While buyers have typically approached, evaluated, and made third-party business process service delivery sourcing decisions at the operational level, and separated out decisions on the underlying software applications and/or technology infrastructure, they are increasingly realizing the value of looking at IT and BPO in an integrated manner.

Enter Business-Process-as-a-Service (BPaaS), a model in which buyers receive standardized business processes on a pay-as-you-go basis by accessing a shared set of resources – people, application, and infrastructure – from a single provider.

There are many potential upsides of BPaaS…but is it right for your organization? The answer lies in evaluating the model based on a holistic business case that looks at a range of factors including total cost of ownership (TCO), the nature of the process/functional area under consideration, business volume fluctuations, time-to-market, position on the technology curve, and internal culture and adaptability to change.

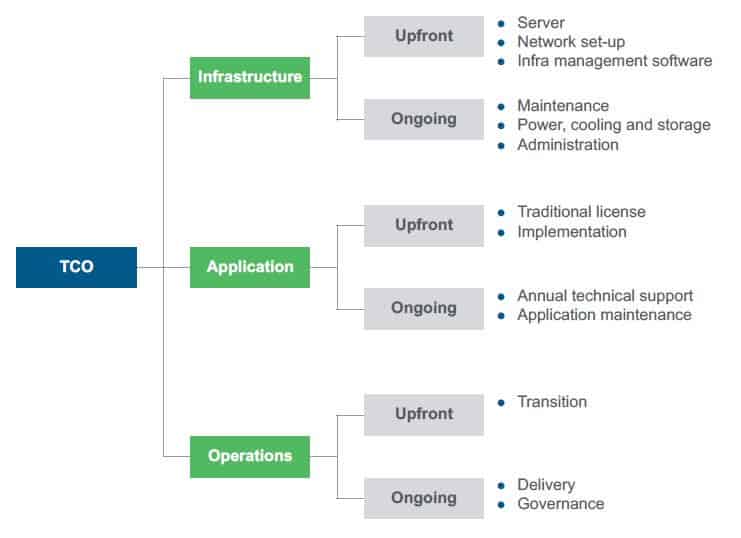

Let’s take a deeper look at the TCO factor, which must be analyzed in terms of both upfront and ongoing costs for all three layers of service delivery.

For our just released research report, Is BPaaS the Model for You?, we developed and used a holistic evaluation framework that compared TCO for BPaaS and the traditional IT+BPO model across three buyer sizes: small (~US$1 billion revenue/5,000 employees), medium (~US$5 billion revenue/20,000 employees), and large (~US$20 billion/100,000 employees.)

Our findings?

Small Companies

BPaaS brings big benefits. It is independent of deal duration, delivers 35-40 percent savings compared to traditional IT+BPO, enables leverage of the provider’s economies of scale, provides access to otherwise cost-prohibitive technology, and allows entry into BPO relationships that as stand-alone’s lack the necessary scale. Small buyers are also highly amenable to BPaaS’ process and technology standardization requirements.

Medium Organizations

BPaaS is pretty impressive. It delivers 25-30 percent savings over the traditional IT+BPO model, which while less than what small buyers reap is still significant in driving a successful business case. Medium buyers’ increased scale allows them to capture some of the economies of scale benefits even in the traditional IT+BPO model, thereby having a lower differential between the two models.

Large Enterprises

BPaaS is not too shoddy. While it only provides ~10 percent cost savings compared to traditional IT+BPO, the absolute differential in cumulative TCO can still be substantial given the high base. And, in certain buyer-specific situations such as technology enhancements, exploration of new BPO/IT infrastructure relationships, and expiration of legacy technology licenses, BPaaS can be a good model for large buyers to evaluate. But…their tendency to balk at following a tightly defined, standardized approach – unless significant configuration features offset a good portion of customization needs – reduces BPaaS’ appeal for them.

As you see, our evaluation framework shows an inverse relationship between buyer size and cost savings from BPaaS – i.e., the larger the buyer, the lower the percentage savings. In fact, as buyer size increases, the scale benefits of renting versus owning infrastructure and applications can dip into the negative column over ten years. Of course, the assumptions in our BPaaS to IT+BPO model analysis are ideal, and your organization’s individual reality may be quite different.

To learn more about how to evaluate BPaaS’ applicability to your company, select a BPaaS provider and solution, and implement the selected solution, please read our report, Is BPaaS the Model for You?