Increasing demand for integrated benefits platforms, rising employer expectations, and a heightened focus on operational efficiency are rapidly transforming the North American Life and Annuity (L&A) insurance industry. As insurers modernize their core legacy systems, cloud-native Policy Administration Systems, AI-driven automation, and low-/no-code development platforms have become essential business transformation enablers.

To support evolving workplace benefits models, platform providers are delivering API-driven, SaaS-based ecosystems with embedded compliance, modular integration, and real-time analytics. Simultaneously, the rise of voluntary benefits and supplemental health products is driving insurers and niche insurance providers to introduce differentiated offerings tailored to diverse workforce needs, further intensifying the demand for flexible, configurable solutions. Several providers are also leveraging TPA and hybrid SaaS models to offer seamless claims processing, provider administration, and multi-line support.

-

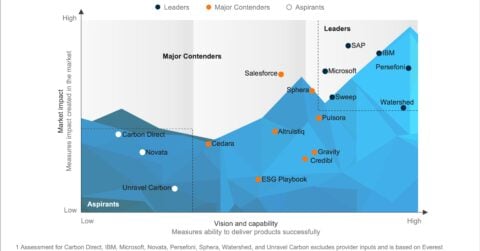

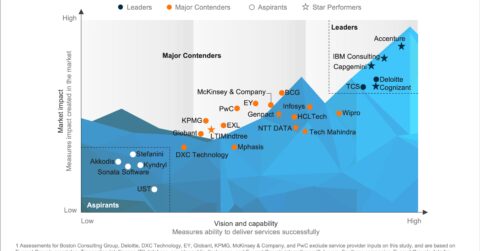

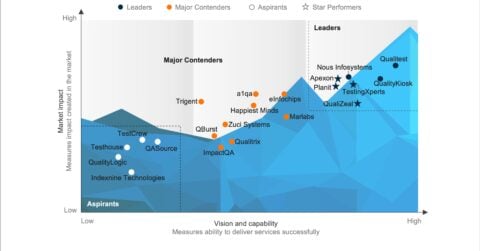

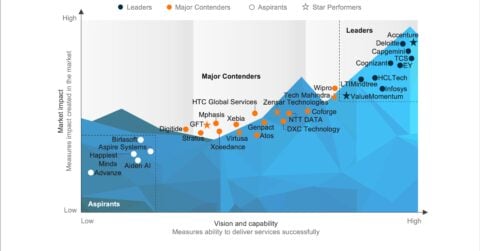

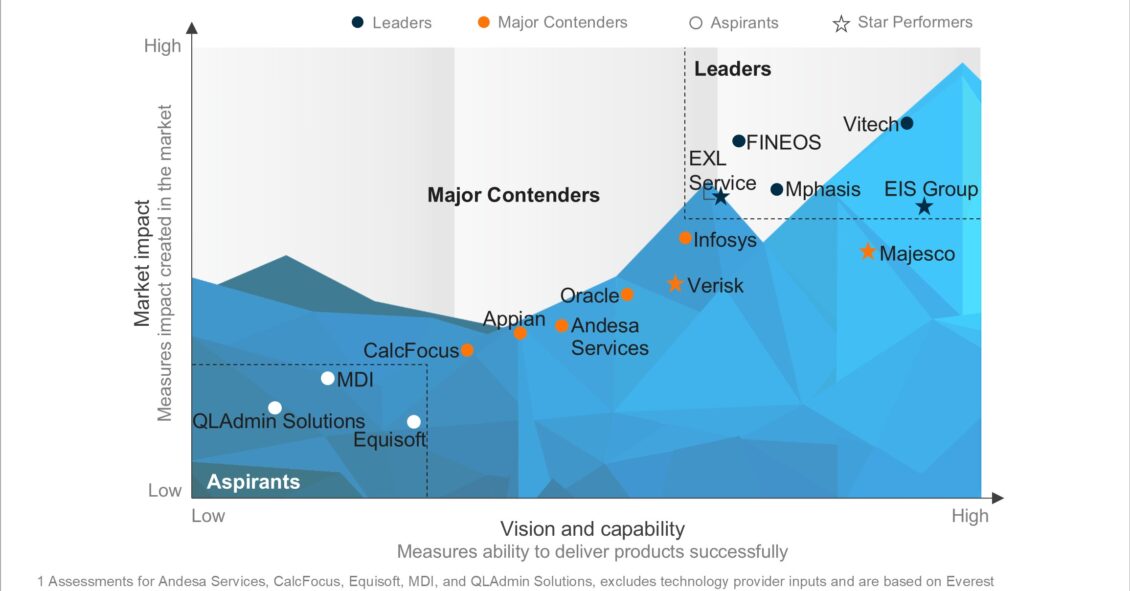

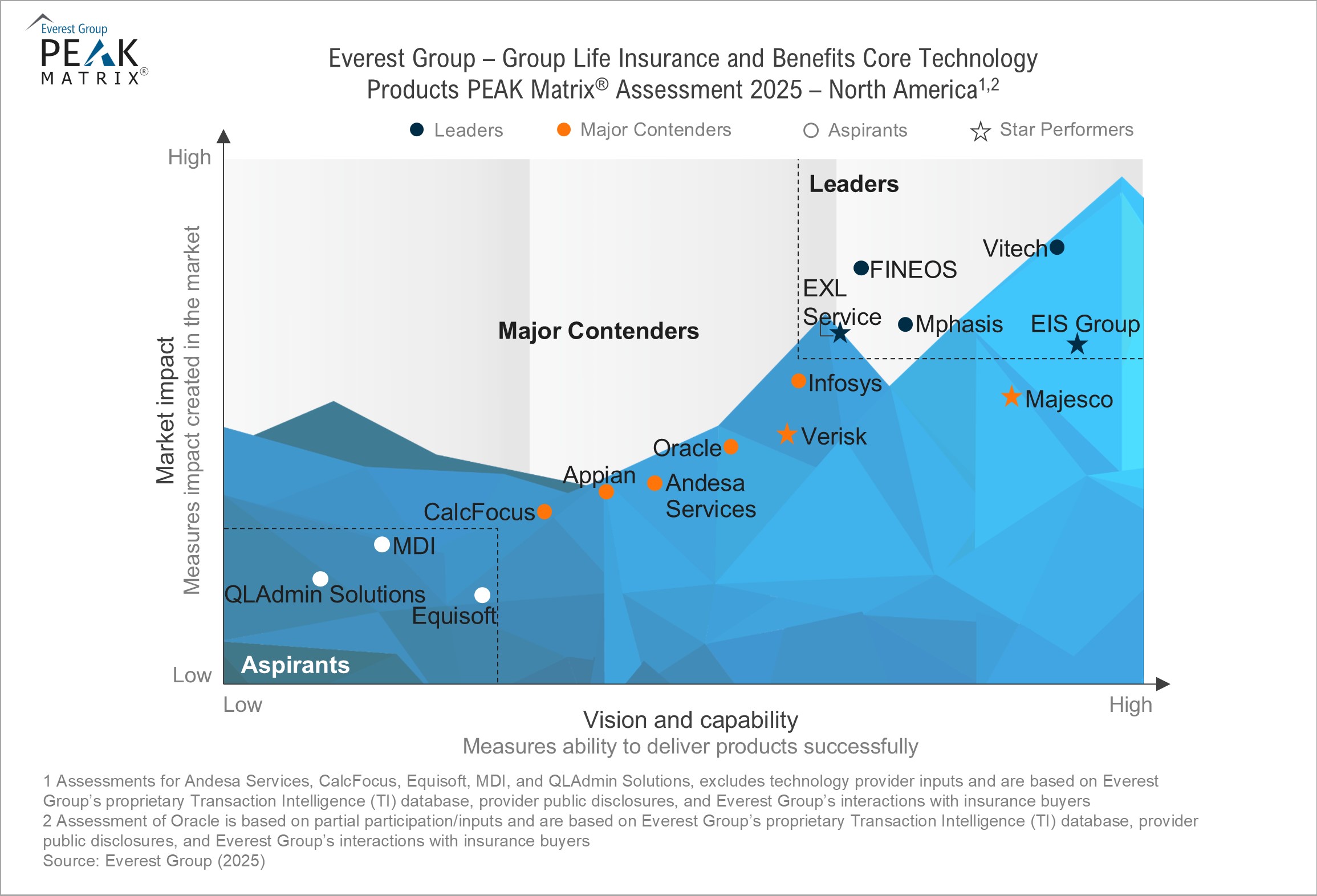

Group Life Insurance and Benefits Core Technology Products PEAK Matrix® Assessment 2025 – North America

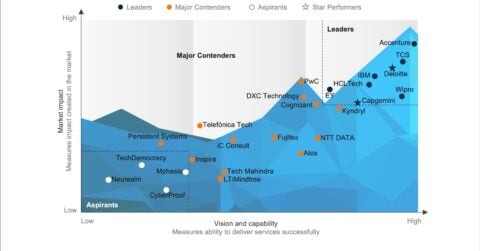

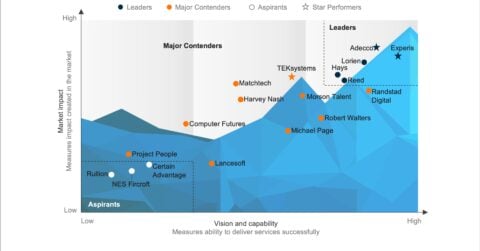

This report comprehensively assesses 15 leading core technology providers featured on Everest Group’s Group Life Insurance and Benefits Core Technology Products PEAK Matrix® Assessment 2025. Based on our annual RFI process, client feedback, and ongoing market research, it evaluates leading providers’ capabilities in enabling digital-first insurance operations. The assessment focuses on their abilities to deliver scalable cloud architectures, AI-powered solutions, stakeholder experience initiatives, and seamless integration across the insurance technology ecosystem.

Scope

- Industry: L&A insurance

- Geography: North America

Contents

In this report, we assess:

- 15 group life insurance and benefits insurance core technology providers on Everest Group’s Group Life Insurance and Benefits Core Technology Products PEAK Matrix® Assessment 2025: North America

Leaders’, Major Contenders’, and Aspirants’ characteristics - Providers’ offerings, along with their visions, product capabilities, adoption characteristics across geographies, case studies, partnerships, and investments

- North America’s group life insurance and benefits core technology provider market’s market size, growth drivers, investment themes, and future outlook

- Enterprises’ priorities and demand themes

READ ON

What is the PEAK Matrix®?

The PEAK Matrix® provides an objective, data-driven assessment of service and technology providers based on their overall capability and market impact across different global services markets, classifying them into three categories: Leaders, Major Contenders, and Aspirants.