Growth in the contact center outsourcing (CCO) market has slowed to ~4 percent – as compared to 5-6 percent a few years ago – primarily due to service providers’ focus away from the traditional cost-driven business model toward value-added services, omnichannel solutions, and high-value work that will shape the contact center market of the future. As it’s expected to take a few years for the new age solutions to reach maturity, providers across the board will have ample time to rejig their broader strategies with market realities, and come out on top of their game when the growth rate shifts again into higher gear.

The size of contract renewals has outgrown that of new contracts by almost three times over the past few years, implying that larger buyers are shifting their vendor management strategy, moving away from smaller contracts with multiple providers to a smaller group of providers handling larger parts of their operations. There has also been an increase in multi-geography contracts in the last several years, which indicates buyers are consolidating their global engagements across multiple countries to simplify their operations and offer a consistent customer experience.

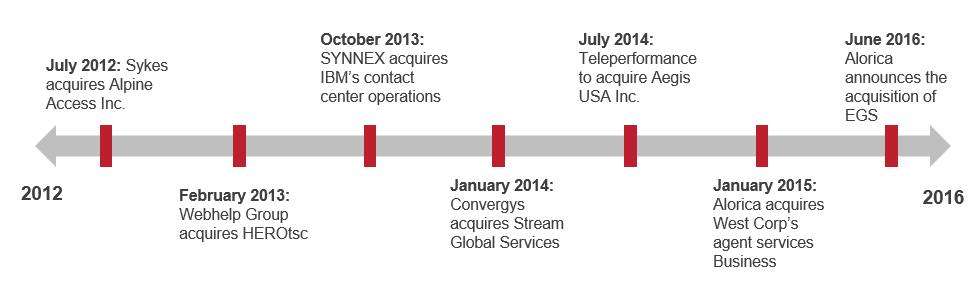

Service providers are responding to this challenge by making sure they have adequate resources to meet the new buyer requirements. Many are doing so via acquisitions for scale and to fill capability gaps they may have, e.g., those related to value-added services, multi-channel capabilities, emerging geographies such as those in Asia Pacific and the Middle East, and rapidly growing verticals including travel & hospitality and healthcare.

Large service providers are also actively focusing on the United States as a buyer geography. In the last few years, we have seen multiple acquisitions primarily focused around the U.S. market. These include Alorica-EGS, Alorica-West Corporation, Convergys-Stream, and Teleperformance-Aegis. While at first glance the U.S. appears to be among the slowest growing geographies, one needs to remember that it accounts for almost half of the CCO market. As such, despite its low growth rate compared to other geographies, in absolute dollar terms the U.S. added more than US$1 billion in new business in 2015, one of the largest spending gains globally, and more than half the size of the entire Middle East CCO market.

Acquisitions aren’t just specific to the large service providers. Even the small and mid-sized players in the market are ramping up their capabilities and scale by absorbing smaller firms. For example, Capita and Webhelp have acquired several smaller firms within Europe, and Knoah Solutions, a comparatively smaller CCO player in the United States, acquired LL Contact Center in Tegucigalpa, Honduras, to expand its nearshore capabilities.

With the move to a more digital contact center experience, the market dynamics have changed significantly in recent years. As customers move away from traditional offerings, service providers can no longer rely on their key strengths within a set of domains, and need to make sure they have capabilities across the board.

While the focus will remain on organic growth, acquiring it through inorganic means seems inevitable. We expect to see more consolidation in the market in the coming years, not only to reduce competition but also to improve margins and stabilize prices that are already under pressure due to the increasing role of automation and RPA. As such, we can expect several more M&As in the coming years, as service providers try to secure their place in the new world order of the digital customer experience and the changing CCO value proposition.

For an in-depth review of the CCO service provider landscape, please see our newly released 2016 CCO PEAK Matrix.