Everest Group’s just released research on Remote Infrastructure Management (RIM) services shows that the overall infrastructure services market, which was already undergoing significant changes due to various factors, is being further disrupted as RIM adoption takes center stage.

Let’s take a step back before we talk about RIM’s current state. Over the years, our RIM-focused research analyzed the growing challenges offshore providers, who pioneered RIM industry, faced in offering services that went beyond typical low-cost infrastructure monitoring. As their aspirations grew, and more buyers became willing to engage, those providers began offering newer RIM services, such as delivering from offshore locations those infrastructure services typically provided at onshore by competitors. Yet, the core value remained remote low-cost helpdesk and status quo monitoring of infrastructure assets, which experienced a significant growth across buyer landscape.

However, now we are witnessing substantial growth in the adoption of offshore infrastructure services that are moving beyond the typical RIM offerings. Our discussions with various buyers have revealed a clear evolution in the delivery and market messages of offshore infrastructure providers. Most of them are marketing and selling their portfolio of infrastructure offerings as “new service X,” “new service Y,” and “RIM,” unlike earlier years when they solely focused on RIM as a generic brand for all infrastructure offerings. This messaging effort is backed by changes in delivery model, engagement terms, transitioning process, investment in tools/automation, and various other related initiatives.

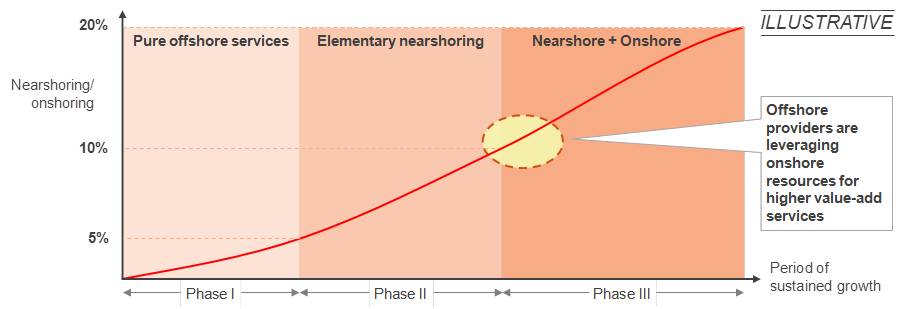

One example of this strategy is the willingness displayed by large offshore providers to open nearshore and onshore delivery centers to serve bigger customers. The typical 100 percent offshore ratio in RIM is dropping to around 80-85 percent as the providers offer higher value-added services that are normally delivered from client locations.

We are now seeing RIM providers gearing up to enter this new, big league. While cost savings is still the core tenet, their strategy is to move up the value chain, grab larger market share, and create more “downstream” opportunities for pure RIM services.

Traditional infrastructure and managed service providers that were already facing challenges due to stagnation in their core market and reduction in mega size, multi-towers, multi-years deals, are getting further squeezed by RIM providers. RIM providers are squarely part of this disruption, and are tweaking their delivery model, market messages, buyer engagement strategy, and investment focus to exploit this opportunity.