Blog

Navigating the Evolving Private Equity Landscape: Driving Value from Technology and Collaborative Ecosystems

In a rapidly shifting global economic environment, private equity (PE) firms are confronting a myriad of challenges precipitated by heightened interest rates, macroeconomic uncertainties, and constrained liquidity in entry and exit channels.At the same time, the industry is sitting on a record level of dry powder, highlighting the stark contrast between available capital and viable investment opportunities. In this blog, we delve into the current state of the private equity market, identify the strategic priorities reshaping PE firms’ approaches, and explore the transformative role of technology and service providers in this sector.

The last 18 months presented a significant period of recalibration for the private equity market. Elevated interest rates sharply reduced the availability of inexpensive debt, and fundamentally altered the dynamics of leveraged buyouts.

Simultaneously, mounting recessionary fears dampened overall market optimism, resulting in subdued deal activity and challenging exit strategies. Despite these headwinds, the industry’s unprecedented levels of dry powder present both a challenge and an opportunity – compelling PE firms to deploy capital with greater precision, whilst meticulously selecting investments poised for higher returns.

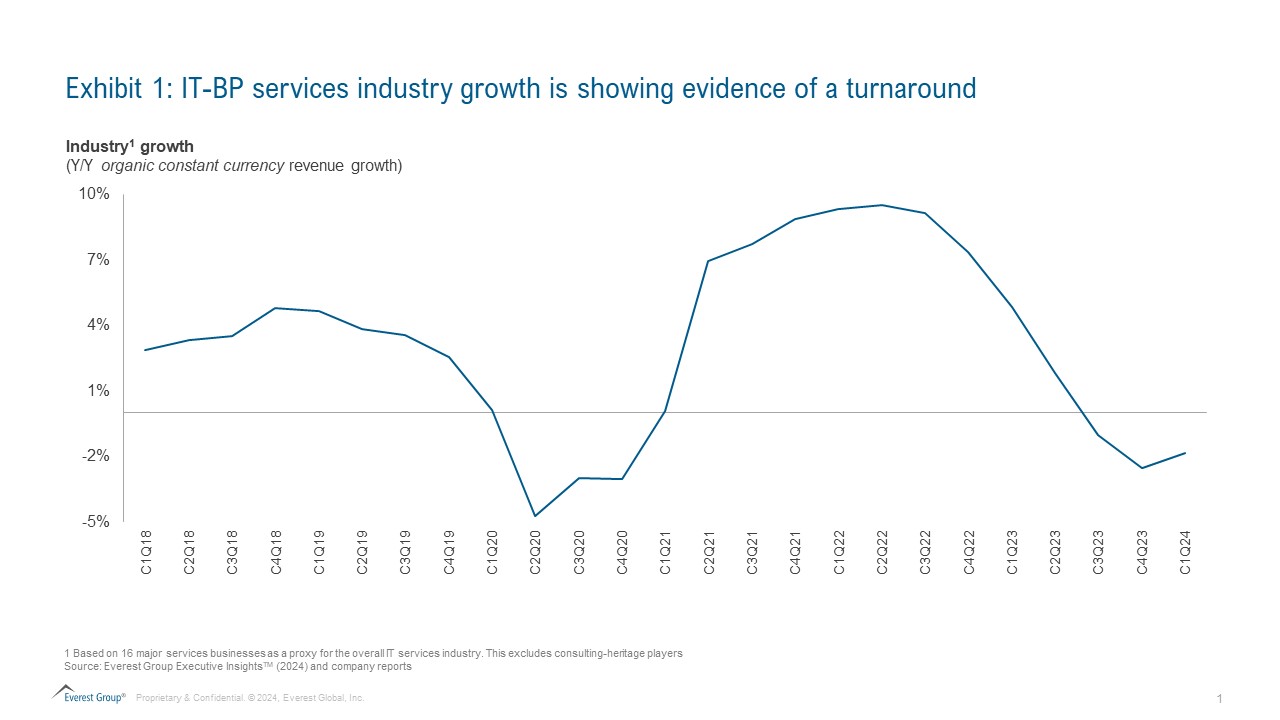

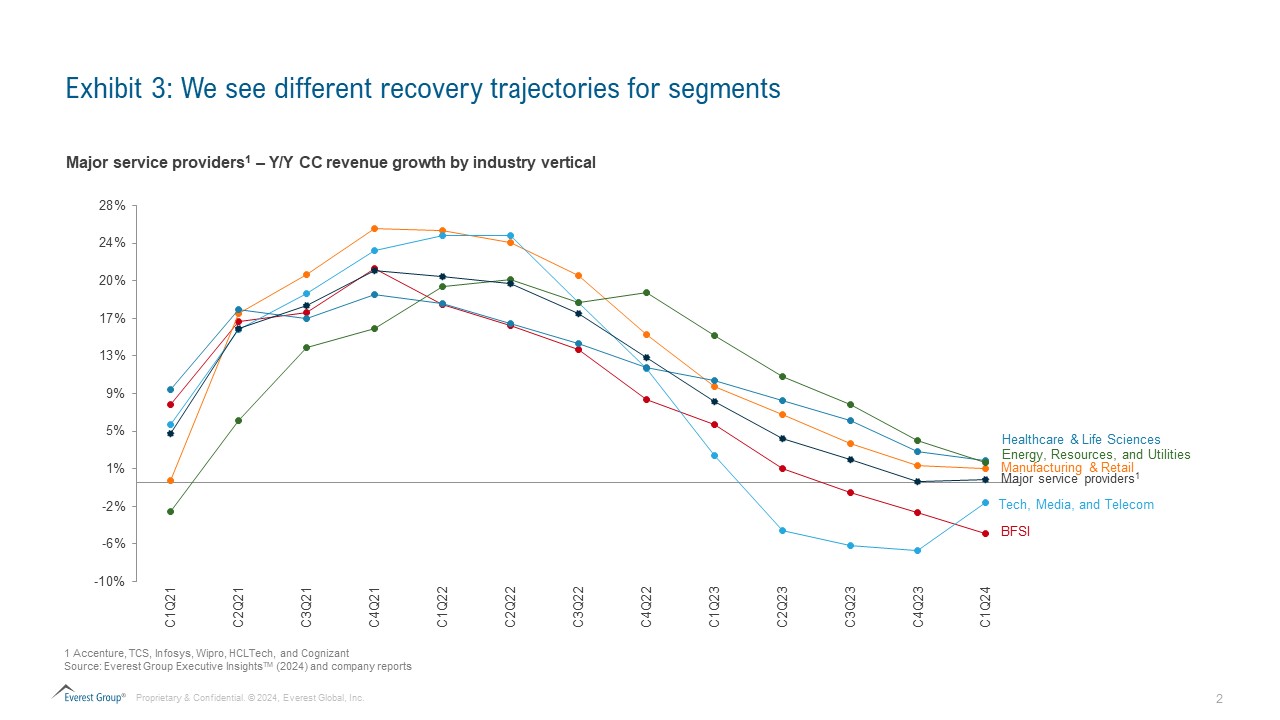

Looking ahead, the next 12 months offers a cautiously optimistic outlook, with early signs of growth anticipated to materialize in the latter half of the year.

Current macroeconomic conditions, an evolving regulatory landscape, advancements in technology, and a focus on diversification and Environmental, Social and Governance (ESG) are some of the major factors influencing the private equity industry.

- The macroeconomic effect on the PE industry– Current economic conditions and fears of a recession have slowed growth in the private equity industry. Consequently, there has been a decrease in deal activities and a shift in focus toward tightening the bottom line and managing risks. Investors are also actively monitoring changes in inflationary trends, interest rates, and asset allocation levels as they navigate economic uncertainty.

- A substantial accumulation of dry powder– Having significant dry powder means that PE firms are ready to act quickly when opportunities arise. This can be particularly advantageous in the current period of economic downturns, where the ability to swiftly execute transactions can differentiate a PE firm from its competitors.

- Regulatory compliance – With stricter regulations, the due diligence required before making investments has become more complex and thorough. Regulatory requirements can also influence the structure of deals. For instance, regulations around financial disclosures, anti-money laundering (AML) standards, or cross-border capital flows can dictate the terms and conditions of investments, affecting everything from the valuation of assets to the exit strategies.

- Diversification in investment areas – Many PE firms are looking beyond their traditional markets to invest in emerging markets, where higher growth rates can potentially yield higher returns. They are also diversifying their investments across various sectors to capitalize on new technologies and evolving consumer preferences. Sectors such as technology, healthcare, renewable energy, and consumer goods are particularly attractive due to their growth potential and resilience to economic downturns.

- Technology and digital transformation – Technological advancements are reshaping the PE industry. Data analytics, artificial intelligence (AI), and machine learning are enhancing deal sourcing, portfolio management, and risk assessment. Digital transformation is enabling PE firms to improve operational efficiency, enhance decision-making, and drive value creation.

- The rise of thematic investing – Thematic investing has gained prominence as investors look to capitalize on long-term trends. Strategies focused on ESG, impact investing, and technology are propelling the industry forward, with ESG integration becoming a competitive advantage. Impact investing, which aims to generate both financial and social returns, is increasingly popular as investors seek to align their portfolios with their values.

Strategic priorities for PE firms

To address these multi-faceted challenges and capitalize on new opportunities, private equity firms are now prioritizing several key strategies. These include optimizing working capital management to enhance financial stability, focusing on targeted value creation through strategic transactions like carve-outs, integrating advanced technologies for operational efficiency, and developing robust leadership within portfolio firms to drive sustainable growth.

These priorities are critical in helping firms manage risk and maximize returns in a fluctuating economic environment, in order to navigate the evolving private equity landscape.

Technology as a strategic lever in private equity

In the dynamic and competitive private equity landscape, amidst shifting strategic priorities, technology is not merely a facilitator, but a transformative tool that can reshape investment landscapes and significantly drive value creation:

Strategic integration of technology

- Due diligence: Advanced analytics and AI technologies can redefine due diligence by providing deeper, actionable insights much faster than traditional methods. These tools can enable PE firms to perform predictive risk assessments and scenario modeling, offering a detailed understanding of potential investments and market conditions.

- Operational agility: The integration of Internet of Trusted Things (IoT) and cloud technologies across operational frameworks can allow PE firms to enhance agility and responsiveness. This capability is crucial for adapting to market changes and operationalizing data-driven strategies swiftly and effectively.

Driving value creation with technology

- Enhanced portfolio performance: Digital tools like AI-driven predictive maintenance and personalized customer relationship management (CRM) systems through machine learning, can transform portfolio companies from operational and customer engagement perspectives. This approach can lead to cost savings, open new revenue streams, and enhance customer retention.

- Innovative market positioning: Technology can enable portfolio companies to pioneer new market spaces and innovate existing ones. For instance, deploying blockchain technology to create transparent supply chains can appeal to a growing market segment concerned with sustainability and ethical sourcing.

Optimization and scalability

- Scalable solutions for growth: Technologies such as scalable cloud infrastructure and automated business processes can enable portfolio companies to grow without proportional increases in operational costs. This scalability is vital for PE firms looking to expand their market footprint without diluting managerial focus or financial resources.

- Sustainable operations and ESG compliance: Technology can play a pivotal role in monitoring and managing environmental impact and governance frameworks. Digital platforms can track and analyze carbon footprints and automate compliance reports, making it easier for companies to adhere to evolving ESG standards and regulatory requirements.

Preparation for exits

- Digital transformation as a value multiplier: Before exiting an investment, PE firms can increasingly focus on digital transformation initiatives to boost the underlying value. This might involve implementing state-of-the-art enterprise resource planning (ERP) systems or digital marketing strategies that solidify the company’s competitive edge and market position.

- By harnessing these technological strategies, private equity firms can navigate the complexities of today’s investment environment more effectively, ensuring robust returns and sustainable growth.

Role of service providers in the evolving private equity landscape

The evolving needs and strategic shifts of PE firms present substantial opportunities for service providers. Service providers are essential in enabling PE firms to navigate the complexities of the current economic landscape through strategic advisory, technological deployment, and operational support.

Service providers are poised to deliver comprehensive solutions that encompass risk management, compliance adherence, and the integration of cutting-edge technologies such as AI and cloud computing. These collaborations are crucial, enabling PE firms to enhance their operational agility, drive innovation, and ultimately, realize superior investment returns.

Key benefits for PE Firms

The collaboration with service providers offers PE firms significant benefits:

- Enhanced competitive advantage: Leveraging service providers’ expertise and technology to stay ahead in the market

- Improved financial stability: Through cost optimization and effective financial management strategies

- Increased operational efficiency: Streamlining operations leads to more efficient and effective management

- Sustainable value growth: Ensuring long-term growth and value creation through strategic and operational enhancements

The road ahead

Looking ahead, the role of service providers will become increasingly pivotal. As private equity firms continue to navigate the intricacies of the evolving economic and private equity landscape. As well as this, the strategic integration of technology and expert advisory will be critical.

Service providers will not only need to offer innovative solutions that address immediate operational efficiencies, but also support long-term strategic goals, fostering both stability and growth.

The successful navigation through these challenging times will likely define the new paradigms of excellence in the private equity industry, emphasizing resilience, adaptability, and proactive growth strategies.

To discuss more on this topic, please reach out to Ronak Doshi, Kriti Gupta and Akshay Rajput.