Navigating the Summit: Tech’s Role in Achieving the World Economic Forum’s 2024 Vision | Blog

Technology stands at the forefront in realizing Davos 2024’s vision of “Rebuilding Trust.” By providing innovative strategies and solutions, the technology sector can help address cybersecurity, job creation, artificial intelligence, and climate challenges. For a preview of the critical topics that world leaders will address at the annual event, read on.

As we stand on the precipice of a new year, the global community is gearing up for the World Economic Forum’s annual meeting in Davos. This pivotal event from Jan. 15-19 brings together leaders from across industries to collectively address the world’s most pressing challenges.

In 2024, the spotlight is on “Rebuilding Trust,” with a focus on restoring collective agency and reinforcing fundamental principles of transparency, consistency, and accountability among leaders. Let’s take a glimpse into the themes that will shape the conversations at Davos. Also, see this LinkedIn Live, Pressing Global Issues and Solutions in Tech: Reflections on WEF Davos ’24, for key takeaways from the WEF annual meeting and major trends in the climate and sustainability tech and services industry that are changing the marketplace in 2024.

The 2024 theme: Rebuilding trust

The overarching theme for Davos 2024 underscores the critical need to rebuild trust in a world marked by fractures and uncertainties. The summit aims to catalyze actionable solutions that transcend borders and industries, placing businesses at the forefront of global collaboration.

Against this backdrop, the role of the technology and technology services sectors takes center stage, offering innovative strategies and solutions to address the following four subtopics outlined for this year’s summit:

- Achieving security and cooperation in a fractured world

In an era of geopolitical complexities, achieving security and cooperation is paramount. The technology sector, with its expertise in cybersecurity and collaborative technologies, has a unique role to play. Beyond safeguarding digital assets, tech can foster global cooperation through secure communication platforms and advanced analytics for early threat detection.

- Creating growth and jobs for a new era

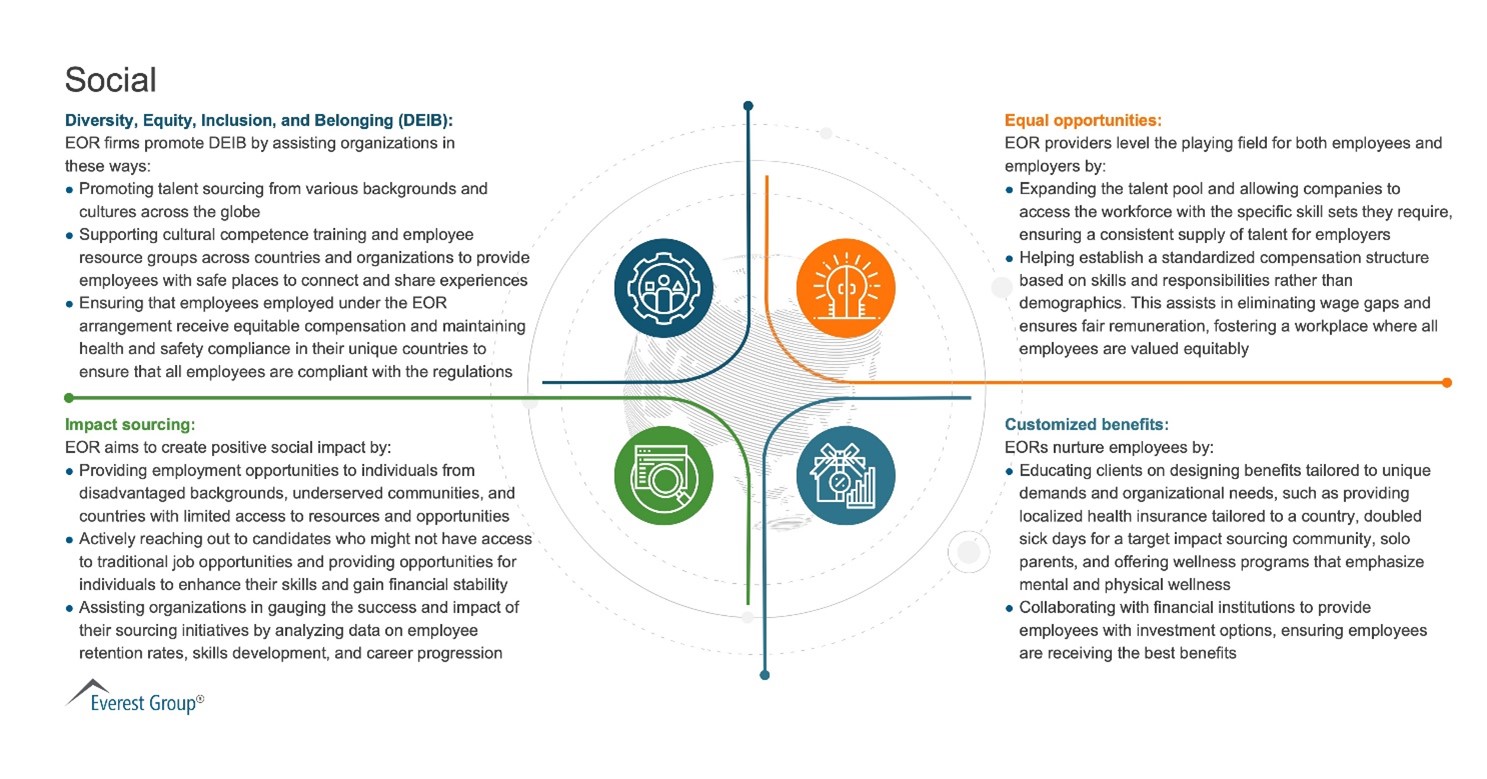

For the technology services sector, the second subtopic hits close to home. The emphasis on creating growth and jobs in a new era aligns with impact sourcing, an inclusive talent strategy that empowers marginalized communities by providing them with meaningful employment opportunities. As we navigate an ever-evolving workforce landscape, technology can be a driving force in fostering inclusive economic growth.

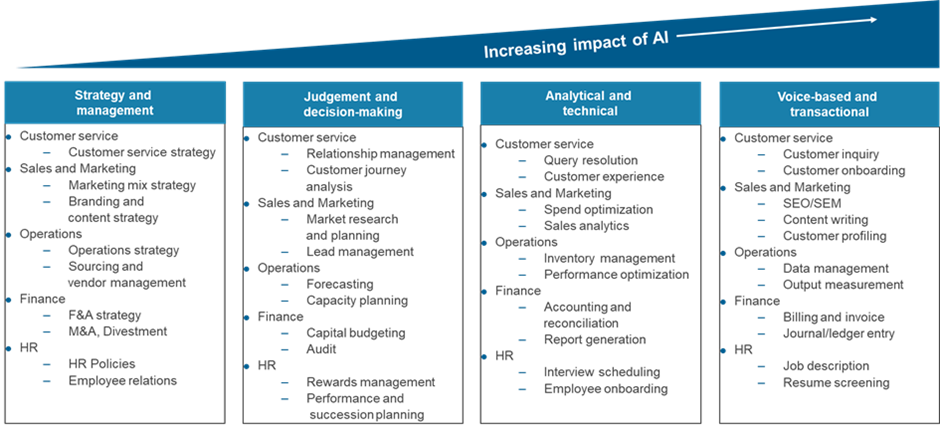

- Artificial intelligence as a driving force for the economy and society

Artificial Intelligence (AI) has already transformed the technology and technology services sectors, and its impact is only poised to expand further. From personalizing training programs to enhancing productivity and offering expanded service offerings, AI is a linchpin in shaping the future of work. Davos provides an unparalleled platform to discuss responsible AI practices that prioritize ethical considerations and human-centric approaches.

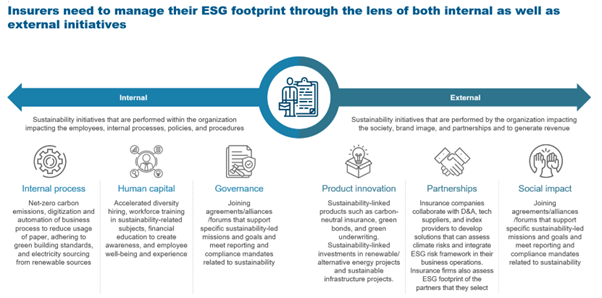

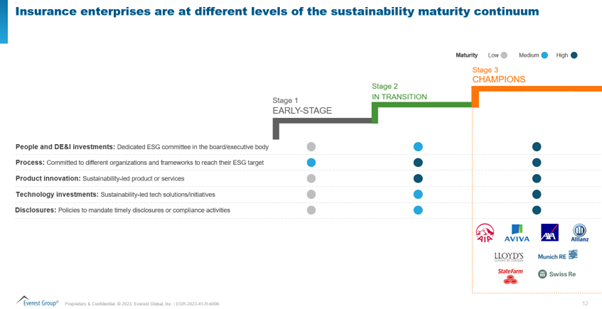

- A long-term strategy for climate, nature, and energy

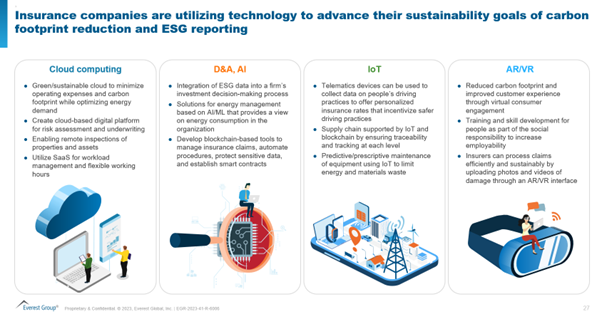

The urgency of addressing climate change has never been more evident. The technology sector is pivotal in developing sustainable solutions and innovative approaches to mitigate climate change’s impact. From energy-efficient technologies to data-driven insights for environmental conservation, tech leaders at Davos can forge a path toward a greener, more sustainable future.

As Everest Group anticipates the discussions at Davos, we recognize the transformative role that the technology and technology services sectors can play. By aligning with the summit’s themes and subtopics, the tech industry has the potential to contribute significantly to rebuilding trust and shaping a more inclusive, sustainable, and prosperous global future. for a LinkedIn Live conversation on Feb. 7 with analysts Arpita Dwivedi and Rita N. Soni, and tech expert Marisa Zalabak as we navigate the summit and bring you insights into the pivotal role of technology in achieving Davos 2024’s vision.