The latest Forces & Foresight™ research by Everest Group highlights the beginning of a turnaround in the services industry’s growth. However, the significance of this recovery is unexciting, as balancing forces exist that both impede and support industry growth. How a service provider aligns with the right set of forces will become key to competitive success. Read on to learn about the necessitating strategic foresight and tailored approaches for industry players to thrive in the post-downturn landscape.

In my last blog, Driving Factors for IT Services Recovery in 2024: Insights from Everest Group’s Forces & Foresight™ Research, I highlighted three forces fueling our services industry growth turnaround foresight. We are seeing more points of evidence validating those. Let’s revisit these forces and their progression:

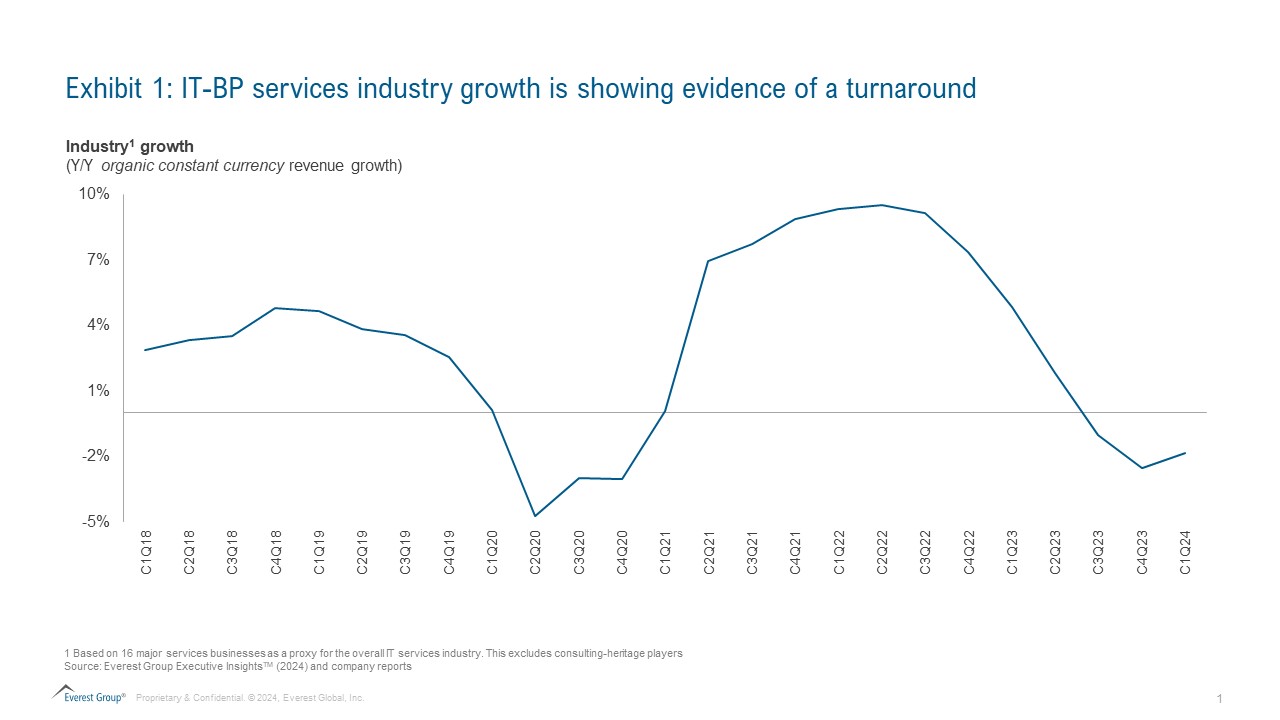

- Stabilizing base – We spoke about seeing a pause in deteriorating demand trends. The turnaround in growth (see Exhibit 1) and forward-looking views of service providers validate this thesis

- Fixing revenue leakage – We noted signs of stabilization in leakage, such as bookings not commensurate with revenue. While the differential still exists, we are seeing more confidence in service providers. Almost all the growth guidance estimates are dependent on the booked business translating to revenue over the next 12 months

- Pockets of additional growth – As previously highlighted, cybersecurity, ER&D, and data and analytics continue to thrive. For instance, cyber security players like Zscaler have surpassed expectations, leading to upward revenue projections

Turnaround is a given, but does it really matter so much?

As we outline our growth outlook in the next Forces & Foresight edition, we roll forward our forecasts to the next 12 months (ending March 2025). From this analysis, we have narrowed down two convictions:

- The IT services industry will see a turnaround in growth

- In the absence of an extraordinary event, we expect the magnitude and speed of this turnaround to be “unexciting” (unlike comebacks in previous downturns)

The reason for this unexciting recovery is that the magnitudes of industry forces, supporting and impeding the industry growth, are roughly equal, as portrayed in Exhibit 2.

Exhibit 2

| Forces impeding services industry growth | Forces supporting services industry growth |

| Over-influence of macro sentiments on services spend

Spend cautiousness will impact quick and big pickup in major segments like BFSI despite any signs of turnaround Enterprise confidence levels are still far from promising pickup in discretionary spend Elongated durations of large contracts don’t allow for high ACV contributions

|

North America is showing recovery, driven by a notable turnaround in Hi-Tech spend resilience in the public sector and energy

Less matured geos are playing a strong role in the industry growth contribution The new wave of productivity demand is providing better avenues vs. strict cost-cutting on volume and pricing Newer revenue streams are playing out (e.g., net expansion in GIC-generated revenue) |

Our inference from the balance of these forces is that, while the positives will outdo the negatives, the latter are sticky and emerge from a somewhat changing psychology of demand – a topic we are consciously tracking. This stickiness negates a euphoric pickup in services industry growth, which was observed in previous downturns (we presented these in our previous blog).

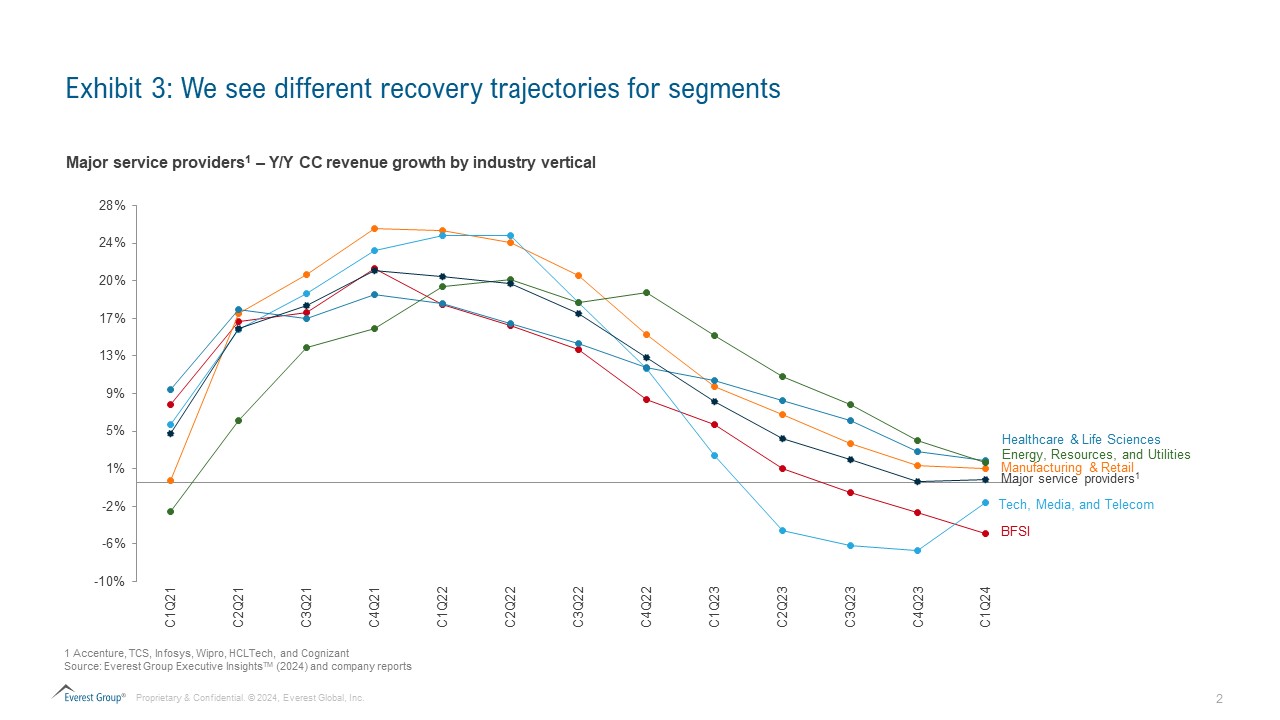

As we mentioned, the industry will be an interesting mix of performance of segments and providers based on their portfolios and part of trajectories. Simply put, segments and providers that could be at a higher risk of longer recovery cycles are the ones with heavier exposures to (a) discretionary revenue, (b) negative geo-specific dynamics, and (c) non-flexible delivery and commercial models.

Things are not so straightforward

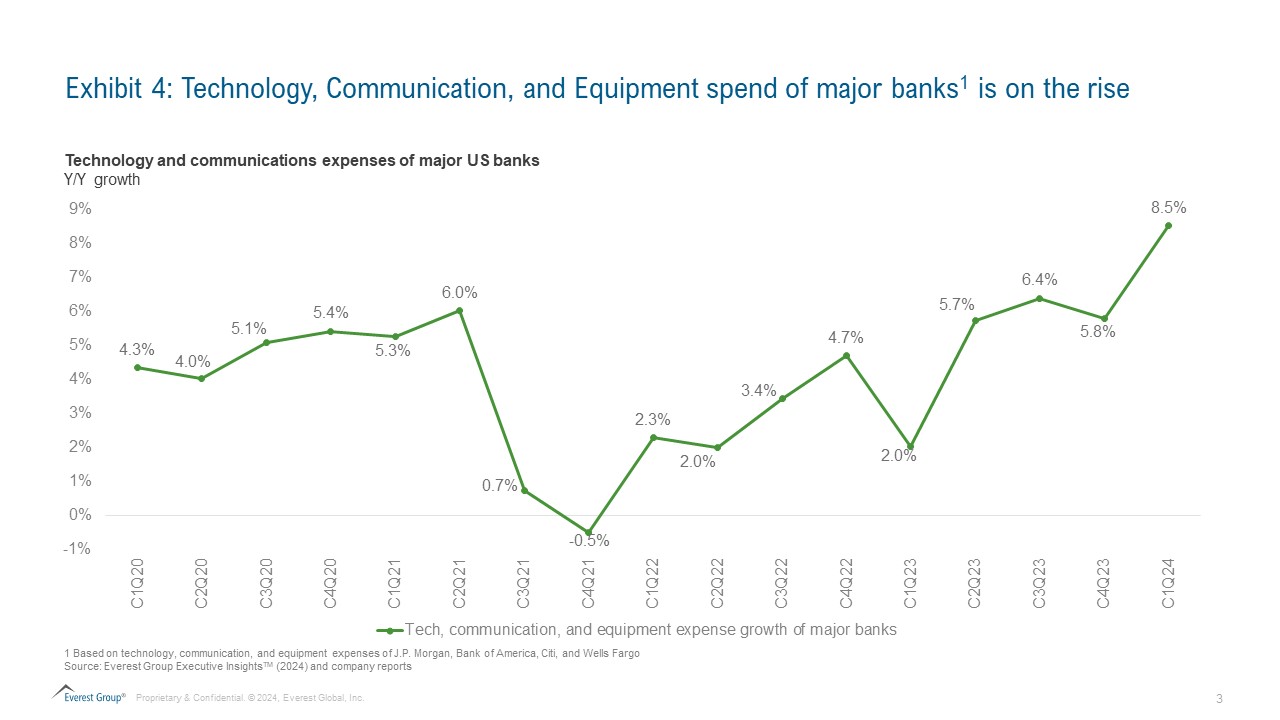

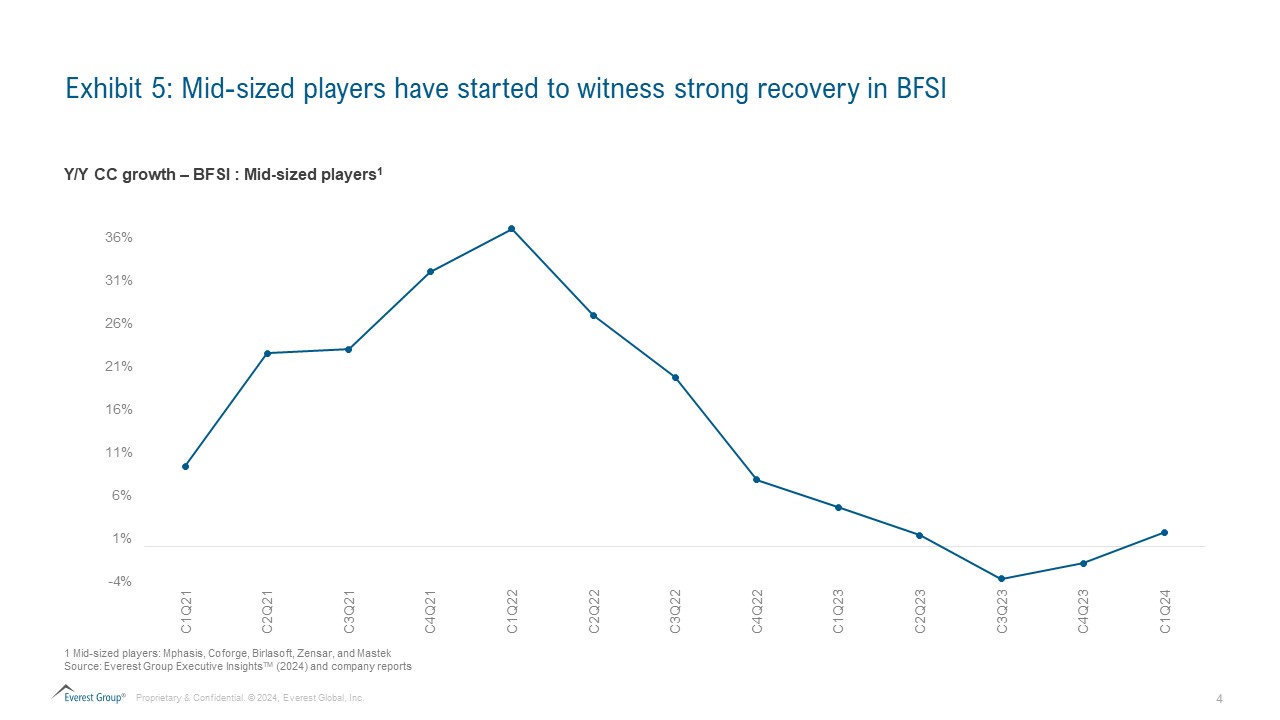

The devil lies in details. Every segment has its own set of near-term palpable possibilities as well as challenges. Take the example of banking, financial services, and insurance (BFSI). On the one hand, it is the most severely impacted segment (Exhibit 3), with the future seemingly still tied to economic events like rate cuts. On the other hand, we are seeing signs of tech spend pickups by banks. For example, tech and comms spend by major banks is on the rise, and small deals are picking up in BFSI, as evidenced by small service providers’ performances in this segment. See Exhibits 4 and 5.

In our Forces and Foresight research, we are conducting a detailed analysis on each of the major geo and vertical segments with the aim of uncovering the not-so-obvious aspects that contribute significantly to their forward-looking direction of growth. We are also linking those to segment and industry-wide forecasts.

Implications for market participants

One would need to work harder to earn their position coming out of this downturn, as industry forces will be less kind than in previous downturns.

A (somewhat) naïve implication for service providers would be to put focus on high-growth potential areas of services. We call it naïve because portfolio changes and decisions can’t be made overnight, leave apart the actual portfolio change. Coming out of this downturn, a well-defined playbook will be instrumental in navigating these changes. A simplistic model could include steps such as:

- Classification of parts of portfolios (verticals, capabilities, geos, customer size, and type of deals) by demand recovery cycles

- Sales focus on the quick recovery segments and immediate results-generating areas (like GICs)

- Having account-specific playbooks – mining vs. new accounts

- Investment focus on longer-term (but promising) recovery areas

Such playbooks have been the reason why every downturn creates a distinct separation between the new set of winners and the rest of the industry. And with the unique set of challenges associated with this downturn, the winners will need to work much harder than before. Learn more about Forces & Foresight™, or reach out to Prashant Shukla to discuss further at [email protected].