Navigating Tariff Turbulence and the OBBBA: Strategic Consulting Opportunities Amid 2025’s Macroeconomic Shifts | Blog

In 2025, enterprises worldwide now find themselves navigating a landscape of heightened macroeconomic uncertainty. President Trump’s renewed commitment to aggressive tariff policies, coupled with transformative fiscal legislation under the One Big Beautiful Bill Act (OBBBA), has reshaped the strategic landscape.

For consulting providers, these disruptions represent significant opportunities to guide businesses through complexities, enhancing their resilience and competitive advantage, as our analysts have explained below.

Reach out to discuss this topic in depth.

Tariff turbulence unleashed: Enterprise challenges fuel consulting opportunities

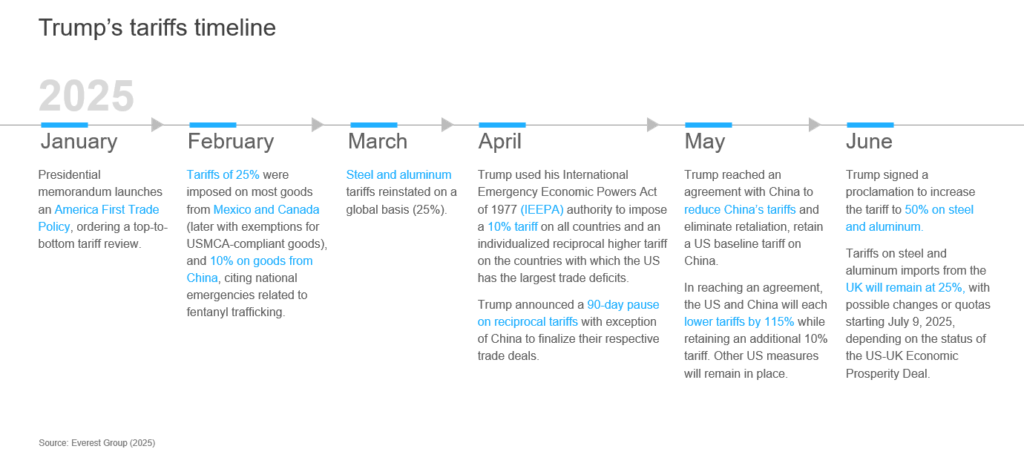

Since January 20, 2025, Trump’s administration has dramatically reshaped global trade through significant tariff escalations. Enterprises across industries have faced immediate disruptions, with costs surging due to tariffs of 25% on goods from Mexico and Canada, global steel and aluminum tariffs at 25%, and a universal 10% tariff leveraging the International Emergency Economic Powers Act (IEEPA). These abrupt policy changes have increased operational complexities, leaving enterprises grappling with critical questions: How can they manage soaring costs? Should they pass price increases onto consumers, or reroute supply chains entirely?

The timeline below provides a detailed overview of these tariff escalations and their rapid implementation throughout early 2025. However, tariff schedules remain fluid, with frequent revisions, new categories added, and trade negotiations continuously altering rules with minimal notice.

Enterprises thus face significant compliance risks, such as misclassifying products or overlooking customs exemptions, that can result in substantial financial penalties or lost savings. Given these complexities, internal capabilities alone are often insufficient.

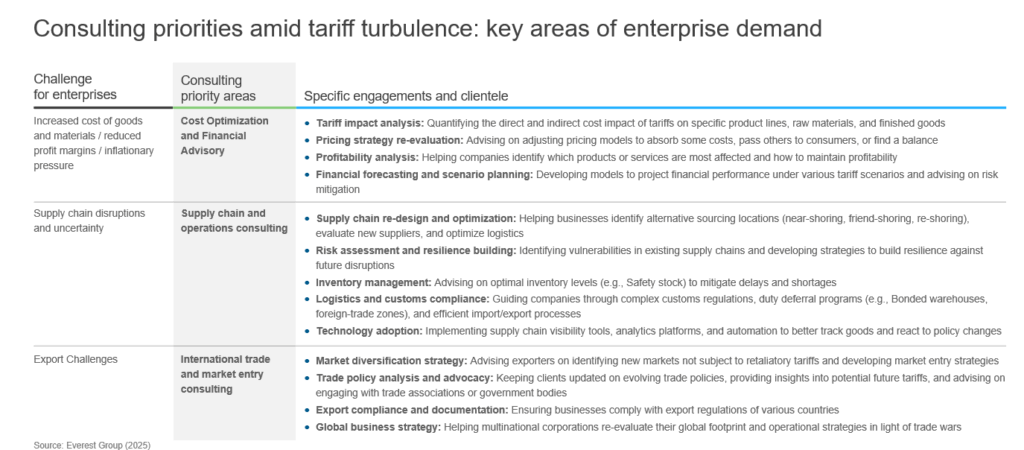

Enterprises urgently seek consulting expertise to:

- Develop real-time geopolitical and economic intelligence dashboards

- Implement rapid-response playbooks for supply chain agility and disruption management

- Execute long-term strategic repositioning of sourcing and operational frameworks

This creates a clear and growing need for specialized expertise, positioning consulting providers uniquely to turn trade turmoil into strategic opportunities and substantial value for enterprises.

From tariffs to taxes: Fiscal shocks under OBBBA

Amid tariff-driven disruptions, enterprises now face additional complexities following the enactment of the OBBBA on July 3, 2025. This fiscal reform profoundly impacts enterprises through:

- Permanent extensions of individual and small-business tax cuts

- Introduction of selective provisions coupled with the rollback of clean-energy incentives

- Major restructuring of social entitlement programs, notably Medicaid

These changes significantly exacerbate enterprises’ financial and operational uncertainties, manifesting as volatile after-tax earnings, increased compliance burdens, and heightened financing risks due to expanding public deficits.

In response, consulting providers find an expansive playing field:

- Strategic tax optimization to leverage permanent tax cuts and navigate new deduction frameworks

- Comprehensive redesign of employee benefits and compliance management strategies to align with entitlement reforms

- Advanced macro-risk scenario modeling to manage fiscal risks and navigate complex financial landscapes

OBBBA’s fiscal policies amplify the opportunity for consulting providers to deliver value-added strategic guidance, turning uncertainty into actionable enterprise insights.

Geographic and sector-specific consulting demand dynamics

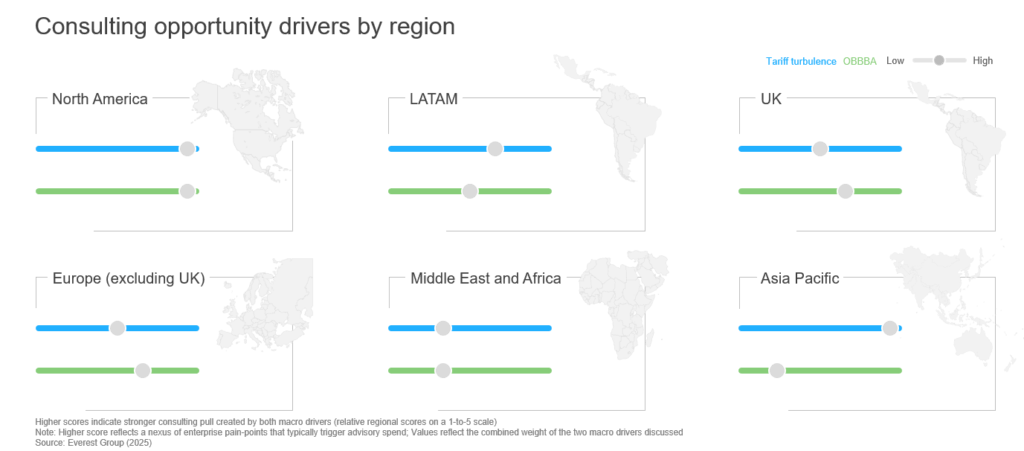

The challenges and opportunities stemming from tariffs and OBBBA vary significantly by geography and industry sector.

The heatmap below highlights the varying intensity of consulting demand across regions, reflecting the differentiated impact of tariffs and fiscal reforms globally.

- North America: Strongly impacted due to the direct origin of both policies. Enterprises are aggressively navigating tariffs and OBBBA-driven fiscal shifts, fueling robust demand for tax strategy and supply chain realignments.

- Latin America (LATAM): Tariff-induced nearshoring opportunities combined with regional inflation drive the need for detailed feasibility assessments and currency-risk management strategies.

- Europe and Asia Pacific (APAC): Diverse trade policy shifts and fiscal stress create opportunities for nuanced regional advisory services, notably in sourcing diversification and geopolitical scenario planning.

Industry-specific opportunities are equally compelling, with manufacturing, energy, banking, and retail sectors particularly affected by tariff-driven costs and fiscal uncertainties.

- Manufacturing: Dual pressures of input tariffs and “Made in America” incentives call for swift plant-footprint optimization and cap-ex reprioritization

- Energy and utilities: Fluctuating costs and shifting tax-credit rules necessitate revamped project-finance models,

- Banking and financial services: Increased economic uncertainty heightens credit and rate risks, boosting scenario planning and balance-sheet optimization needs,

- Retail and consumer goods: Higher costs and price sensitivity spur demand for pricing strategy, consumer modeling, and inventory optimization,

- Electronics and hi-tech: Escalating import duties and fractured supply chains require immediate network redesign and near-shoring road maps,

Consulting providers that tailor their offerings to these nuances stand to capture significant incremental advisory opportunities.

Strategic imperatives for consulting providers

Given the complexity of enterprise needs, consulting firms must rapidly adapt and expand their capabilities. Below are four actionable recommendations to leverage current macroeconomic disruptions and drive sustainable advantages:

- Rapid scenario planning: Deploy real-time scenario tools that translate macroeconomic data into proactive client decisions.

- Integrated supply chain teams: Build agile, multidisciplinary teams to swiftly redesign and optimize supply chains amid trade volatility.

- Tech-driven cost efficiency: Embed artificial intelligence (AI) and cloud solutions in cost-management initiatives for sustained, deeper savings.

- Geo-risk monitoring: Offer real-time geopolitical intelligence through dedicated monitoring hubs to enable proactive risk management.

By adopting these strategic imperatives, consulting providers can effectively transition from short-term problem solvers to indispensable long-term enterprise resilience partners.

Next stepsThe macroeconomic disruptions from tariffs and fiscal reform in 2025 are substantial, challenging enterprises significantly. However, within these challenges lie unprecedented opportunities for consulting providers. Those who strategically align their capabilities to meet these emerging enterprise needs will not only enable businesses to navigate immediate complexities but also position themselves as vital long-term partners for sustained growth and strategic advantage.

For more information regarding the US administration’s tariffs and to see what the US tariffs mean for the global services market, please visit https://www.everestgrp.com/us-administrations-tariffs/ .

If you found this blog interesting, check out our How Will The New Tariffs Affect The Global Services Market? | Blog – Everest Group, which delves deeper into the global services industry regarding the latest tariffs and how this may affect various sectors in the US and beyond.

If you have any questions or want to discuss the impact of tariffs on the global landscape, please contact Alisha Mittal ([email protected]), Parul Trivedi ([email protected]), Shreya Arora ([email protected]) and Mehek Sethi ([email protected]).