Over the past year, enterprises have had to overcome a series of macroeconomic and geopolitical challenges. The potential uncertainties with the implementation of the Inflation Regulation Act (IRA) and the rise in federal interest rates to curb inflation, compounded by an ongoing war resulting in the shifting of clinical trials from Russia and Ukraine, have forced enterprises to rethink their strategies. Further, the advent of generative, AI such as ChatGPT, will enable the biopharma and MedTech firms to repackage their offerings and provide cutting-edge technology and cost optimization.

To effectively serve evolving enterprise needs, service providers have invested in increasing the breadth and depth of their functionalities/offerings across the life sciences operations value chain. They have invested in a host of avenues, such as Decentralized Clinical Trials (DCT), with many Information Technology / Business Process Outsourcing (IT/BPOs) companies partnering with DCT providers. Further investments include analytics-driven tools for razor-sharp Healthcare Professional (HCP) profiling and targeting and the use of automation tools in areas such as Adverse Events (AE) intakes to rapidly evolve with the market needs.

-

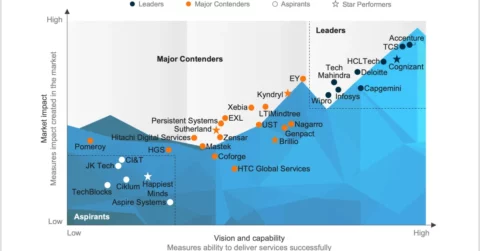

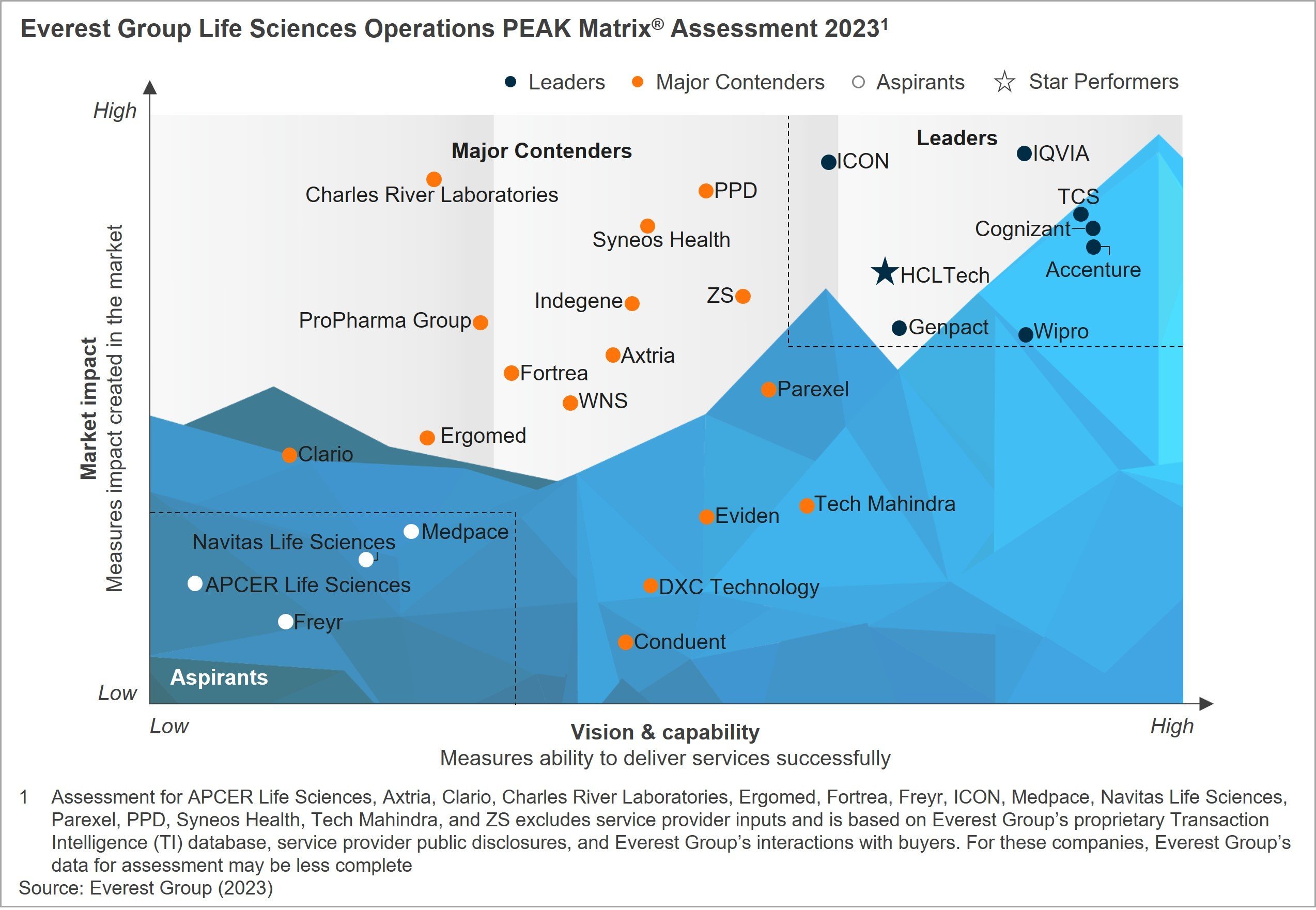

Life Sciences Operations PEAK Matrix® Assessment 2023

What is in this PEAK Matrix® Report

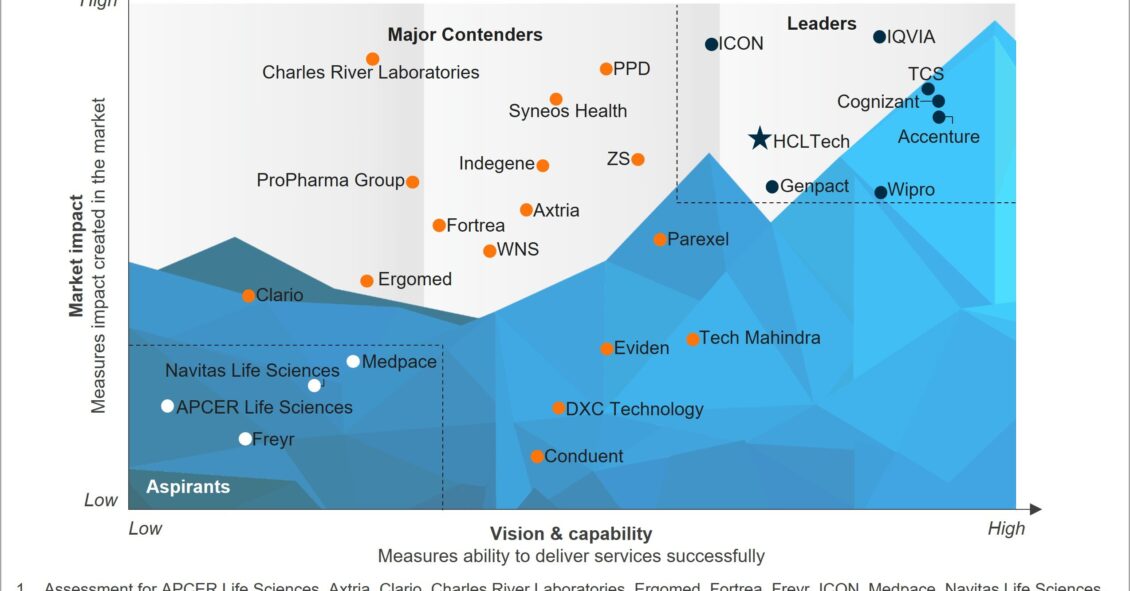

In this research, we present a detailed assessment of 28 operations service providers featured on the Life Sciences Operations Services PEAK Matrix®. We provide a relative positioning and analysis of the providers’ market shares, along with our evaluation of their strengths and limitations. This report will enable enterprises to identify suitable service providers to manage the evolving needs of their businesses.

Content:

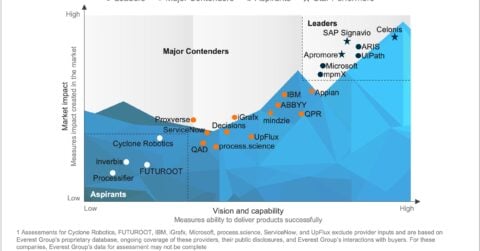

- The relative positioning of the providers on Everest Group’s PEAK Matrix® for Life Sciences Operations Services

- A comparison of the providers’ capabilities and market shares

- Everest Group’s analysis of the providers’ strengths and limitations

Scope:

- Industry: life sciences BPS

- Geography: global

- The assessment is based on Everest Group’s annual RFI process for calendar year 2023, interactions with leading life sciences operations service providers, client reference checks, and an ongoing analysis of the life sciences operations market.

READ ON

What is the PEAK Matrix®?

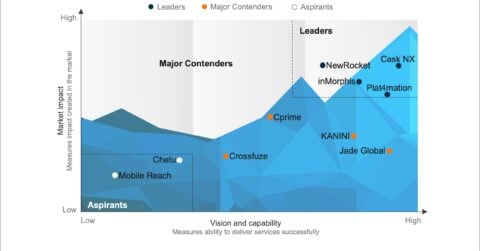

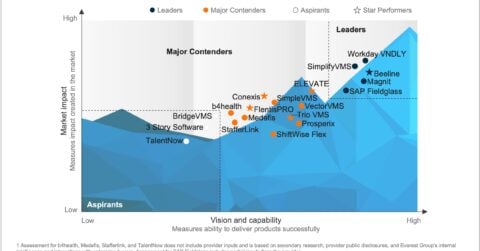

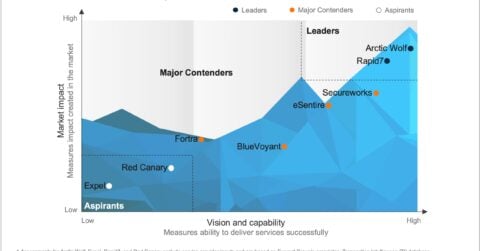

The PEAK Matrix® provides an objective, data-driven assessment of service and technology providers based on their overall capability and market impact across different global services markets, classifying them into three categories: Leaders, Major Contenders, and Aspirants.