Blog

Measure “Longitudinal” User Experiences to Learn What Users Want, Need, and Dislike

It would be an understatement to say that COVID-19 has significantly altered people’s personal and professional lives. On the business front, most enterprises have been struggling with business continuity challenges as they grapple with the new reality of sustained Work From Home (WFH). To ensure operationality and employee productivity in the midst of this mayhem, many organizations’ previous focus on user experience (UX) has taken a backseat due to a siloed/flawed approach to UX management.

For example, in a recent Everest Group survey with enterprises on their response to the pandemic:

- More than 66% were concerned about employee burnout

- More than 64% were concerned about remote culture building

- More than 43% believe their employees lack the right set of tools and training for remote work

While measuring true user experience has been a perpetual challenge for enterprises, COVID-19 has made it even more difficult given the dynamic and contextual nature of UX.

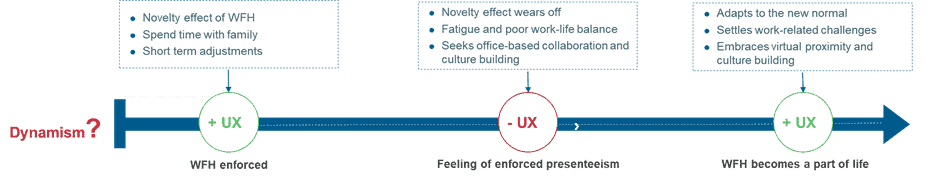

The following exhibit showcases how the initial user experience associated with WFH adoption was positive and then dipped due to various challenges such as poor work-life balance and lack of physical proximity to colleagues. However, the UX gradually improves as users adapt to and embrace WFH as the new normal.

![]()

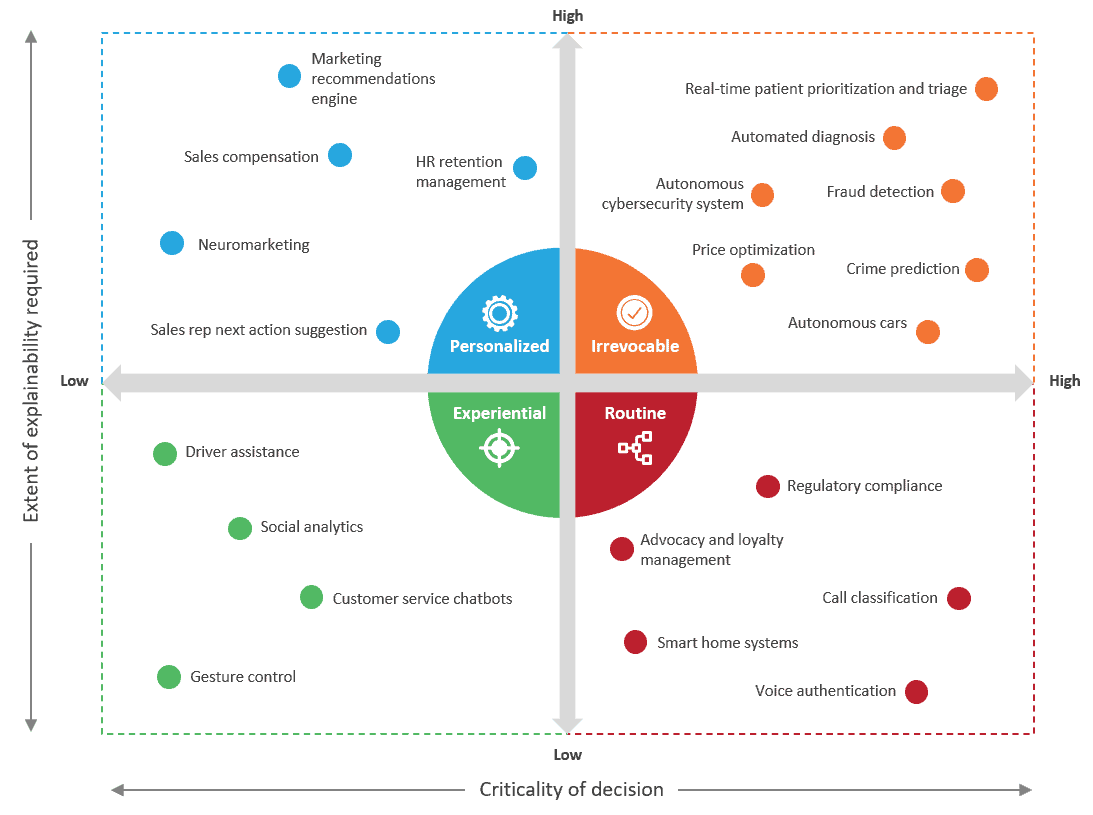

This next exhibit shows how UX is highly contextual and varies with a change in the user’s location, time, and preferences, leading to a different user reaction for the same incident. This is because UX is a continuous outcome and cannot be effectively measured at a specific point in time.

Measuring “longitudinal” user experiences is the key to UX management

A longitudinal study is a research design that involves observing variables over a period of time to understand the effects of time and background variables on the observation. In a UX context, measuring longitudinal user experiences provides enterprises with a holistic UX management approach to identify, uncover, and interpret an exhaustive list of hidden factors that contribute to UX variation. When tracked over time, it helps organizations understand the impact of any specific work disruption or workplace initiative on UX. In other words, measuring longitudinal experiences helps enterprises resolve the mystery of what users want, need, and dislike, with tangible data to back it up.

Measuring longitudinal experiences will allow enterprises to elevate their UX management strategy with a holistic focus on various technological touchpoints such as devices, applications, networks, and employee-level attributes to accommodate the contextual and dynamic nature of UX.

The enterprise guide to UX management

UX management tools provide end-to-end visibility of user experiences, identify back-end challenges, and address them while ensuring consistent and high-quality front-end experiences. In addition to real-time monitoring of end-users and applications, enterprises can leverage these tools for vulnerability assessments, root cause analyses, and prescriptive resolution.

To create an exhaustive list of factors that contribute to UX, any holistic UX management tool needs to capture user activity across the dimensions listed in the below table.

| Dimension | Tool functions |

| Devices | Track usage across various end-user devices (laptops, desktops, tablets, mobile) and other workplace devices such as telephony and printers to ensure high system availability, compliance, and performance. |

| Applications (web, mobile, desktop, cloud) | Track the complete application landscape across devices and platforms to identify and proactively resolve availability, compatibility, and performance issues. |

| Network | Continuously monitor network devices to identify/resolve problems such as connectivity issues, security vulnerabilities, network errors, bandwidth fluctuations, and latency issues. |

| Employee attributes | Holistically track employee attributes through relevant metrics over a period of time to remove noise and identify the true impact of any change on UX. |

The UX management space has grown tremendously over the last two to three years, and new technology vendors have joined the ranks of native vendors such as Google and Microsoft.

Here are key considerations that enterprises should keep in mind when selecting a UX management partner:

- Requirements analysis: Enterprises should choose a UX management tool that aligns with their requirements and should request a demonstration from top picks before making their decision. While most vendors offer strong expertise across device and application analytics, only select vendors have a holistic focus and well-balanced capabilities across all the four dimensions (device, app, network, employee) of UX management.

In addition to segmentation by scope, the vendor landscape can also be segmented by native and emerging vendors. Native vendors consist of players who already have a successful base product in the market and are providing analytics capabilities on top of it. Emerging vendors provide license-based analytics software that connects with native vendors’ prevalent products and platforms to aggregate data for analytics.

| Vendor Landscape | |

| Native vendors | Emerging vendors |

| Include CISCO, Citrix, Google, Microsoft, OEMs, Oracle, and VMware | Include 1E, AppDynamics (CISCO), AppNeta, Aternity, CatchPoint, Datadog, Dynatrace, eG Innovation, Enow, Lakeside, Microfocus, New Relic, Nexthink, Rigor, Sinefa, SolarWinds Pingdom, and ThousandEyes (CISCO) |

- Pricing: Enterprises should evaluate the pricing construct and deployment model to arrive at a total cost of ownership for the overall requirement. They also need to factor in bundled benefits offered by certain vendors with large deployments.

- Integration and customizations: Enterprises should choose a tool that best integrates with their existing IT landscape. Evaluating out-of-box connectors and the API landscape for each tool can help determine the level of integration offered by the vendors.

- Out of the box features: Enterprises looking to get their DEM landscape up and running quickly need to evaluate out of the box features and use cases offered by each vendor. These ready to implement capabilities reduce the implementation time frame and the gestation period of the tool. Additionally, organizations need to analyze the rate at which newer use cases are being added by vendors.

- Reporting and dashboarding: Enterprises should make sure they focus on simplifying data consumption and reporting. Having terabytes of device, app, network, and user data with no concrete framework around reporting and ultimate utilization of this information to improve the UX is a common pitfall.

We’ll soon be launching a new vendor assessment in the Digital Experience Management product space, so keep your eyes peeled. Please contact us at [email protected] or [email protected]for more information.