Our banking analyst team just finished its evaluation of how the leading North American retail banks are doing in their efforts to create the best digital customer experience, and we want to share some highlights from this breakthrough research. This is our third year of assessing 30 of the largest retail banks. The premise for the research is to examine the new consumption context of financial services – where customers are demanding a SUPER (Secure, Ubiquitous, Personalized, Easy, Responsive) banking experience.

Our research assessed the functionality and pervasiveness of the banks’ consumer-facing digital interaction layer to help establish correlations with superior customer experiences, stronger customer engagement, and higher overall business growth.

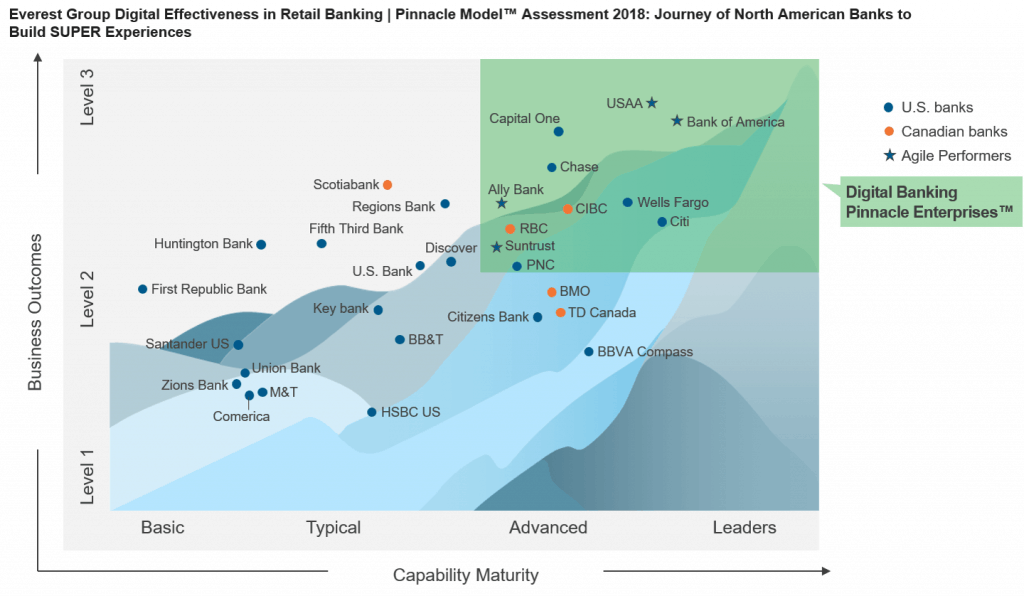

Based on our research, nine U.S. banks (Ally Bank, Bank of America, Capital One, Chase, Citi, PNC, SunTrust, USAA Bank, and Wells Fargo) and two Canadian banks (CIBC and RBC) have been featured as “Digital Banking Pinnacle Enterprises™.” These banks demonstrated business results that stood above the rest:

- Better growth – 3% higher growth in deposits

- Better efficiency – 9% lower efficiency ratio

- Better customer experience – 20% higher mobile application ratings

We have also recognized four retail banks as “Agile Performers,” as they made the greatest improvements in 2017. These banks include Ally Bank and Bank of America, both of which launched multiple initiatives to meet millennials’ customer experience expectations, such as virtual assistants for personalized experiences and voice-command enabled banking capabilities. USAA demonstrated best-in-class adoption of digital banking channels and maintained its frontrunner position in customer-centric innovation. USAA also joined the cryptocurrency world by adding the ability to display customers’ bitcoin balances. SunTrust made considerable investments into self-service technologies across its branch network and recorded strong growth in customer engagement on social media.

The retail banking industry will continue to make dramatic changes in the next few years. These shifts will require banks to have increased capabilities to deliver an enhanced customer experience whose key elements include:

- A paradigm shift from the current “product” mindset to a “customer lifestyle” mindset to combine, package, and offer products/services from banking and allied businesses

- Open banking and partner ecosystems leveraging APIs to integrate third-party services into the bank’s digital banking platforms

- Collapsing the siloes across the front-, mid-, and back-office to create a frictionless front-to-back experience

- Harmonized data repositories to enable a unified view of the customer

- A technology operating model that embraces automation, AI, blockchain, and cloud to enable the needs of the “new business”

We believe the current Digital Banking Pinnacle Enterprises have created superior customer experiences because they deliberately invested in their digital capabilities. But the bar for success is constantly moving, as the industry continues to witness rapid and significant changes. Nonetheless, our data from the last three years establishes an increasing correlation between digital functionality and business outcomes. Banks that are able to quickly adopt a human-centered design thinking approach, build usable experiences, and create a culture of obsessive customer focus will be able to better differentiated experiences, achieve growth, create shareholder value, and ensure market relevance.

To read all of our research findings, see our report: Digital Effectiveness in Retail Banking | Pinnacle Model™ Assessment 2018: Journey of North American Banks to Build SUPER Experiences