In September 2008, Satyam, then the sixth largest India-based IT services company, received the coveted “Golden Peacock Global Award for Excellence in Corporate Governance” award. Then, just four short months after this recognition, one of the biggest cases of fraud in the Indian IT service industry came to light, with the firm’s Chairman B. Ramalinga Raju admitting to financial fraud to the tune of ~US$1.5 billion.

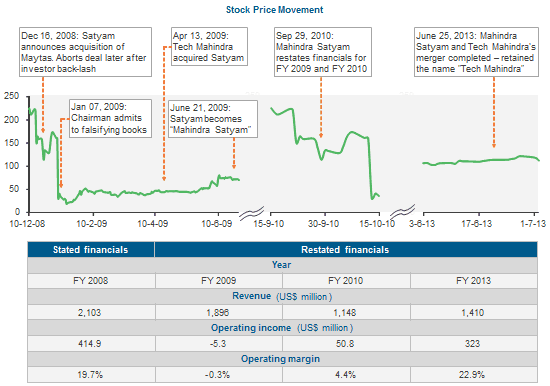

The industry was shaken. The company’s stock and fortunes crashed.

Satyam’s much-needed rescue support came from the Indian government and the new Satyam Board, which consisted of numerous stalwarts from the Indian industry. This provided the required handholding to avoid a complete collapse, protect the interest of its employees and clients, and uphold the image of the Indian IT industry. Consequently, a sense of stability was achieved in April 2009 when Tech Mahindra won the bid to acquire a majority stake in Satyam (which was later renamed to Mahindra Satyam).

Since then, the company went through struggles, twists and turns, and finally reached a steady stage under the Mahindra umbrella. Following is an analysis of company’s financials and its stock price movement during its turbulent times and through its last financial year:

The formal merger of Mahindra Satyam with Tech Mahindra in June 2013 made “Satyam” brand history. The combined entity, retaining the name Tech Mahindra, regained ground to again become the sixth largest Indian IT-based service provider, intensifying competition for the industry-wide known WITCH (Wipro, Infosys, TCS, Cognizant, and HCL) group, and turning it into the TWITCH group (with Tech Mahindra being the new addition!). This turn of events strengthens Everest Group’s hypothesis about the possible formation of new groups in the industry (for details, refer to our blog “The Changing Pecking Order and Emerging Irrelevance of the WITCH Group Term”

The new Tech Mahindra, with US$2.7 billion revenue, has laid down an ambitious roadmap to be achieved by 2015, where each digit of this year denotes a meaning:

|

2015 |

The aspiration |

The realism |

|

2015 |

Reach US$5 billion revenue by 2015 |

|

|

2015 |

Zero differential between its bottom line and the EBITDA of the fastest growing rival |

|

|

2015 |

Being number one as the best employer and amongst the best-known companies for corporate social responsibility |

|

|

2015 |

Five focus areas – telecom; manufacturing; mobility analytics, cloud security and banking; network services; and banking, financial services and insurance |

|

Do you believe that Tech Mahindra has the mettle to reshape the contours of the India-based technology provider landscape?