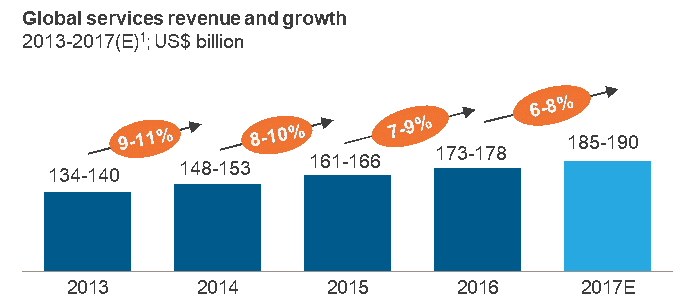

The global services market is in upheaval, and disorder seems to be the new world order. Geopolitical developments, macroeconomic pressures, and unprecedented pace of changes in technology have resulted in huge disruptions to the usual ways of doing business. However, despite the turmoil, the global services market continues to grow, albeit at a much slower pace compared to previous years.

When developing our Global Locations Annual Report 2017, Everest Group spent considerable time and effort analyzing the underlying data to determine if there are some signs of structure amidst the disorder. Here are some patterns and trends visible from our analysis:

Pervasive rotation of delivery capability toward digital

There has been significant increase in both number and share of new centers focusing on delivery of digital services. Between 2013 and 2016, the number of such centers grew by ~177 percent.

- Regions: Most of this growth was concentrated in Asia Pacific and nearshore Europe

- Segments: Cloud, Internet of Things, and Big Data witnessed the highest adoption rates

- Sourcing model: While the lion’s share of the growth was with the in-house model, service providers also reoriented their delivery portfolios

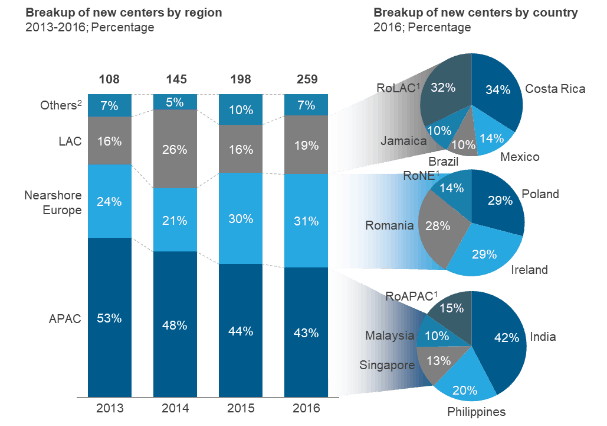

Greater leverage of nearshore locations

Both service providers and global in-house centers are growing faster in nearshore locations, such as central and eastern Europe, Latin America, and the Caribbean, compared to traditionally offshore locations (such as Asia Pacific.) This is driven by multiple factors, most prominently the drive towards digitalization and the different talent demands this imposes. The chart below shows the increasing share of nearshore regions in new delivery center setups:

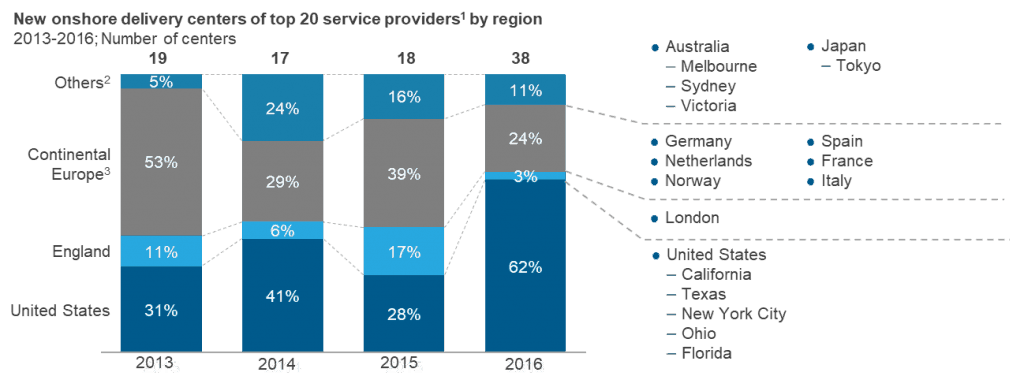

Complementary growth in onshore locations

There has been a rapid surge in large enterprises’ and service providers’ service delivery footprint in locations traditionally considered onshore. While firms either retained or reduced the pace of growth in offshore/nearshore locations, they ramped up presence significantly in the United States and continental Europe (see the following chart for new onshore delivery center setups of top-20 IT-BPO service providers.)

1 20 leading service providers across IT and BPS that Everest Group uses as “Index” providers to gauge market trends

1 20 leading service providers across IT and BPS that Everest Group uses as “Index” providers to gauge market trends

This is largely driven by enterprises’ desire to deliver complex services coupled with the advantages of customer intimacy. However, for many providers, this is in anticipation of strict work visa issuance guidelines which may make it imperative for them to have a foothold in the onshore market for hiring talent

While there’s some “method to the madness” in these pervasive trends, there are many operational risks that are likely to add to the disorder. These include:

- Increased safety and security risks (terrorism and border issues) in Indonesia, Malaysia, and Thailand, and high crime rates in Guatemala and Jamaica

- Continuing conflict between Russia and Ukraine

- Frequent changes in political leadership in Egypt

- Macroeconomic instability in Brazil and Argentina.

For more such trends and analyses on the value propositions of different locations through Everest Group’s MAP MatrixTM, which will help you frame your global services location strategy, please refer to our report, “Global Locations Annual Report 2017: Signs of Structure in a Disordered World.”