While Legal Process Outsourcing (LPO) has been in practice since the late 1990s, it gained prominence post the economic recession in 2008 when corporate legal departments and top law firms were forced to prune costs. What started out as cost optimization for transactional legal tasks has now evolved to global delivery for complex services like compliance, IP services, and legal research. In addition to the obvious benefit of cost savings, LPO has led to significant additional value for firms including better technology leverage, improvement of on-time contract delivery rates, and wider access to a vast pool of talent.

The growth of the market in the initial years was driven by specialist providers like Integreon, Mindcrest, Pangea3, and Quislex. M&A activity has been high over the past few years, with providers looking at inorganic growth. Simultaneously, a number of Tier 1 BPO providers like Genpact, Wipro, and WNS have ramped up their capability in this space.

Pricing drivers for LPO services

Contrary to popular belief, a number of complex and specialist services like commercial analysis and contract drafting are being outsourced with reasonable success. Quite naturally, the skill sets required for these services are judgment-based and command a higher price point. On the other end, more rules-based services like document management and preparation of matters are lower priced, commoditized capabilities.

The extent of offshoring utilization affects the overall price of LPO deals, as is true with all types of outsourcingengagements. Acceptable offshore leverage for a particular LPO process is determined by various factors such as frequency and depth of client interaction, level of intellectual judgment required, standardization of work processes, analytical skills required, intellectual property rights protection, etc. Based on these factors, the offshoring for support functions such as knowledge management is typically 50-60 percent, while that for relatively more judgment-intensive primary functions such as compliance and business development falls in the 35-40 percent range.

Broad price spectrum for these services

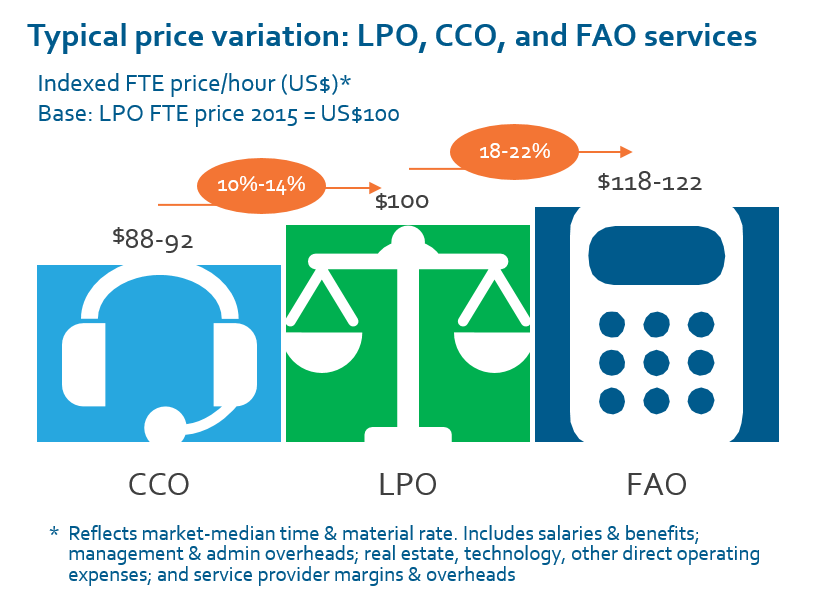

In a very broad way, relating LPO services to traditional BPO functions like Contact Center Outsourcing (CCO) and Finance & Accounting Outsourcing (FAO) provides a fair idea of where LPO stands on the BPO pricing spectrum.

Typically, pricing of LPO support functions like document management is similar to that of transactional CCO services. However, for other mid-complexity but core LPO functions –think knowledge management and contract drafting – pricing is typically 10-14 percent higher than CCO. This is primarily due to the need for more specialized skill sets for higher complexity legal services, a relatively less abundant talent pool, and the higher amount of client interaction required.

Transactional FAO services are typically priced ~20 percent over transactional LPO services, primarily due to their higher judgment and technology requirements.

Who commands a premium

Disclaimer… nothing can be generalized! Deal pricing varies based on a number of factors like competitive tension between providers, client bargaining power, and overall perceived risk in the solution. However, Everest Group has observed that specialist LPO providers often command a premium of 5-7 percent over multi-service Tier 1 providers delivering similar services. This is attributable to pure-play LPO providers’ higher degree of sector focus and greater investment in superior legal knowledge, while multi-service BPO providers leverage their wide footprint and existing client relationships to win and deliver LPO business.

It will be interesting to track how the commercial constructs for LPO evolve as further consolidation happens in the industry and economies of scale come into play.

What have you experienced with LPO?