In my May 3 blog entitled “Size Does Matter – The Real Pecking Order of Indian IT Service Providers” – I commented on the rapid growth achieved by the Top 5 Indian IT majors or WITCH (Wipro, Infosys, TCS, Cognizant, and HCL) in the last few quarters. Last week as we were rounding up our latest service provider risk assessments, I couldn’t but help notice that this very growth has taken its toll on some of these providers, with buyers increasingly highlighting service delivery concerns especially as it relates to the quality (or lack thereof) of resources deployed on their engagements.

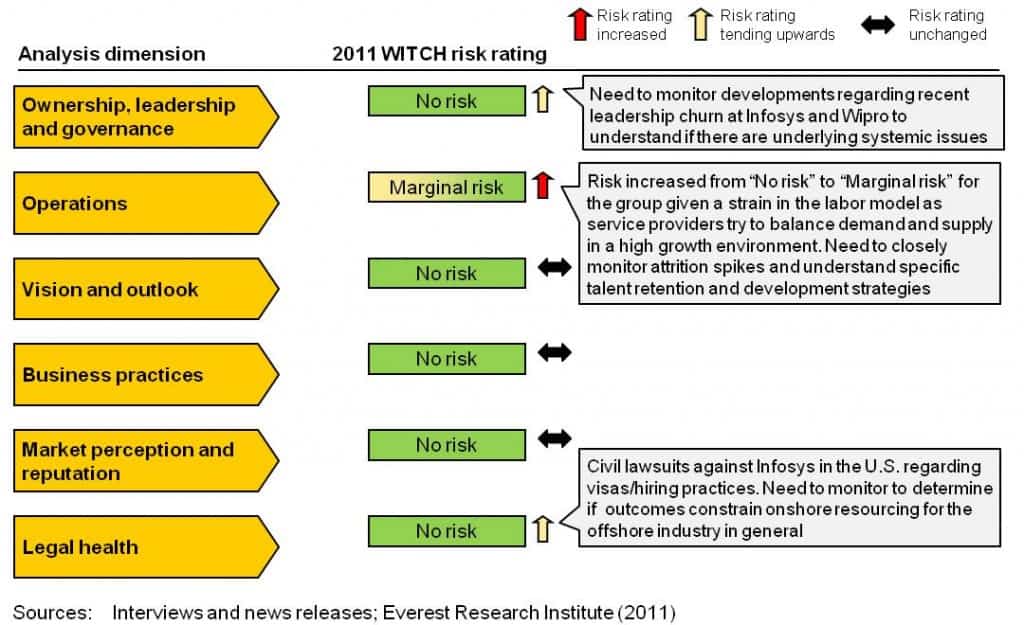

Since the Satyam crisis in early 2009, Everest Group has been tracking global and offshore majors across a number of dimensions to analyze patterns that indicate deviation from “ideal” behavior, and thereby highlight risks to service delivery. Based on analysis of 1Q 2011, our risk dashboard for the WITCH majors required a change in operational parameters from “No Risk” to “Marginal Risk.” While individual, provider-specific rating changes are common, this is the first occurrence of a collective group rating change since we started our assessment over two years ago.

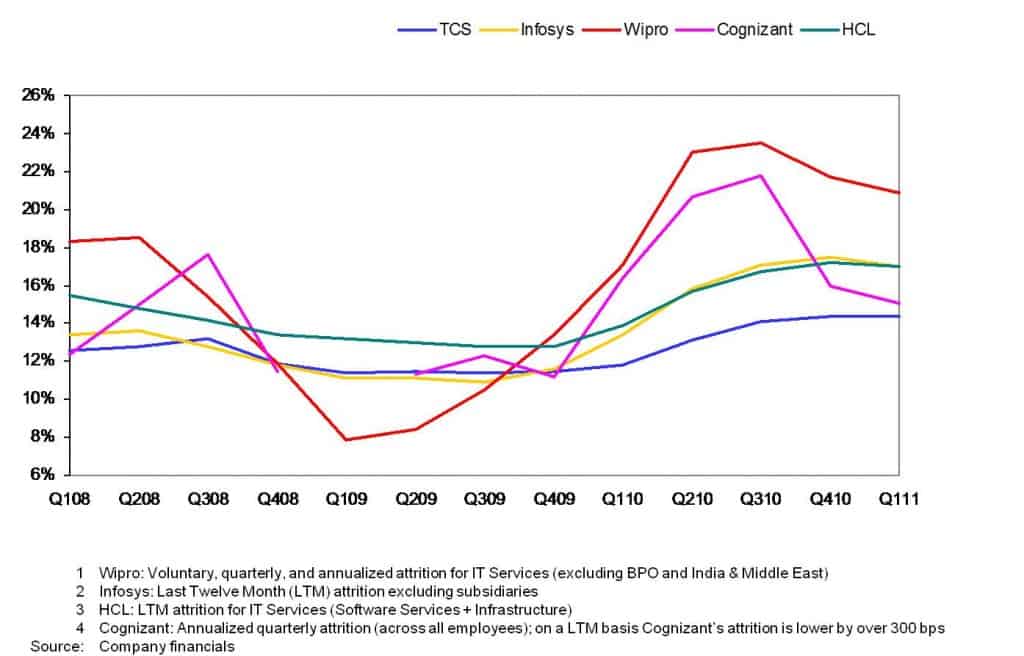

At the core of these operational challenges is the strain on the labor model of the offshore majors that are “blessed” with an environment of hyper growth. With attrition levels at a three-year high, service providers are being forced to meet the commitments for new logos/projects by rotating employees out of existing accounts, especially smaller ones. This practice of robbing Peter to pay Paul is eroding service quality and creating concerns for clients. Further, the hiring freezes and cutbacks at the peak of the economic crisis in late 2008 and most of 2009 created an imbalance in the labor model. Service providers are now having to back-fill for attrition through relatively junior and less-experienced resources than those to which clients were typically accustomed.

Attrition Trend for WITCH

To clarify, this is not a “WITCH hunt” and should not be read as propaganda against offshoring, India, or the WITCH majors. I firmly believe in the fundamentals of offshore growth, India’s delivery competitiveness, and the capabilities of WITCH majors’ management to navigate what we hope are merely short-term hiccups. The issue, however, reinforces the need for a more robust approach to global sourcing risk management in which being proactive is key to staying ahead of the game. While a proactive approach does not guarantee prediction of the next major crisis (e.g., Satyam), our experience suggests that a focused and consistent approach can deliver early warning signals to buyers, who can then use them to potentially undertake mitigation or course correction strategies. After all, as the old saying goes forewarned is forearmed!

In a complimentary Breaking Viewpoint released earlier this week, I shared additional information on this topic, and provide perspectives to better manage the current set of offshore delivery challenges. Download the complimentary Breaking Viewpoint.