmented workflows: Manual handoffs between multiple departments and front-line adjusters have resulted in subrogation being non-scalable and prone to errors and omissions. As claim files move through the organization, there is a high possibility of critical information falling through the cracks and this impacts the overall recovery process

-

- Data silos and expertise gaps: Effective recovery relies on the availability of timely and accurate information. Yet critical data such as police reports, incident details and third-party contact information often sits in adjuster notes, PDF attachments, email threads and legacy claims platforms. These silos make it hard to build a complete picture of a claim’s recovery potential and ultimately slow down the process. The challenge is greater for small to mid-sized enterprises that lack dedicated subrogation teams. Front line adjusters already manage heavy workloads and typically spot only the most obvious opportunities, leaving many recoverable dollars uncollected

-

- Legal and regulatory hurdles: Subrogation rules shift the moment you cross a state line or a national border. A claim that is straightforward in New York’s comparative-fault regime can stall in Alabama’s contributory-fault rules, while no-fault states such as Michigan may block recovery on smaller auto losses. Overseas, civil-law markets like Spain and common-law jurisdictions like the UK apply different statutes and filing deadlines that turn cross-border cases into legal puzzles. Miss the right jurisdiction or deadline, and a valid recovery disappears. To stay ahead of these shifting rules, enterprises need jurisdiction-specific playbooks embedded in their workflows and an early legal triage on every potential recovery. Putting those guardrails in place keeps cases on track, within deadlines, and maximizes the recoveries ultimately collected.

Overall, most P&C enterprises lack deep subrogation talent, a unified artificial intelligence (AI) platform for identifying recovery opportunities, and data driven governance. They should address these gaps through four targeted steps to modernize and improve their recovery operations.

-

- Baseline and prioritize: Measure current recovery yields, cycle times, leakage by various lines of businesses, litigation spend, etc.; rank loss types with the highest upside and set targets accordingly

-

- Embed advanced analytics: Deploy AI / Machine Learning (ML) models and low-code tools to score every claim for recovery potential, trigger straight-through tasks for low-complexity files, and surface next-best actions for successful recovery

-

- Adopt a blended talent model: Establish a dedicated team of subrogation experts that actively identify and pursue recovery opportunities, govern AI models and negotiate with the outside counsel and third-party vendors

-

- Pursue data-driven governance: Track leading and lagging Key Performance Indicators (KPIs) such as recovery rates, recovery made per claim, cycle time, model precision, etc. on real-time dashboards. Review vendor and attorney performances and legal outcomes regularly and incorporate explainable-AI controls and audit trails to ensure compliance

How are service providers closing the subrogation gap?

According to Everest Group estimates, the serviceable addressable market for outsourced subrogation recovery services currently stands at $2.5 to $3 billion. Leading service providers have gained an early-move advantage by strategically developing end-to-end subrogation capabilities. These investments have not only enhanced their positioning within the Property & Casualty (P&C) insurance segment but have also reinforced the breadth and depth of their overall insurance Business Process Services (BPS) portfolios.

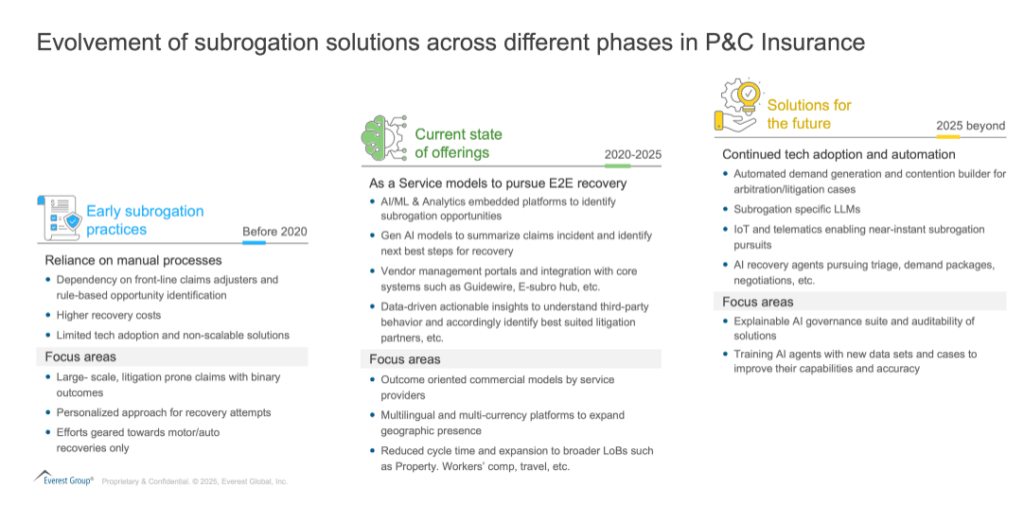

Exhibit 1

EXL has deployed its AI and Analytics embedded Subrosource™ platform across multiple P&C enterprises to identify recovery opportunities, provide decision support regarding the next best steps for efficient recovery, and proactively manage litigation and vendor partners.

On the other hand, WNS’s Subrogation as a service offering is also gaining traction in the market. It comprises of a dedicated pool of subrogation experts coupled with an optimized technology stack. Their as-a-Service model is supported by a “no win, no fee” commercial model that enables enterprises to pursue subrogation with zero upfront costs and no risk proposition.

In parallel, several InsurTechs have also rolled out standalone subrogation platforms. Shift Technology deploys an AI-driven Software-as-a-Service (SaaS) solution to review claims data and flag potential recoveries, while CCC Intelligent Solutions’ Safekeep and Inbound Subrogation applications apply machine-learning and workflow automation to score, triage, and expedite settlements. These software-led options give enterprises another route to strengthen their in-house recovery efforts with data-driven decision support.

The critical question that service providers must answer is: As the subrogation recovery market evolves, how will you build credible, scalable offerings, and what is your strategy to effectively enter and win in this space?

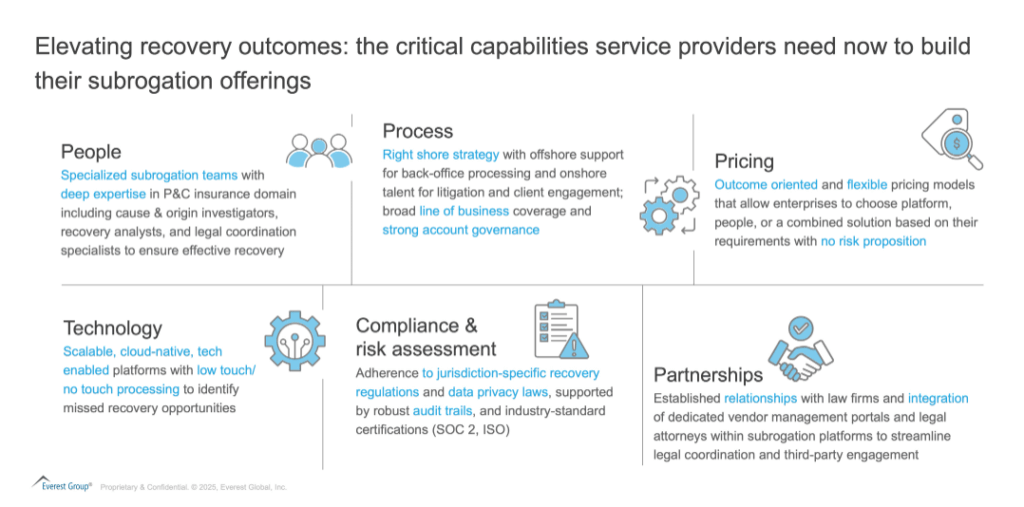

Exhibit 2

Subrogation is emerging as a strong growth frontier in the P&C insurance ecosystem. If you are a P&C insurance enterprise planning to design a comprehensive recovery framework that aligns people, processes, and technology to maximize outcomes while controlling loss expenses, or a provider looking to build or refine a subrogation offering, Everest Group can help you benchmark current capabilities, identify the gaps that matter most, and shape a go-to-market strategy.

If you enjoyed this blog, check out our Rising Tariffs, Rising Claims: How P&C Insurers Can Stay Ahead | Blog – Everest Group, which delves deeper into other topics regarding P&C.

Please reach out to Abhimanyu Awasthi ([email protected]) and Ritvij Tripathi ([email protected]) to know more about subrogation in claims.