The Property and Casualty (P&C) insurance industry stands at a critical juncture due to volatile market forces and rising customer expectations. Heightened competition, increasing catastrophic event frequency, and an urgency to drive digital-first interactions fuel transformation initiatives in claims. Traditional methods that rely heavily on human intervention are prone to inaccuracies, prolonged cycle times, and resource inefficiencies, compelling insurers to explore avenues for faster, more transparent claims experiences.

In response, AI-enabled claims management solutions have emerged as a strategic priority. They blend predictive analytics, workflow automation, real-time fraud detection, and advanced integration capabilities, enhancing operational effectiveness and customer satisfaction. Against this backdrop, this assessment highlights how targeted solutions and partnerships are reshaping the claims landscape. These solutions enable carriers to streamline the entire life cycle, from first notice of loss to post-settlement support, and pave the way for resilient, data-driven operating models.

-

AI-enabled Claims Management Systems for Property & Casualty (P&C) Insurance – Products PEAK Matrix® Assessment 2025

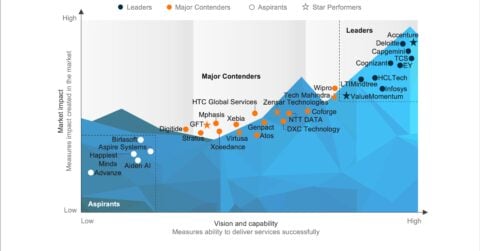

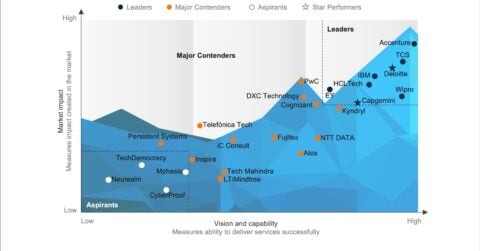

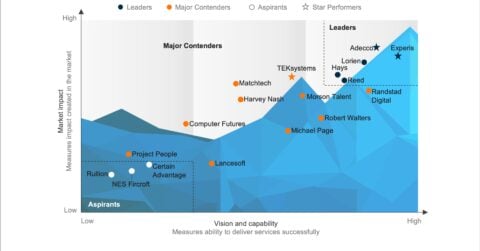

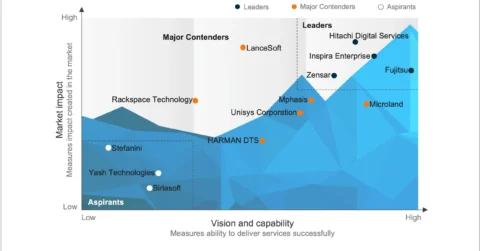

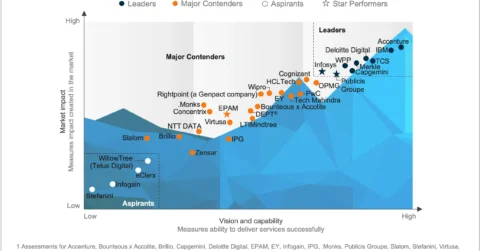

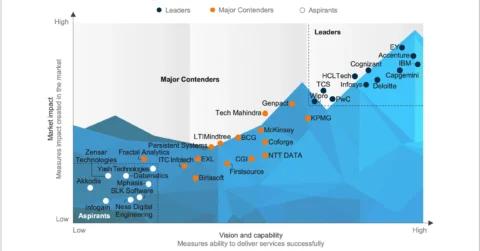

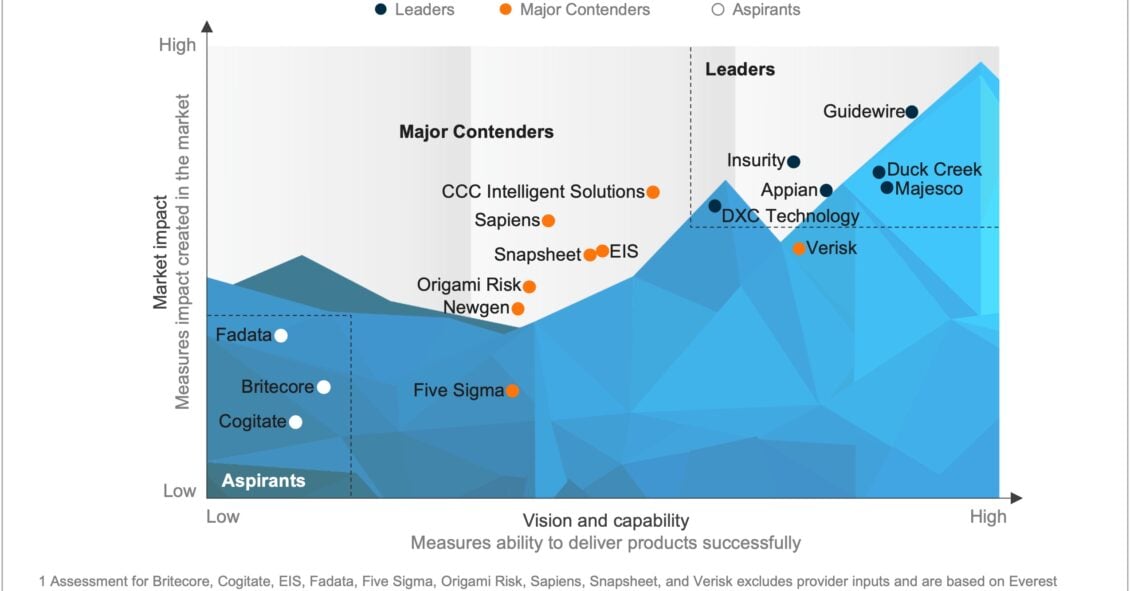

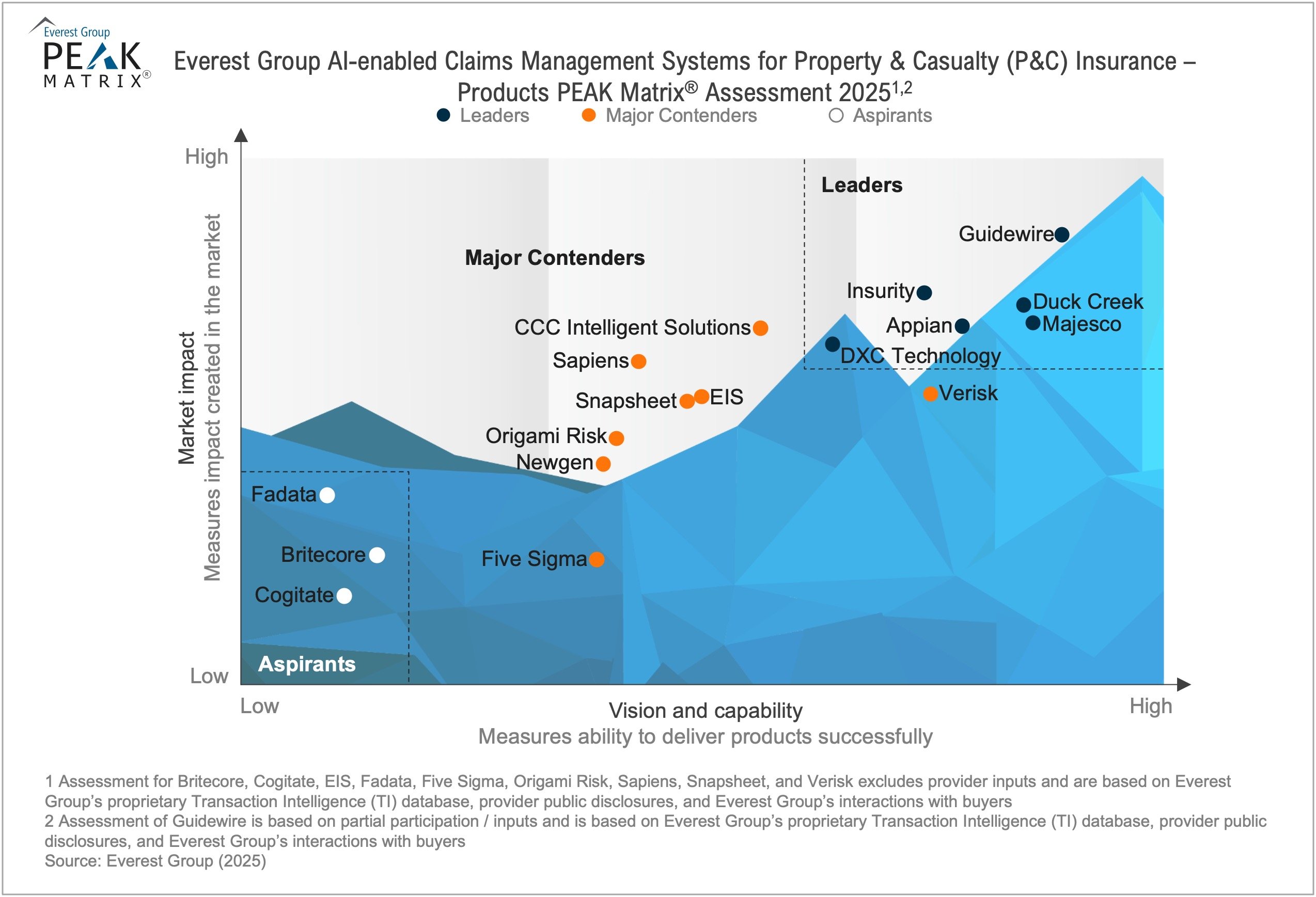

In this report, we analyze 17 technology providers as part of the AI-enabled Claims Management Systems for Property and Casualty (P&C) Insurance – Products PEAK Matrix® Assessment 2025.

Scope

- Industry: Insurance

- Geography: global

Contents

In this report, we:

- Assess 17 technology providers

- Position providers as Leaders, Major Contenders, and Aspirants

- Compare providers’ key strengths and limitations

READ ON

What is the PEAK Matrix®?

The PEAK Matrix® provides an objective, data-driven assessment of service and technology providers based on their overall capability and market impact across different global services markets, classifying them into three categories: Leaders, Major Contenders, and Aspirants.