Earlier today, Cognizant reported its financial results for the first quarter of 2011, bringing to an end the earnings season for the Big-5 Indian IT providers – affectionately referred to as WITCH (Wipro, Infosys, TCS, Cognizant, and HCL). Cognizant’s results were yet again distinctive: US$1.37 billion in revenues in 1Q11, which represents QoQ growth of 4.6 percent and YoY growth of 42.9 percent. The latest financial results reaffirmed – yet again – Cognizant’s growth leadership compared to its peers and are a testament to Cognizant’s superb client engagement model.

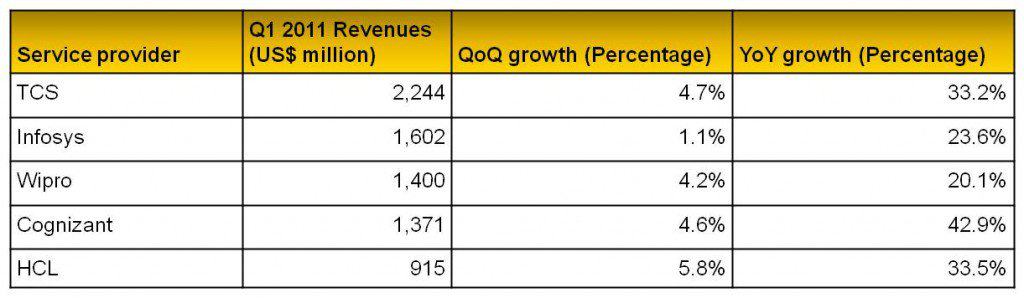

Q1 2011 financial highlights for WITCH:

In a recent blog post, my colleague Vikash Jain commented on the changes in the IT services leaderboard, and especially the questions and speculation on the relative positions of Wipro and Cognizant in the Indian IT services landscape. Cognizant’s 1Q11 revenues are now just US$29 million below Wipro’s IT services revenues, and based on current momentum, Cognizant could overtake Wipro as early as 2Q11, making it the third largest Indian IT major in quarterly revenue terms. The guidance provided by the two companies for the next quarter – Cognizant (US$1.45 billion) and Wipro (US$1.39-1.42 billion) – provides further credence to the projected timelines.

How important is this upcoming change in the relatively static rank order of the Indian IT industry (the last change happened in January 2009 post the Satyam scandal)? Not very, in our opinion. As and when this happens, the event will indeed create news headlines and the occasional blog entry, but the change in rankings does not imply a meaningful change to the overall IT landscape. Further, other than providing Wipro with even more conviction to make the changes required to recapture a faster growth trajectory, the new rank order does not suggest any changes in the delivery capabilities of either of these organizations.

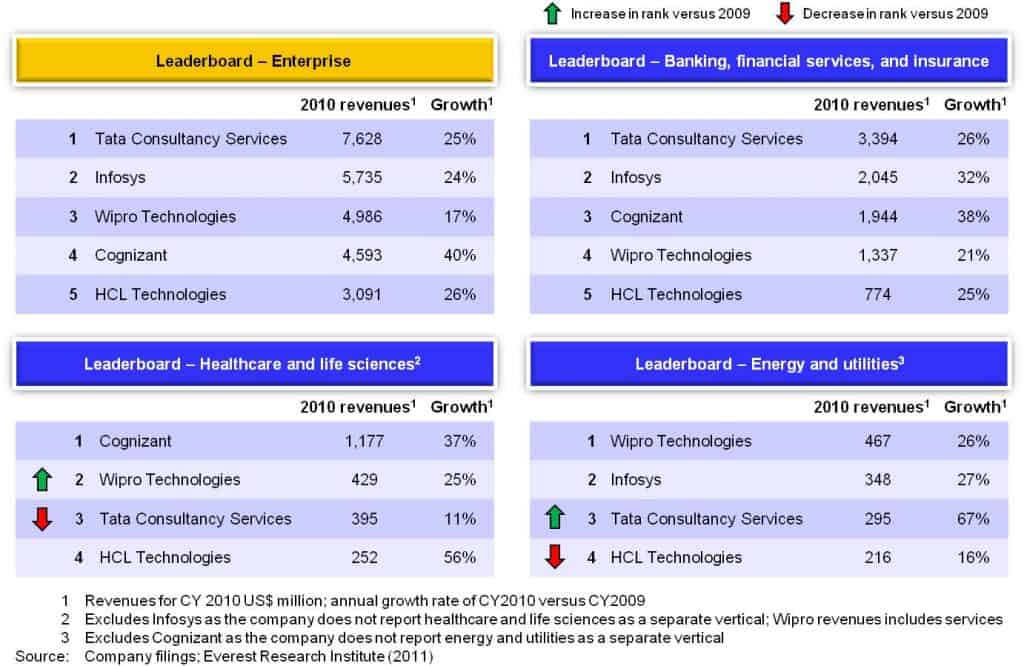

As we advise our clients on selecting service providers, we believe that it is more important to understand the service provider’s depth of capability and experiences in the buyer organization’s specific vertical industry. While total revenues and financial stability are important enterprise-level criteria, performance in the vertical industry bears greater relevance and significance as buyers evaluate service providers. In our 1Q11 Market Vista report, we examine the CY 2010 revenues of the WITCH group to determine the pecking order in three of the largest verticals from a global sourcing adoption perspective – banking, financial services and insurance (BFSI); healthcare and life sciences; and energy and utilities (E&U).

As we recognize there are differences in the way these providers segment results, for simplicity we are relying on reported segmentation (which we believe does not meaningfully alter the results). The exhibit below summarizes the results of our assessment:

Industry leaderboard for WITCH:

Our five key takeaways:

- The ranking of WITCH based on enterprise revenues has limited correlation to industry vertical rankings. The leader in each of the three examined industries is different.

- In BFSI, while TCS is the clear leader, Cognizant is rapidly closing in on Infosys for the second spot. (Note: Wipro is already #4 in this vertical).

- In Healthcare and Life Sciences, Cognizant emerges as the clear leader with 2010 revenues greater than those of Wipro, TCS, and HCL combined. (Note: Infosys does not report segment revenues for Healthcare).

- In E&U, Wipro leads the pack and is expected to widen the gap through its acquisition of SAIC’s oil and gas business. TCS achieved the highest growth in 2010 to move to third position ahead of HCL (TCS was #4 in 2009) and narrow the gap with Infosys (Note: Cognizant does not report E&U revenues).

- Finally, the above ranks are going to change quickly. Based on the results announced for the first calendar quarter of 2011 alone, we anticipate a change in the second position for each of the three examined verticals:

- Cognizant’s Q1 BFSI revenue of US$570 million is nearly identical to that of Infosys’ US$572 million

- TCS’ Q1 Healthcare and Life Sciences revenue at US$ 119 million is higher than Wipro’s US$111 million (which also includes services)

- TCS reported Q1 E&U revenues of US$103 million, versus Infosys’ US$93 million

While it will be interesting to see the impact on a full year basis, the above changes in momentum already indicate further changes in the industry leaderboard before the end of the year.

On an unrelated note, by the time we revisit the Wipro versus Cognizant debate when the Indian majors announce their Q2 results starting mid-July, WITCH will assume an additional meaning – the last installment of the Harry Potter movies is due for release on July 15, 2011!