Insuring the future: The Dawn of Smart Insurance in the ACES Mobility Era

The global mobility landscape is undergoing a seismic shift, driven by four converging forces: Autonomous, Connected, Electric, and Shared (ACES) mobility.

These innovations are not just reshaping how we move but are fundamentally transforming how insurers assess, underwrite, and service risk. This transformation is more than just technological too, it’s a complete overhaul of the traditional insurance product, its risk calculus, and the operations that support it.

Reach out to discuss this topic in depth.

The insurance paradigm shift

Traditional auto insurance was built around individual risk profiles and human driving behavior. In contrast, ACES vehicles introduce complex, interconnected systems requiring a data-centric approach to insurance; where product liability, software reliability, and real-time behavioral data are the new underwriting inputs.

Insurers must now evaluate the safety performance of artificial intelligence (AI) algorithms, sensor reliability, and update cycles for autonomous systems. Policies will need to incorporate coverage for:

-

- Software and firmware errors

-

- Cybersecurity breaches

-

- Sensor and hardware malfunctions

-

- Third-party technology integrations

The U.S. auto insurance market; valued at over $330 billion in 2024 is projected to see a significant recalibration. With Autonomous Vehicle (AV)-related technologies reducing accident frequency, the insurance costs per mile could drop by over 50% by 2040, translating into tens of billions in potential cost savings.

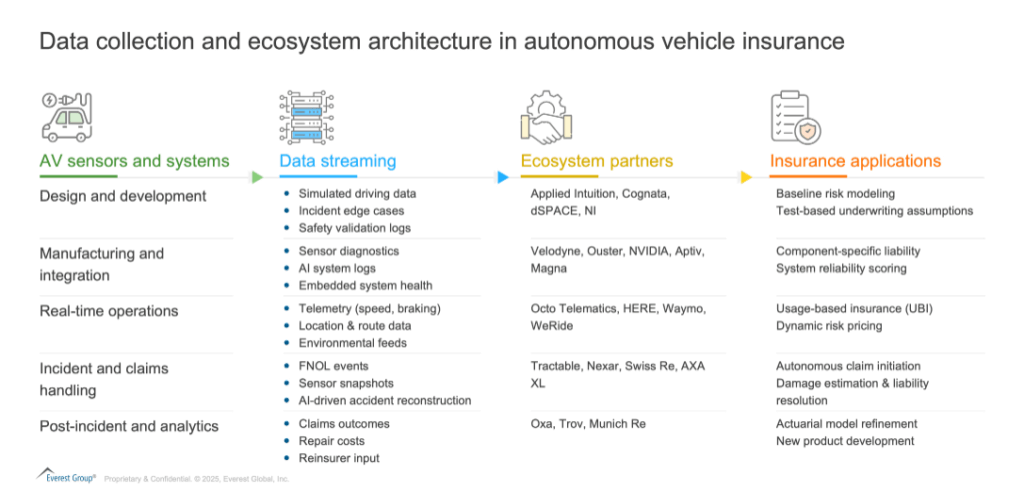

Exhibit 1 Data collection and ecosystem architecture in autonomous vehicle insurance

Autonomous vehicles: From driver to data-driven risk

AV firms like Waymo, Motional, Tesla, and Zoox are leading the charge in the U.S., while WeRide and DeepRoute.ai expand across Europe and Asia. These vehicles continuously collect petabytes of data through Light Detection and Ranging (LiDAR), radar, cameras, and onboard processors.

-

- Example: Waymo’s partnership with Swiss Re has proven that AVs result in fewer liability claims than traditional vehicles, reshaping how actuaries model risk

-

- Example: Waymo also leverages embedded insurance from Trov (now part of Travelers) for on-demand passenger protection

Insurance Models:

-

- Embedded and usage-based insurance (UBI)

-

- Product liability coverage for software/hardware vendors

-

- Cyber insurance for connectivity-related risks

Connected vehicles: Real-time risk intelligence

Telematics providers like Octo Telematics, Cambridge Mobile Telematics, and Nexar enable insurers to analyze real-time driving data, system diagnostics, and contextual risk (e.g., weather, traffic). This allows for:

-

- Dynamic underwriting

-

- Proactive risk scoring

-

- Instant claims triggering via FNOL (First Notice of Loss) automation

Claims example: Tractable uses AI to process crash images, automate damage assessments, and recommend settlements without adjuster intervention.

Electric vehicles: A new risk category

EVs introduce novel underwriting variables: battery degradation, thermal events, and charging infrastructure reliability. Companies like Tesla and Rivian are launching their own insurance units, integrating vehicle performance data directly into pricing algorithms.

Tech Partners:

-

- NVIDIA, Qualcomm: Edge AI processors

-

- Velodyne, Ouster: Sensor data for environmental awareness

Shared mobility: Insuring the platform economy

The rise of shared AV fleets (e.g., robotaxis) and EV subscription services demands modular, micro-duration insurance policies.

-

- Example: Autonomy, an EV subscription provider, partners with Liberty Mutual to bundle monthly insurance with vehicle access

Insurance models:

-

- On-demand trip-based coverage

-

- Embedded microinsurance

-

- Fleet-based liability models

Challenges and risks in ACES implementation

Despite its promise, ACES mobility brings new risks and operational hurdles:

-

- Liability attribution: Determining fault among drivers, Original Equipment Manufacturers (OEMs), software vendors, or operators is complex, particularly in Level 3 and 4 autonomy scenarios

-

- Rising repair costs: Advanced sensors and AV hardware increase the cost of vehicle repairs, potentially offsetting savings from fewer accidents

-

- Cybersecurity threats: The connected nature of ACES vehicles makes them vulnerable to cyberattacks, requiring new insurance models for data and system protection

-

- Regulatory gaps: Inconsistent or underdeveloped legal frameworks hinder insurers’ ability to price and structure policies

-

- Consumer trust: Public skepticism about AV safety and ethical decision-making must be addressed to drive adoption and insurance enrollment

Reimagining the insurance operating model

Each ACES dimension demands redesign across the insurance value chain:

-

- Underwriting: Powered by telematics, simulation data (e.g., from Applied Intuition, Cognata), and real-time diagnostics

-

- Claims: Fully or semi-autonomous using AI/Machine Learning (ML) tools like Tractable and Nexar

-

- Policy design: Transitioning from static, annual premiums to flexible, usage and behavior-based policies

-

- Partnerships: OEMs, reinsurers (e.g., Swiss Re, AXA XL), and tech enablers forming a connected insurance ecosystem

What our analysts have to say…

The ACES mobility transformation is not a distant future, it’s today’s challenge and tomorrow’s opportunity! Insurers that embrace data, automation, and ecosystem collaboration will lead the way in designing resilient, responsive insurance models that mirror the intelligent mobility revolution they support. The transformation spans five key innovation pillars:

-

- Product innovation: From static coverages to modular, embedded, and on-demand offerings tailored to AVs and EVs

-

- Risk innovation: Leveraging real-time operational data and AI-based insights for continuous risk profiling and dynamic liability modeling

-

- Channel innovation: Expanding through OEM integrations, mobility platforms, and digital Application Programming Interfaces (APIs) for seamless distribution

-

- Pricing innovation: Usage-based, behavior-driven, and situational pricing replacing traditional actuarial models

-

- Experience innovation: Personalized, frictionless experiences enabled by self-service portals, AI-led FNOL, and proactive risk mitigation

Together, these pillars redefine the role of insurance in a world powered by intelligent, shared, and sustainable mobility.

If you enjoyed reading this blog, check out our research on The Future of Mobility – on the Cusp of the Electrification Revolution, which delves deeper into other topics regarding ACES.

To learn more about ACES revolution in insurance and related topics, as well as anything else relating to BFSI, please contact Ronak Doshi ([email protected]) and Abhimanyu Awasthi ([email protected]).