Move over, Angry Birds. Your standing as “the largest mobile app success the world has seen so far,” (as stated on February, 18, 2011 in MIT’s Entrepreneurship Review) is giving way to mobile banking apps.

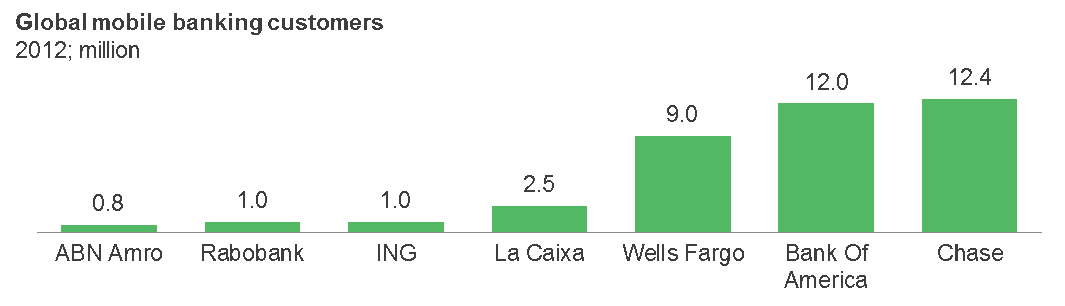

Indeed, apps from American Express, Bank of America, Capital One, Wells Fargo, Westpac, and others rank among the top apps on iTunes and the Android play store, with tens of millions of downloads already under their belt! And there’s little surprise about that…photograph your check and then have it deposited directly into whatever account you want, or send money to people via their email addresses or mobile phone numbers. Isn’t that cool?

Thanks to the increased adoption of smart phones and innovative technology, banking today has become so convenient. With innovations such as near field communications (NFC), mobile wallets, and a number of customized applications being developed and adopted, the mobile banking landscape has undergone a rapid transformation. In fact, according to The Federal Reserve Board, as of November 2012, 28 percent of all mobile phone users and 48 percent of smart phone users in the U.S. had used mobile banking in the past 12 months, an increase of 7 percent from December 2011.

Here’s a brief overview of the current state of mobile banking:

Current adoption and growth:

The past year saw a number of banks expanding and upgrading their mobile banking application features to keep up with extremely strong and growing demand. For example:

-

Bank of America recently launched new services such as mobile remote deposit capture, person-to-person payments, expanded contactless payment functions, and a mobile component to its BankAmeriDeals merchant rewards program. It also recently began testing payments executed via QR codes with five merchants. In fact, its mobile banking app (Bank of America – Version 4.3.229) was among the top 10 Android apps upgraded by customers during the week of July 29, 2013. The new version allows customers to:

- Make payments to credit cards using checking accounts at other banks

- Add/edit/delete bill pay accounts

- Add own email/mobile number to receive money from others

- Send money to people and small businesses via their email addresses or mobile phone numbers

- Utilize the Call Me Now feature (for Platinum Privileges clients)

-

BNP Paribas recently announced that it will be launching a full-service mobile bank in Germany, Italy, France, and Belgium. Its Hello Bank is the first bank designed specifically for mobiles, and BNP aims to have 1.4 million customers for Hello Bank by 2017

-

Citibank is the first financial establishment to put up a mobile banking app in the Asia Pacific region. Initially launched in Hong Kong in 2008, the app is now available in 12 regional markets. Citi is also looking to invest in improving its mobile banking capabilities in 2013

So how exactly are people using mobiles for banking? While some of us stick to basic services such as checking bank statements and paying bills using our smart phones, “smart banks” have started using mobile banking for marketing their products and services. As mobile phones become more functional, they have evolved from being tools to enhance customer service to being vehicles for revenue growth.

But there are some barriers to adoption. Concerns about the security of mobile banking and the possibility of hackers remotely accessing consumers’ phones have been the two major reasons which have limited the use of mobile banking. While consumers are slowly building trust and becoming more open to adopting mobile banking, the possibility of a new mobile deposit fee some banks are considering might be off-putting to end users.

Having said that, Everest Group believes more customers will use mobile banking applications as the explosive growth of smart phones and tablets continues. As banks evaluate the level of investments they must make to keep pace with customer expectations, they will also need to identify key opportunity areas, use mobile channel functionality as a competitive differentiator to attract new customers and retain existing ones, and ultimately expand market share.