As enterprises move from an arbitrage-first to a digital-first model to gain business value beyond cost savings, and to lessen the impact of potential immigration-related issues, service delivery from locations that were traditionally considered “onshore” is gaining prominence.

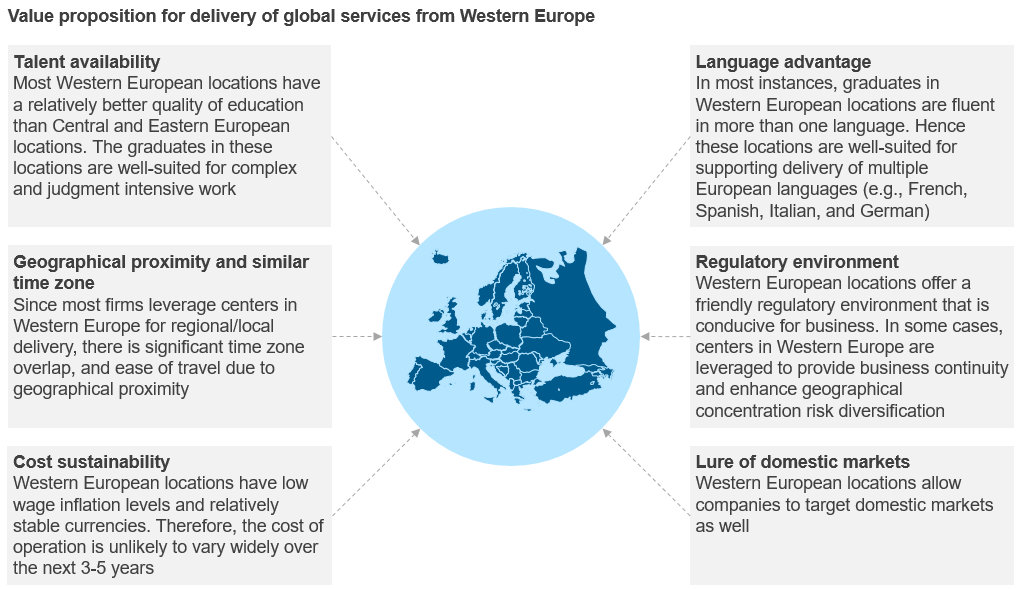

Western Europe* is one region that has gained significant importance as a global/regional delivery geography over the last several years. Indeed, Everest Group’s research on the growth of back- and middle-office services delivery demonstrates a compellingly strong value proposition across all the countries in the region.

* The Western European region is defined as Austria, Belgium, Denmark, France, Finland, Germany, Greece, Italy, Ireland, Luxembourg, Netherlands, Norway, Portugal, Spain, Sweden, Switzerland, and United Kingdom.

Yet, due to multiple misconceptions about the region, some readers may need to be convinced of its viability as a digital-first delivery location. Thus, here are some fallacy-busting facts from our recently-released report, “Emergence of Western Europe for Centralized Global Service Delivery to Europe”:

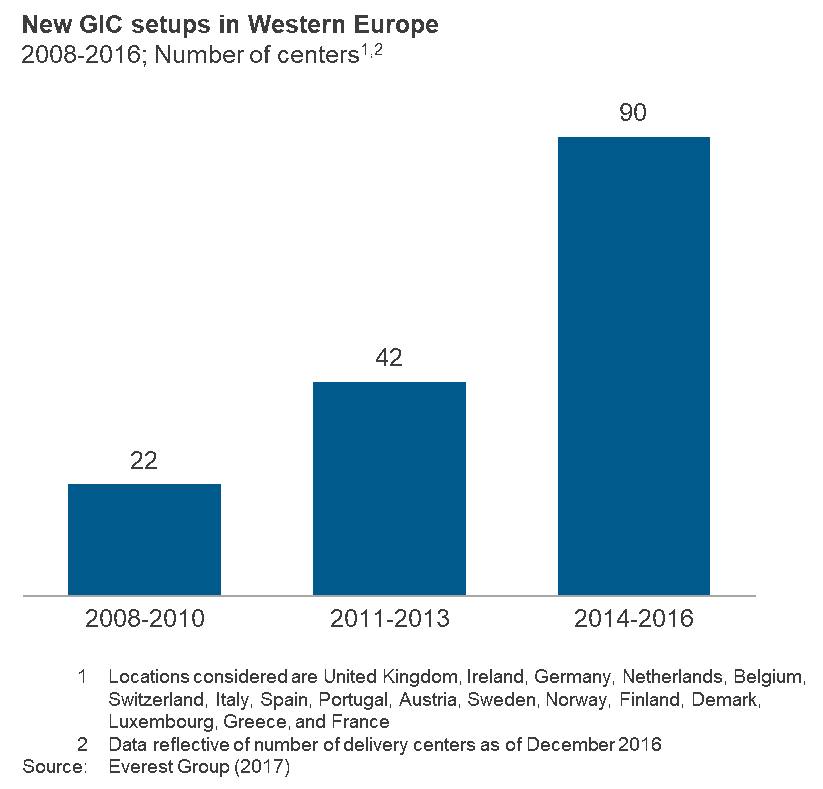

- Myth 1: Western Europe is predominantly a source geography, not a delivery geography

- Reality 1: Global in-house Center (GIC) setup activity has seen significant growth, with double the number of new setups in 2014-2016 compared to 2011-2013

- Myth 2: Western European cities cannot offer more than 10-20 percent savings

- Reality 2: Contrary to popular belief, selected locations in Western Europe can offer cost savings up to 30-50 percent over tier-1 locations (e.g., London, Frankfurt, and Paris)

- Barcelona, Belfast, and Lisbon offer the highest cost savings due to lower salaries and infrastructure costs

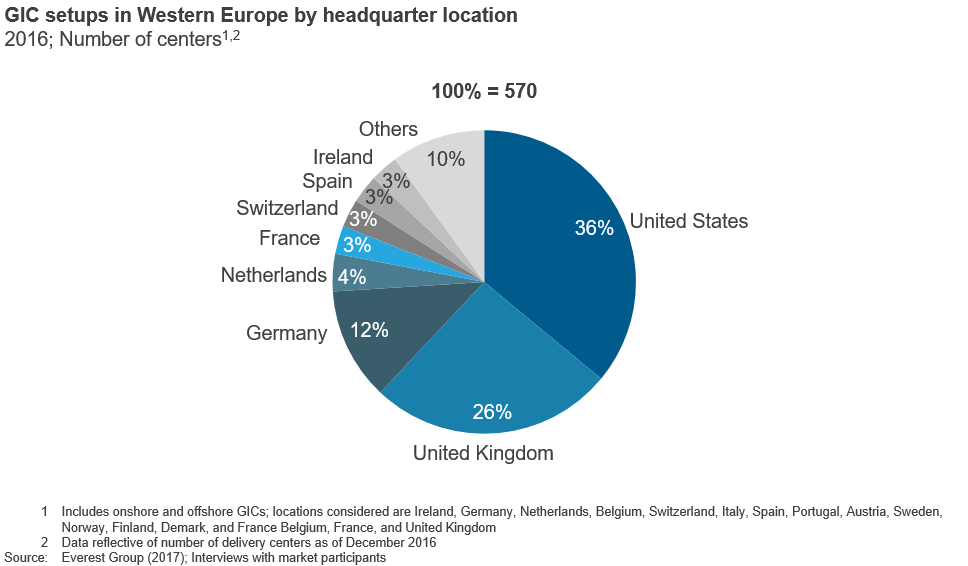

- Myth 3: Western Europe is primarily leveraged by Western Europe-based enterprises for service delivery

- Reality 3: In 2016, U.S-based enterprises established the largest percentage of new GICs in the region

- Myth 4: The value proposition offered by Western European locations is limited to support of European languages

- Reality 4: Western Europe’s value proposition extends far beyond language to the availability of skilled talent, stable business/operating environment, cultural affinity, high maturity for certain niche services, and delivery of skill-intensive work. Multiple locations in Western Europe are particularly well suited for complex digital services (e.g., analytics, blockchain, and mobile development.)

Clearly, there are many reasons why Western European cities are playing a strong role in the delivery portfolio of a growing number of organizations that have highly advanced locations strategies.

Of course, there are multiple factors that could potentially alter the landscape of delivery from Western Europe. Issues global services leaders need to carefully consider include Brexit, adoption of digital technologies (e.g., social, mobile, analytics, and cloud), and likely changes driven by the General Data Protection Regulation (GDPR) and the European Central Bank (ECB.)

For a more detailed analysis of the value proposition of Western European cities, and relative comparisons of leading locations, please see our recent report, “Emergence of Western Europe for Centralized Global Service Delivery to Europe.”