While multiple studies have addressed the significant value-add potential of analytics delivered by third-party service providers, surprisingly little research has been conducted on analytics supported by Global In-house Centers (GICs). To close this gap, Everest Group recently released a research report detailing GIC footprint, adoption, and best practices for analytics processes.

Following are three lesser known facts about analytics in GICs:

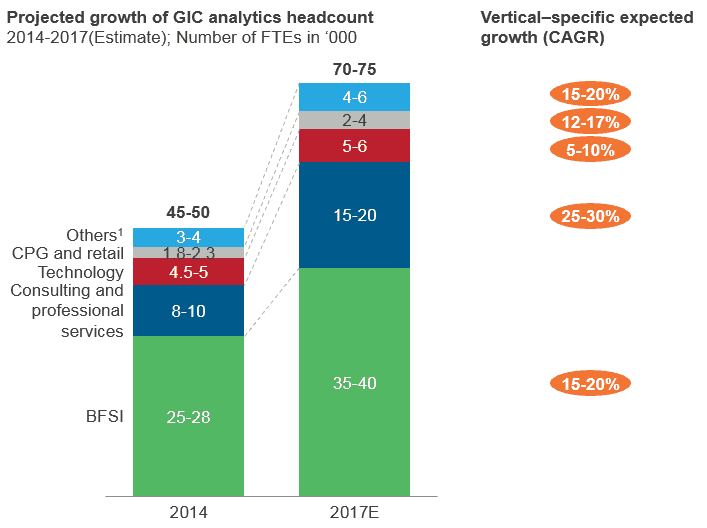

Consulting and professional services is one of the largest and fastest growing verticals in GIC analytics adoption

Perhaps unexpected to many, consulting and professional services is the second largest vertical in terms of GIC analytics headcount, after BFSI. It is also the fastest growing vertical for analytics market. (See Exhibit 1 below). Leading professional services firms such as Deloitte, EY, KPMG, and PwC have developed large analytics teams in their India GICs and other offshore/nearshore locations. These analytics GICs are an integral part of these firms’ core delivery model, and support both internal and external stakeholders. The teams provide support in areas including core audit, tax support, risk advisory, performance improvement, technology advisory, and transaction advisory. They also have sizable headcount supporting market intelligence and reporting activities. Leading consulting firms such as McKinsey & Company and Bain & Company are also significantly leveraging in-house analytics capabilities to support client work.

Most verticals, other than BFSI, primarily use analytics to drive top-line growth

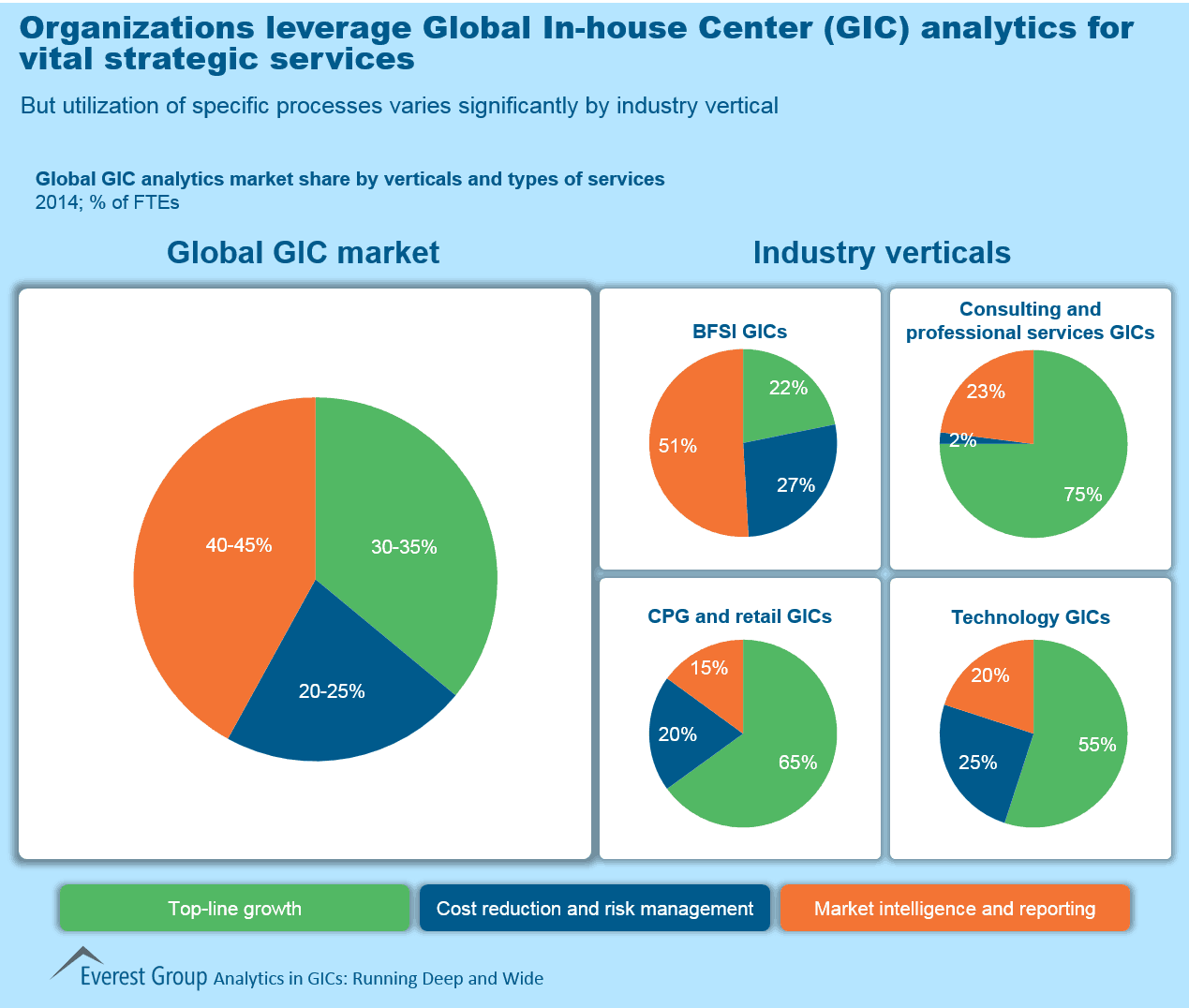

The prime focus of the analytics teams in CPG & retail, and technology is to drive sales through activities such as product recommendations, optimal pricing, and customer lifecycle. And due to GICs’ role as an extended team, most of the analytics work in consulting and professional services contributes towards the firm’s revenue.

This is in sharp contrast with BFSI, which is the most mature adopter of GIC analytics. Major regulatory changes such as Dodd-Frank Act, the CARD Act, FATCA, and Basel III have compelled banks to be more transparent in data reporting, thus requiring regular data collection and event monitoring. Hence, leading financial services firms need to maintain large in-house reporting teams. Increasing usage of online banking, mobile banking, and card payments has led to higher risk of a fraud these days. Banks use analytics to cull out the risky customers and predict default. This, and given legacy reasons, banking GICs tend to have a much higher analytics scale for activities pertaining to cost reduction and risk management compared to those that support top-line growth. These vertical-specific variations in utilization of specific analytics processes by GICs are illustrated in Exhibit 2.

Increasing evidence of analytics consolidated as a shared capability within GICs

Most of the analytics work requires domain understanding and alignment with business unit-specific objectives. Hence, GICs, especially financial services centers, traditionally structured analytics as vertical teams directly reporting to the corresponding business units.

However, there are increasing instances of GICs structuring analytics as horizontal shared capabilities for certain activities. With experience and maturity in service delivery, GICs have realized that certain analytics activities (e.g., data collection and cleaning, model design and validation, and Management Information Systems (MIS)) can be structured as a horizontal shared capability supporting multiple business units. The key driver for this is creation of a common talent pool of like-minded individuals for career development. It also leads to consistency in hiring and recruitment.

Everest Group’s recently released report, “Analytics in Global In-house Centers (GICs): Running Deep and Wide” provides details on the current market size of analytics services delivered by GICs (overall and industry-specific), key growth drivers, and location landscape. For more details, please download a preview of the report.