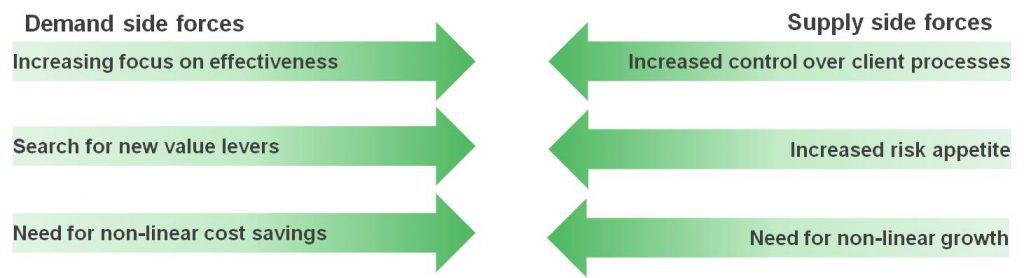

ITO deals in which service providers’ compensation is linked directly to the business outcomes they achieve for the clients have started gaining prominence. While the idea has been around for some time, and indeed should be part of a gradual evolution process from pure FTE or T&M models through to gainsharing arrangements, we’ve observed with interest both parties’ strategic interests (see image below) converging through shared business outcomes on several mega deals.

A number of clients have recently asked for our advice and insights on the upsides and downsides of outcome-based pricing models. Following are the factors we told them they must carefully consider before asking their providers to make the change:

- Trust: Ask yourself, “Do I really trust my partner?” Use your common-sense. Outcome-based models are often used in combination with a base T&M model in situations involving complicated deployment of new technology, where both parties share the risk. However, not everything goes smoothly in such situations, so don’t fall over yourself to shout “Penalty!” You might need to arrive at a negotiated outcome once your partner admits to an honest, unforeseen mistake. In other words, incentivise your provider to make it right, rather than masking the flaw and investing in a sub-optimal environment for the duration of the contract. The latter is the road to poor relationship health, contract disputes, and a frustrating end-user experience.

- Corollary to the Trust Principle, be prepared to Cede control: If the implementation partner is responsible for improved business outcomes, the team needs to have control over the business process and the underlying stack, including platforms, management, and reporting tools, and quite simply…the way you do business. You can play the powerful investor, but let your partner be the empowered CEO. Share your powers.

- Identify scope accurately: Building on the above point, the scope is often beyond the obvious. Mere implementation of an ERP system won’t raise productivity or prevent revenue leakage if the overlying process is inefficient. State the scope in line with your desired outcome. For example, scope is not, “implement ERP”; it’s “raise productivity by XX% by implementing ERP and optimizing the accompanying process.”

- Know the price of improved outcomes: Most providers won’t tell you they build a risk premium into their base fees on outcome-based models. In other words, while you are encouraging your partners to take on more risks, they want to cap the downside. Remember that they don’t want to, and sometime can’t, back out of a contract. Thus, if the desired outcome cannot be reached, they would have spent significant time and effort without recompense. So, you must carefully evaluate the business case for an outcome-based model. Is the scope large enough? Are the benefits of transformation deep enough?

- Make it stick: Arguably, this is the most challenging part, as it’s often difficult to establish causality between the provider’s performance and business outcomes, making “Cede control” (point #2 above) even more important. In addition, governance models must be suitably evolved and often supported by sophisticated management tools and chargeback mechanisms. Keep in mind that these come with a cost and, consequently, must be built into your ROI model.

At the end of the day, an outcome-based model is a bit like marriage – it represents the triumph of hope over experience. So be clear about why you are getting into it, choose your partner carefully, share space, and who knows – you could live happily ever after!