Since the early part of this decade, when technology-backed disruptions started knocking on businesses’ doors, FinTech – or financial technology – transformation has been one of biggest opportunities for BFSI companies. But while they’ve consistently accelerated their transformation journeys, BFSI firms and the FinTech providers themselves have been impeded by multiple complex challenges. These include stringent regulatory requirements, exposure to cyberattacks, lack of customer trust, limited government support, and, most importantly, limited opportunities to refine and train their analytics engines in real environment.

The good news, however, is that now, even government bodies are starting to take up agendas to facilitate and foster FinTech innovation. Over the past two years, multiple countries, including Denmark and the Netherlands, have come up with their own versions of regulatory sandboxes to promote activity in the FinTech space. In addition to attracting a multitude of players looking to innovate and deliver FinTech services, these sandboxes have also contributed significantly to the overall business growth in the countries in which they’re located.

Lithuania’s FinTech Sandbox

Against this backdrop, let’s take a look at Lithuania’s newly-established FinTech sandbox through multiple lenses: what it means for the participants, how it will impact the country’s global services industry, and factors that BFSI and FinTech firms need to focus on to leverage innovation opportunities from these types of initiatives.

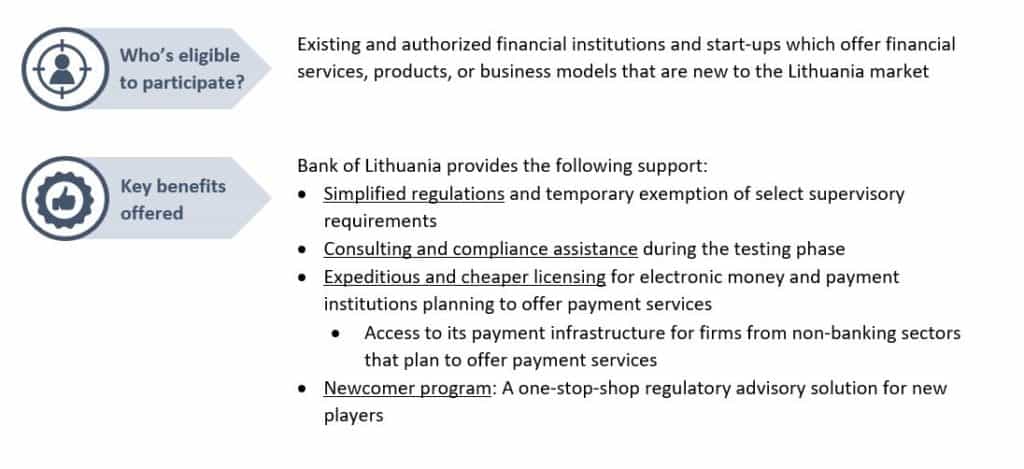

On October 15, 2018, Bank of Lithuania kickstarted a regulatory sandbox for FinTech start-ups and BFSI firms. The goal is to enable the companies to test their new products/solutions in a live environment with real customers, while Bank of Lithuania provides consultations, simplified regulations, and relaxations on supervisory requirements. After successfully testing their new products, the companies can implement them in a standard operating environment.

Key Highlights of the Lithuania FinTech Sandbox

Impact on Lithuania’s Service Delivery Market

While the Lithuanian FinTech market experienced 35 percent CAGR growth between 2015 and 2017, we expect it to grow by an additional 35-45 percent in 2019-2020. The FinTech sandbox will contribute significantly to this growth. Other drivers will include:

- A large, tech-savvy, and growing workforce with relevant skills and educational qualifications (e.g., advanced degrees in science, mathematics, and computing)

- Unified license providing access to a large EU market across 28 countries

- Favorable regulatory policies, including expeditious licensing procedures and regulatory sanctions exemptions (e.g., remote KYC allows firms based outside Lithuania to open an account in the country without having a physical presence there)

- Proactive government policies, including creation of funding sources (e.g., MITA), and streamlining laws and tax relief programs for start-ups

- A state-of-the-art product testing environment for blockchain, through the country’s LBChain sandbox, which is set to open in 2019

Here are several aspects of Lithuania’s service delivery growth story that we expect to see in the next couple of years.

- Delivery region: While service delivery demand will continue to be strongest from Lithuania and the Nordic countries, we expect strong growth in delivery to other European and SEPA (Single Euro Payments Area) markets. This will be driven by players looking to hedge their post-Brexit risks of buying/delivering services from only London

- Segments/use cases: Most of the growth will come from lending and payments platforms, with relatively lower growth in capital markets and insurance

- Business model: While B2B will remain the dominant model, we expect a significant uptick in in “B2C & B2B,” due to increasing demand for a better customer/institutional experience

- Collaboration between startups and financial institutions (FI): Startups will continue to leverage FIs as distribution partners, but we expect significant growth in models where FIs partner with start-ups as customers or sources of funding

How Should BFSI and FinTech Players Strengthen their Own Growth Stories?

As BFSI and FinTech continue to walk the transformation tightrope in the everchanging regulatory space (e.g., PSD2 and GDPR), they need to focus on the following factors to successfully grow:

- Understand the need: Look across your existing and aspirational ecosystem of FinTech delivery, and zero in on key priorities (e.g., solutions, target markets, need for regulatory sandboxes) if any, to enable a future-ready delivery portfolio

- Establish your approach: Tune your delivery strategy to progressive principles such as availability of talent and innovation potential, not just operating cost. This includes prioritizing geographies with high innovation potential and next generation skills (e.g., Denmark, Israel, and Lithuania) over low cost but low innovation potential alternatives

- Brainstorm your scope: Build relationships with leading BFSI players and start-ups to share/learn best practices around efficient operating models and promising use-cases. This specifically includes liasing with incumbents operating in sandboxes to prioritize select use cases with transformative potential before testing in a real environment

- Get ready: Selectively rehash your technology model to simplify legacy systems, become more intelligent about consumer needs, and reduce exposure to cyberthreats

- Keep an eye out: Look for opportunities (e.g., sources of funding, sandboxes, and partnerships) to help you innovate, develop, test, or successfully implement solutions

The good news is that the push (or pull) towards FinTech transformation is in same direction for all leading stakeholder groups – service providers, buyers, collaborators, customers, and government bodies. But, because the least informed is often the most vulnerable, BFSI, FinTech firms, and companies seeking their services must stay informed and keep looking for opportunities and solutions.

To learn more about other key emerging trends in the FinTech space, please read our recently released report, FinTech Service Delivery: Traditional Locations Strategies Are Not Fit For Purpose.