How to Eliminate Your Competitors in IT Services Sales | Gaining Altitude in the Cloud

As a result of the consumerization of IT within today’s businesses, many technology service providers struggle to find a sales approach that drives greater growth. With CIOs now playing a far less prominent role as an intermediary determining the best solutions and, instead, business stakeholders making buying decisions, traditional solution selling is not a very effective approach today. But something akin to solution selling is meeting with success in the business stakeholders market.

At Everest Group, we have come to think about this issue as the difference between a “push” or pull” approach. Here’s what they look like:

- Push approach: “I have a product or service offering. You should buy it because it will help you run your business better.”

- Pull approach: The existing or potential client asks: “Can you help us with our business problem?”

CIOs and IT organizations tolerate the traditional push approach, but it doesn’t get traction with the business stakeholders market. In fact, they find the push approach offensive. If you use this approach, you run the risk of coming across as arrogant, effectively telling them that you know how to run their business better than they do.

The surest way to get to a positive sales outcome in the business stakeholders market is to get them to solicit you for a solution. But how can you create a pull and get them to invite you to help solve their business problem?

Two steps are foundational to a pull approach.

1. Establish your credentials as an expert through marketing

First of all, you need a reason to be in the room having a discussion with the prospective client’s business stakeholders. Thus they must perceive you as relevant. In other words, they perceive you as an industry expert and/or an expert in their functional area.

That perception must occur without you going in and positioning yourself, telling them you’re an expert. They need to already think of you that way and pull you in for a discussion. Hence, the role of marketing is crucial.

2. Demonstrate interest in the client’s issues — without selling

You need to express interest in the client’s issues. How do you do that? One highly effective way is to motivate the sales prospect to commission your company to do research in an industry or functional area. First you must show that you recognize they (not you) are the expert in that area.

For example, you could say, “We are looking to make new investments in your industry (or functional area) to serve you and others like you. We recognize that you are a leading firm in this area, and we would appreciate your telling us your thoughts on specific aspects.”

The key to making this succeed is not having a salesperson make that approach. If you move to a sales pitch at this point, you will alienate your prospect.

In the course of doing the commissioned research, you will begin to understand the issues the prospect faces and how they view the world. If you can then further explore (again, not using a salesperson to pitch this) what it takes to resolve the problems you identified, prospects then often ask the question: “Can you help us do this?”

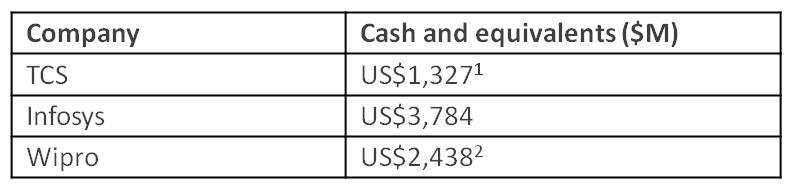

As we pointed out in our blog post about recent earning reports, Cognizant and TCS are leading the services provider pack in growth. We believe that, to at least a small extent, this is because they are being better listeners to their sales prospects in industries where they have expertise and are thus more often able to pull the question: “Can you help us?”

Eliminating your competitors

By the time prospects ask you for help with their business problem, you have already credentialed yourself in their minds. They believe you are interested in them and you have relevance to their problem. At this point, they’re not looking at your competitors; they’re looking to you for help.

At this point, and only at this point, will a sales approach find acceleration in today’s services market.

The traditional sales process with a push approach is quick to reach the RFP and proposal point but then takes a long time going through due diligence and the rest of the RFP process before getting to closure. That process inverts with a pull approach: it’s a long time to proposal, but getting to closure is quick once the prospect asks for your help in solving their problem.