AI as-a-service: Big Tech Has Provided Platforms, But Where Will the Apps Come From? | Sherpas in Blue Shirts

Our digital services research suggests that 40 percent of enterprises have adopted AI in some shape or form. Of course, they’re relying on the foundational platforms from BigTech firms like Amazon, Google, Microsoft, and TenCent – and even from smaller tech start-ups –to drive meaningful business cases.

But while they can leverage Amazon Sage Maker or Microsoft Bot Framework to do the heavy lifting, they still need a meaningful application that operates on the platform in order to solve their business problems.

Enterprise Challenges with AI

Granted, tech vendors like Oracle, Salesforce, and SAP have made initial progress in integrating AI into their application platforms. But their products are very broad and focus on their own planned areas. And enterprises have multiple, complex requirements that fall outside the purview of these generic applications. Therefore, most enterprises must also build their own AI engines to get meaningful insights from these large-scale applications.

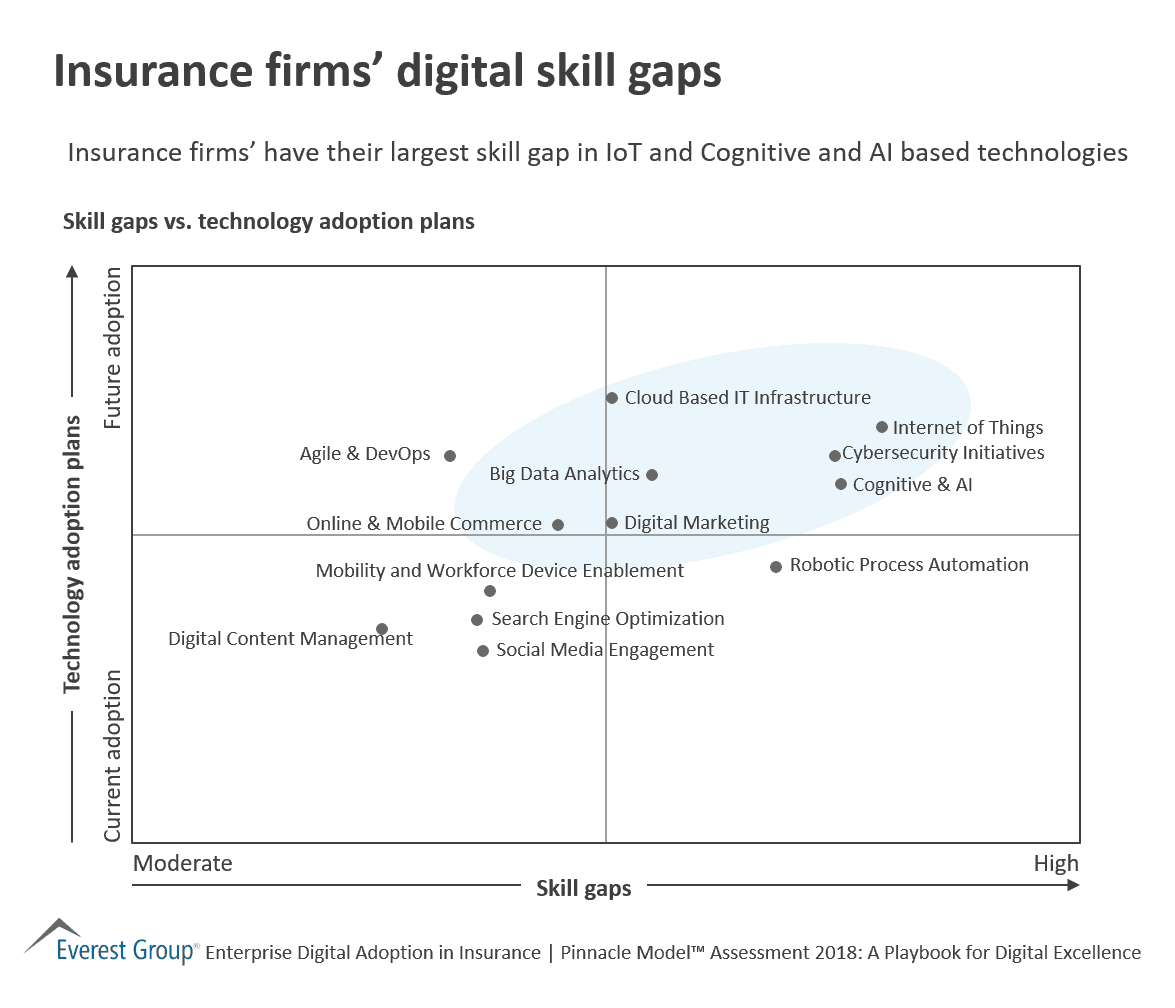

Essentially left on their own, enterprises have to build their own applications to address their needs. But Everest Group digital services research indicates that 60 percent of leading digital adopters struggle for the right talent. And because they lack high-caliber AI talent, they can only take scratch some of the surfaces necessary to create truly valuable apps that can deliver specific business outcomes.

Can Start-ups Help?

We believe this leaves the market wide open to an impending burst of start-ups that can build AI-led niche applications to solve industry-specific business problems. Areas like fraud detection in insurance, compliance management in financial services, and industry-oriented employee engagement and customer experience can significantly benefit from these types of applications. But the key to success here – for both enterprises and these start-ups themselves – will be a focus on building applications for specific business use cases, rather than broad-based platforms. Indeed, AI applications focused start-ups need to commoditize the platform and focus squarely on the application logic that leverages AI.

Enterprises will need to partner or invest in these start-ups to incentivize suitable AI-led applications. Going forward these enterprises should focus to procure off the shelf applications to drive business outcomes than over investing in AI platforms. Unlike today, which requires massive bandwidth to build on top of BigTech AI platforms, these applications will be easy to configure, train, and consume.

The Role of System Integrators

Given that system integrators (SIs) have a strong enterprise DNA and understand business processes, systems, and technologies very well, they can build these applications for enterprises leveraging a BigTech platform. Some of them have made early inroads in areas such as service desk, customer support, and IT operations. However, there is a massive opportunity for business applications and processes. SIs will need to develop point as well as platform-led AI applications that can be plug-and-play in an enterprise set-up. These applications must be pre-trained on industry-fed data for quick deployment and better time to value.

The Road Ahead

It is apparent that enterprises cannot leverage the power of AI on their own. They need to rely not only on large technology vendors, but start-ups and their service partners as well. Though each enterprise must have a pool of valued AI resources, they should not go overboard in investing in them. As AI is not enterprises’ core business, they’re better off letting it be done by companies that are experts.

However, if the AI industry continues to generate next-generation smarter platforms that are do heavy lifting for AI without creating meaningful applications, we will surely see one more AI winter in the near horizon.