53% of Insurers Are Opting to Develop AI Capabilities In-house— Everest Group | Press Release

A high skills gap in AI expertise is impeding adoption and acceleration of AI initiatives and compelling insurers to consider creative tech partnerships

As leading insurers transition toward becoming technology-focused firms, they are encountering a high skills gap in the area of Artificial Intelligence (AI), a significant barrier to their efforts to scale pilot projects and realize the expected value from AI initiatives. Everest Group reports that the majority (53 percent) of insurers are opting to build in-house AI capabilities through hiring, internal training, hackathons, acquisitions and InsurTech partnerships.

Conversely, 47 percent of insurers are turning to IT service providers to address the skills gap and accelerate time to market. Many of these service providers bring AI implementation expertise not only from their work with other insurers but also from their work in other industries that are further ahead on the AI adoption curve. Service providers such as Capgemini, Cognizant, HCL, IBM, Infosys, LTI, TCS and Wipro are building insurance domain-wrappers on top of their existing AI platforms to demonstrate early Proof of Value (POV) and accelerate the time to market for their clients.

“Global insurance executives correctly believe that adopting AI can catalyze the transformation of their business models and help their companies stay competitive in the market,” said Ronak Doshi, practice director with the IT Services research practice at Everest Group. “However, among all technologies being adopted by insurers, the skills gap is the highest for IoT and cognitive and AI-based technologies. So, insurers are exploring creative ways to address the skills gap, not the least of which is partnerships with InsurTechs and service providers who can bring AI expertise to the table.”

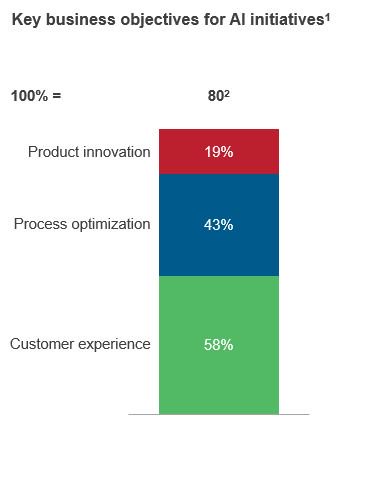

Everest Group studied 80 distinct AI-focused investments by global 100 insurers and recently released its findings in the report, “Artificial Intelligence (AI) in Insurance Moving From Pilots to Programs: Insurance IT Services Annual Report 2018.” In this report, Everest Group explores the adoption penetration of AI across the insurance value chain and provides snapshots of nearly 20 successful applications of AI by leading insurers.

***Download a Complimentary Abstract of the Report***

The key business objectives and leading use cases for AI in the insurance industry fall into these three categories:

- Customer Experience (58 percent). Improving front-end customer experience remains the top priority and accounts for 58 percent of all the analyzed use cases. Insurers are trying to provide personalized and instant services to customers using chatbots and mobile applications. Leading use cases include validating insurance cases against business rules and using speech analytics solutions for sales and operational efficiency.

- Process Improvement (43 percent): AI is helping insurers optimize processes, both internally and externally. Claims management remains a priority for the insurer, helping customers to fast-track their claims process and reduce the time taken for payments. Insurers are also using AI to improve efficiency in documentation and call center operations. Leading use cases include mobile applications and web portals to answer customer queries and give policyholders one-stop access to their documents.

- Product Innovation (19 percent): Leveraging AI for product innovation is in the nascent stage of development. Insurers are using IoT devices such as those for telematics, connected homes and connected self, to develop more usage-based insurance products for customers. Leading use cases include leveraging data from connected vehicles and using AI-powered wearable devices and mobile applications to help customers with personalized advice.

AI Trends in the Insurance Industry

AI Trends in the Insurance Industry