The Life and Annuity (L&A) insurance industry is rapidly transforming, driven by technology advances and evolving customer expectations. As insurers face challenges with legacy systems, regulatory changes, and market dynamics, IT service providers become crucial allies in navigating associated complexities. To accelerate digital transformation, L&A insurers need support to create data-driven workflows, deliver seamless digital experiences, and achieve faster time-to-market.

Previously, insurers focused on cloud migration projects, process automation, and reducing data silos. The recent economic climate has shifted their priorities toward quick wins and long-term growth. This shift emphasizes business outcomes such as empowered intermediaries, enhanced customer experiences, omnichannel interactions, and expanded voluntary benefits for group life insurance.

In response, IT service providers are developing in-house solutions and collaborating with technology providers and InsurTechs worldwide. Further, they are integrating AI and gen AI solutions in their core offerings.

-

Life & Annuity (L&A) Insurance IT Services PEAK Matrix® Assessment 2024

What is in this PEAK Matrix® Report

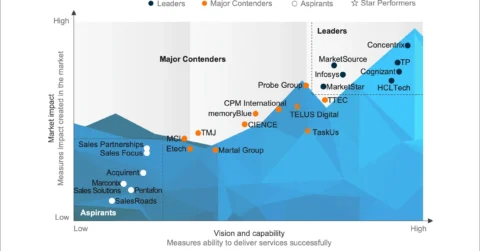

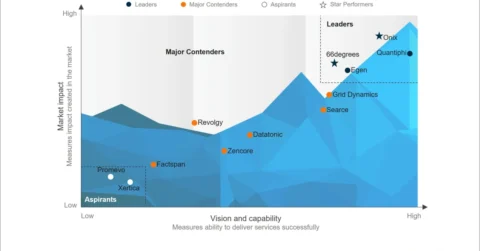

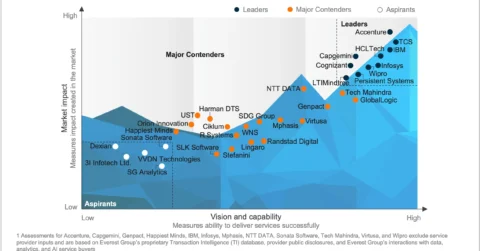

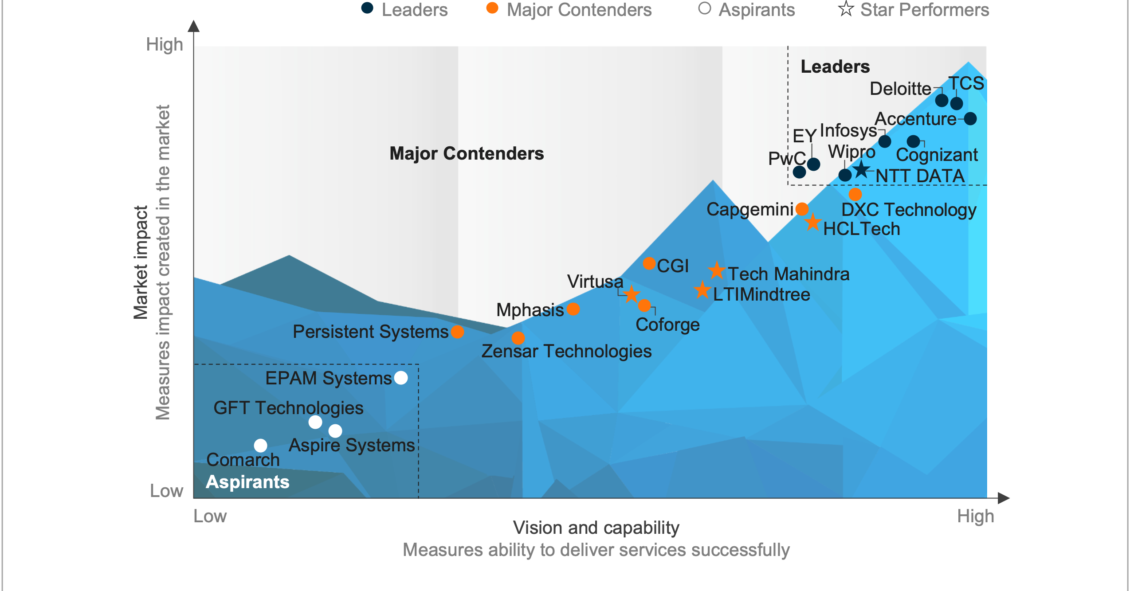

This report assesses 24 leading IT service providers featured in the L&A Insurance IT Services PEAK Matrix® Assessment 2024. Based on Everest Group’s annual RFI process, client references, and ongoing market analysis, this report evaluates these providers and their capabilities in meeting the L&A insurance industry’s evolving needs.

Contents:

In this report, we

- Assess 24 IT service providers on Everest Group’s L&A Insurance IT Services PEAK Matrix®

- Examine the Leaders’, Major Contenders’, and Aspirants’ characteristics

- Evaluate the IT service providers’ offerings, along with their vision, product capabilities, adoption characteristics across geographies, case studies, partnerships, and investments

- Discuss the global L&A IT service market’s market size, growth drivers, investment themes, and future outlook

- Identify enterprise priorities and demand themes

Scope:

- Industry: L&A insurance

- Geography: global

READ ON

What is the PEAK Matrix®?

The PEAK Matrix® provides an objective, data-driven assessment of service and technology providers based on their overall capability and market impact across different global services markets, classifying them into three categories: Leaders, Major Contenders, and Aspirants.