June 7, 2016

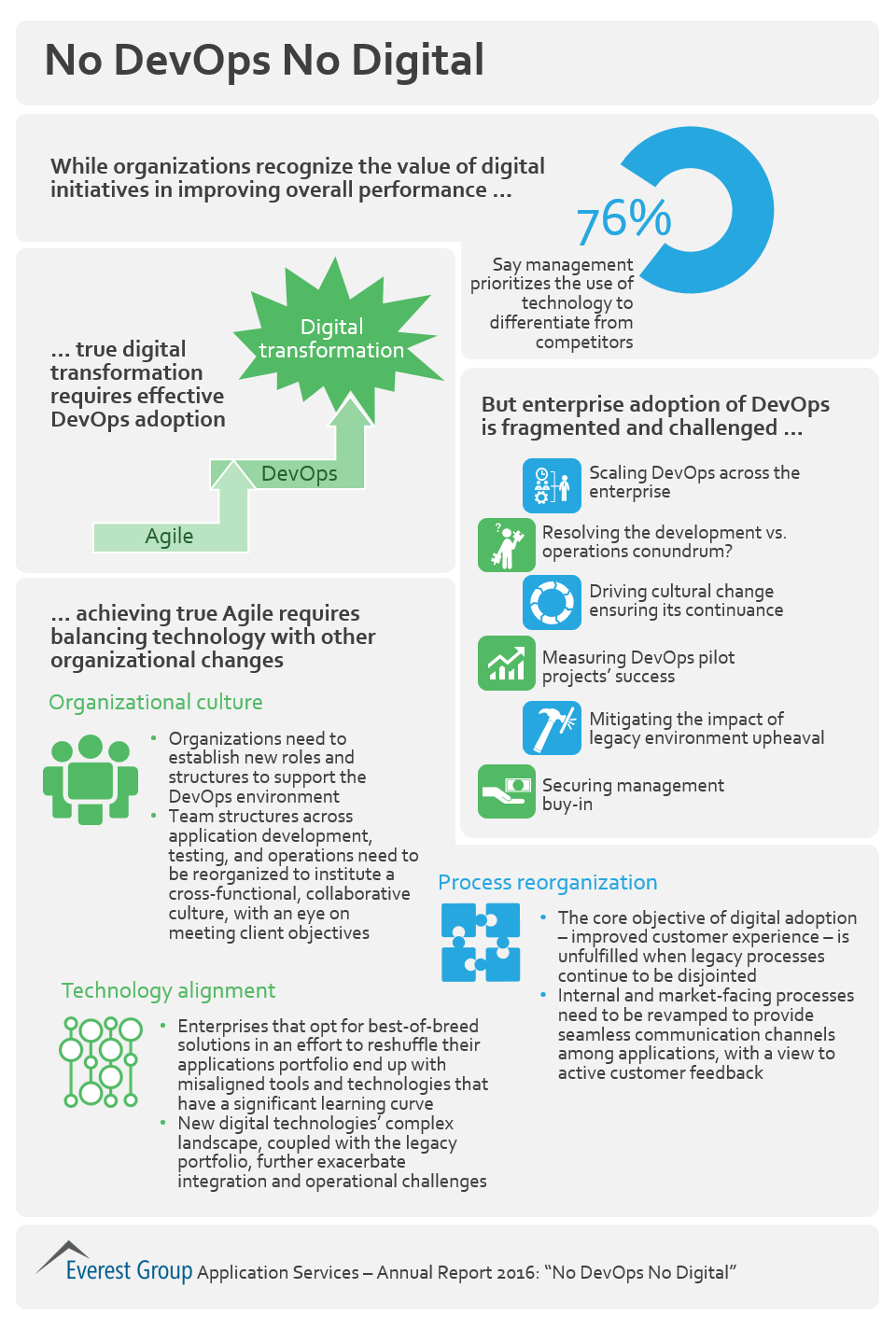

Taking the message a step further, Everest Group cites recent research in warning, “No DevOps, No Digital.”

No longer a peripheral facilitator of business operations, technology must now be at the heart of every enterprise. It is time to “go digital or die,” according to Everest Group, a consulting and research firm focused on strategic IT, business services and sourcing. To become truly digital, enterprises need to develop a holistic applications and infrastructure strategy, with DevOps as the pivotal enabler.

Everest Group experts Sarah Burnett, vice president, and Eric Simonson, managing partner, will discuss these findings at an exclusive event, “Go Digital or Die,” to be co-hosted by Professional Outsourcing magazine and Nasscom on June 23 in London.

Burnett and Simonson will join R. Chandrashekhar, Nasscom president, in discussing technology from the capital point of view, disruptive technology, and making the digital transition.

***More information about this exclusive networking dinner and presentation at the Royal Horse Guards Parade Hotel is available here.***

According to Everest Group’s Application & Digital Services research conducted in Q1 2016, over three-fourths of enterprises believe in leveraging digital technologies to achieve competitive differentiation.

“Enterprises that embrace digital adoption are using technology to create new business, not just enable it. For example, enterprises are discovering how IoT and mobility can dramatically improve user experiences, which is unlike the traditional role of technology for driving efficiencies in back-office operations,” said Yugal Joshi, practice director and lead on the recently published report, “Application Services – Annual Report 2016: ‘No DevOps No Digital.’”

“Digital enterprises are those that employ emerging technologies throughout the enterprise—across internal and market-facing operations,” continued Joshi. “This requires an integrated applications and operations strategy with DevOps as its pivotal element.”

Everest Group also reports that though enterprises are keen to adopt DevOps principles, most organizations struggle with them and require hand-holding on their journey. Nevertheless, this has not resulted in higher engagement with service providers, as enterprises themselves are scaling up their portfolio to meet this demand.

Other Key Takeaways from Application Services Annual Report

- Enterprises have begun adopting Agile and DevOps principles by themselves. However, they are struggling with scaling up their pilot projects to an enterprise-wide adoption.

- Many enterprises already have adopted Agile approaches in the application development and testing phases of the lifecycle and are now experimenting with ways to integrate the crucial operations phase to embark on a truly DevOps journey.

- While in some cases enterprises lack executive leadership commitment to institute cultural change, in other cases, enterprises overemphasize technology without getting the pre-requisite peripherals in place.

- The Application Services market grew by approximately 5 percent in 2015, higher than the overall IT services industry growth of 3 percent.

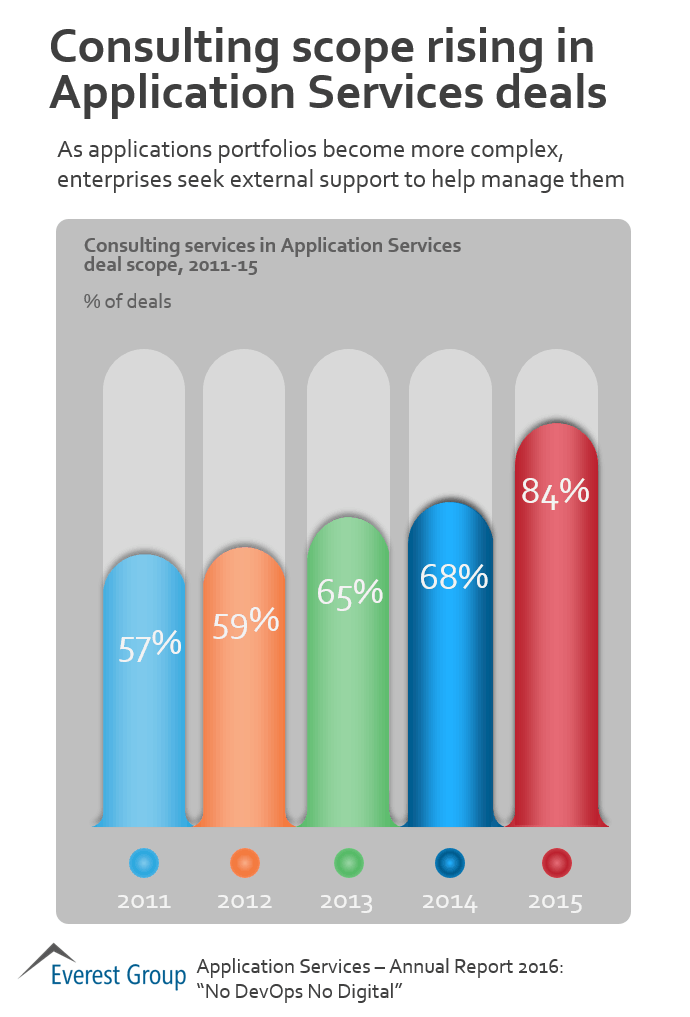

- Demand for consulting services spiked in the last year, driven primarily by enterprise adoption of digital technologies.

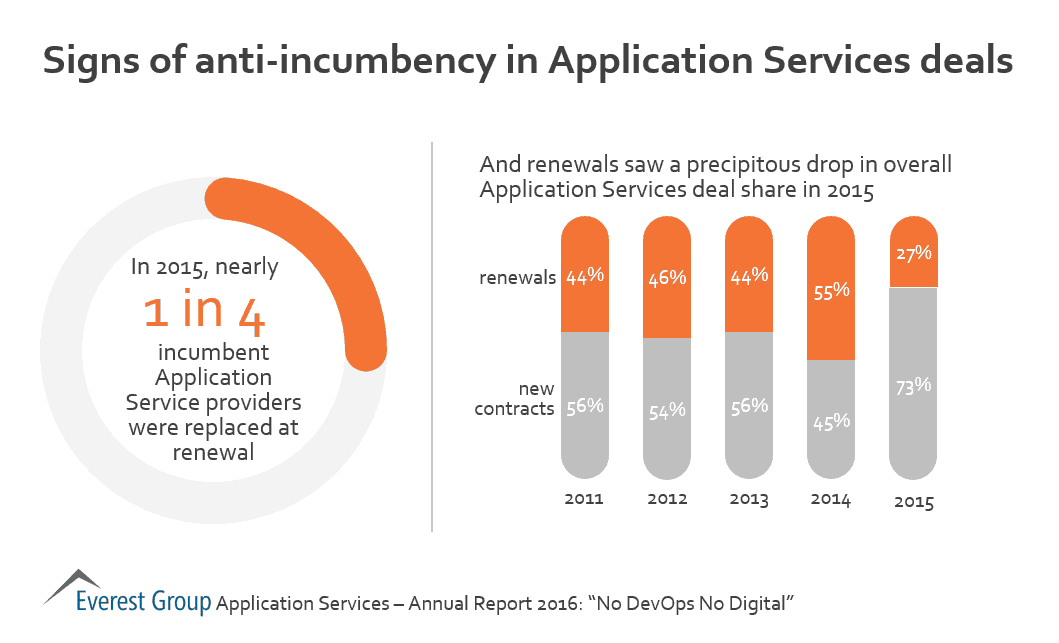

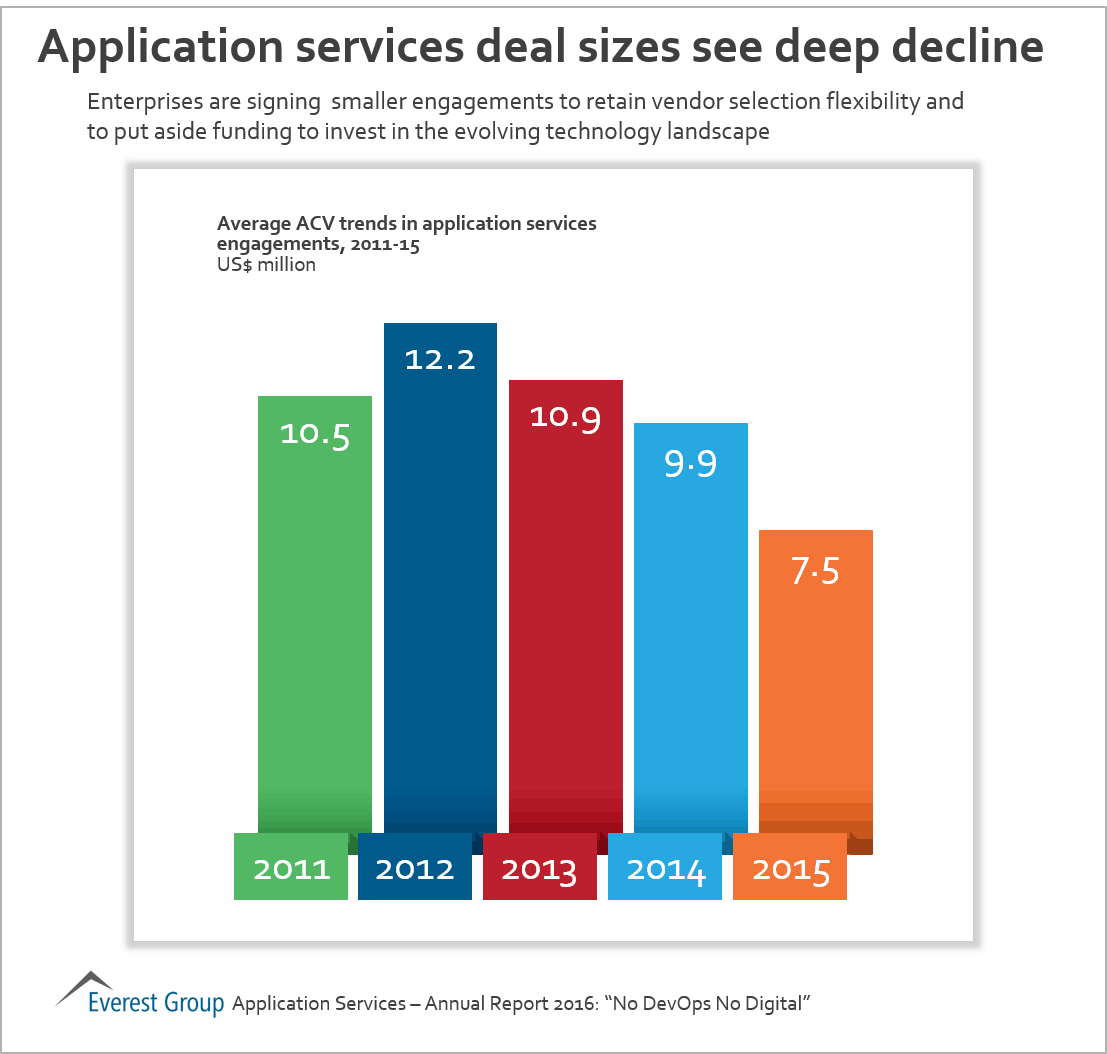

- Anti-incumbency is gaining traction among buyers as they are increasingly seeking newer engagement constructs.

- The Banking, Financial Services and Insurance (BFSI) segment led overall deal activity with 26 percent share. Healthcare and life sciences enterprises increased their spending proportion to 14 percent share.

- As for the outlook for 2016-2017, Everest Group predicts that digital adoption will continue to witness increased traction, but the bulk of enterprise spending will be on traditional application services that take up the majority of legacy application portfolios. Application services will begin to take up a slightly larger share of the market as demand for digital technologies and connected systems will necessitate development of ecosystems across multiple channels.

***Publication-Quality Graphics***

High-resolution graphics illustrating the key takeaways from the “Application Services – Annual Report 2016: ‘No DevOps No Digital’” may be included in news coverage, with attribution to Everest Group. Graphics include:

- No DevOps No Digital

- Signs of anti-incumbency in Application Services deals

- Consulting scope rising in Application Services deals

- Application services deal sizes see deep decline

Download graphics here.