While Finance & Accounting (F&A) is one of the most outsourced functions, it is also one of the first to be delivered through offshore global in-house centers (GICs) on a large scale. Indeed, the GIC market for F&A delivery (by FTEs) now comprises ~13 percent of the overall GIC market. During this insourcing process, the F&A function has grown by leaps and bounds, and has evolved along the following key themes.

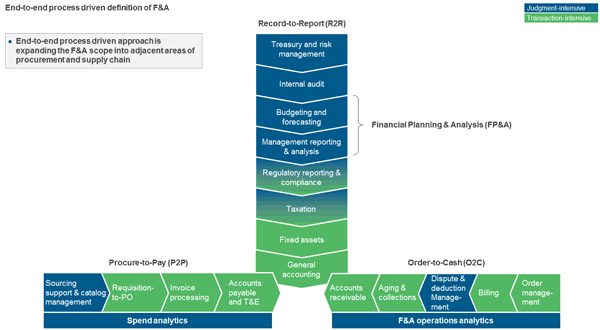

GICs are gradually moving from the functional definition of F&A to an end-to-end definition

The functional definition of F&A has been evolving gradually, giving way to an outcome-focused approach in which organizations are looking to break down functional silos and achieve effective process delivery. F&A processes are no longer being treated as stand-alone activities with independent objectives. Instead, they now have a broader mandate of being delivered in tandem with related procurement and supply chain activities. For instance, accounts payable is both a transactional F&A process and a transactional procurement process. It has been “repackaged” under the Procure-to-Pay (P2P) definition, which takes into account end-to-end delivery of accounts payable, travel and expenses, invoice processing, Requisition-to-PO, sourcing support, and catalog management. Similarly, Order-to-Cash (O2C) and Record-to-Report (R2R) are end-to-end processes now included within the F&A definition. Thus, mature GICs are offering seamless delivery of F&A processes with limited duplication of work.

GICs are increasingly leveraging nearshore locations for F&A delivery

Nearshore locations, such as Central and Eastern Europe (CEE) and Latin America, are increasingly playing a greater role in enterprises’ GIC location footprint for F&A delivery. Apart from time zone advantages and cultural affinity with onshore geographies, nearshore locations offer language capabilities that are essential for delivery to multiple onshore locations. For instance, Poland is being leveraged to serve Western and Eastern European countries due to the availability of language and finance talent. Nearshore locations, particularly in the CEE region, are also being leveraged to deliver niche/complex F&A work.

Companies that have chosen the GIC delivery model prefer to keep judgment-intensive F&A functions in-house

Many companies that have adopted the GIC model extensively prefer to deliver judgment-intensive F&A processes through the same in-house model, rather than outsourcing them. One of the key reasons for this preference is that the nature of work requires greater interaction with senior management.

Companies have evolved to a global delivery model for F&A services

Although many parent organizations initially considered F&A a shared function characterized by shared services centers across various regions, they are increasingly looking to break the regional silos and deliver F&A through global delivery centers, which work toward specific business outcomes. Many companies have been able to derive significant cost savings from this transformation through staff reductions, simplification of processes, and integration across functional silos in the global delivery model.

Multiple GICs have been transformed into Centers of Excellence (COEs) for delivering specific capabilities within F&A

COEs are expected to push beyond stipulated delivery mandates by unilaterally focusing their talent and investment on specific aspects of delivery, and transforming them to help derive additional value for the parent organization. In F&A, analytics and reporting COEs are being created to deliver analytics processes such as management reporting. By making use of data modeling and information analysis, these COEs can help the parent company make impactful decisions.

In addition to the above themes, GIC-based F&A delivery is witnessing critical changes in terms of operating model characteristics. GICs are fairly aggressively adopting analytics to reduce costs and increase operations profitability. They are also running pilot programs to measure the cost advantages offered by technologies such as Robotic Process Automation (RPA) for transactional F&A processes (primarily, accounts receivable, accounts payable, and general ledger). Although cost savings are the immediate motivation for most GICs, RPA will eventually become an intrinsic part of F&A delivery, as it will impact location decisions and future offshoring of work.

Everest Group has conducted a deep-dive analysis of this market, covering the current F&A delivery landscape from GICs, the evolution of delivery across key themes, descriptions of F&A process maturity achieved by GICs, and key operating model elements.

For more details, please see Everest Group’s latest report, “Finance & Accounting Delivery from GICs: Trusted Partner to Move F&A Beyond Delivery to Value Creation.”