Vertical Industry Strategies – Getting Serious about Value and Investments | Sherpas in Blue Shirts

With the maturation of legacy service delivery models, everyone is looking for the next lever to pull.

And the first-ever survey into how shared services and outsourcing models are maturing by industry – being jointly conducted by Everest Group and the Shared Services and Outsourcing Network (SSON) – will finally yield definitive insights from buyers, providers and consultants alike on the abundantly clear next lever…industry-specific strategies. Take the survey now.

For the first time, we will be able to look at how shared services and outsourcing models are maturing for functions specific to more than 25 industries, such as claims management in insurance, order management in telecommunications, and loyalty program management in hospitality and tourism.

The responses from the Vertical Industries Strategies for Shared Services and Outsourcing survey will enable us to document the current role of shared services and outsourcing, degree of centralization, expected optimization initiatives, technology strategies, and other factors relating to more than 150 functions across all the covered industries. We’ll then be able to arm you with both the broad themes and the detailed nuances that are relevant to you and your business.

Why is a view of vertical industry strategies important?

First, we are receiving an abundance of these questions. We are increasingly asked to help organizations calibrate their approaches based upon factors unique to their businesses. For example, although sometimes collectively referred to as “Energy and Resources”, oil & gas, utilities, and mining are very different industries, and the location of businesses requiring support, the role and degree of centralization, and the tolerance for operating shared services in “non-traditional” geographies vary tremendously. And SSON is hearing the same thing from its members –industry-specific content and networking are increasing in prominence.

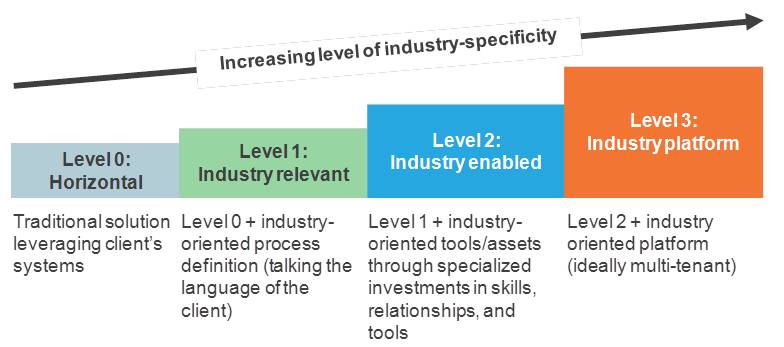

Second, solutions specific to vertical industry strategies drive more complex economics, especially as they relate to technology. As the functions being supported more closely touch the business, the potential impact on revenue and cost increases…as does the potential for greater value. However, the unique nature of each function complicates the technology options. Make-buy decisions become more complicated and fewer options exist. Further, service providers must carefully assess whether they have the stomach to invest in and maintain more narrow solutions with fewer potential clients across which to spread their investments. As illustrated below, service providers must think carefully about where to draw the line in making technology investments to serve unique industry needs. Further, their clients must make a corresponding commitment to a technology model.

Third, organization models are under attack and will be shaped by the answer. Traditional shared services models were initially defined around the scope being impacted by ERP implementations. The scope for offshore outsourcing and captives was largely shaped around roles that could be delivered remotely with lower cost labor. Neither was fundamentally designed around what best enabled the business. As shared services and outsourcing initiatives mature and expand, they are challenging existing organizing philosophies, and the degree and type of industry-specific services will fundamentally set the stage for the next generation in global services.

Oh yes, this is an important topic.

The survey, which will launch in early January 2012, will include relevant questions for enterprises, service providers, and consultant/analysts. If you have any questions or comments before you participate in it, please contact me at [email protected].