During a recent discussion with a large buy-side client around pricing trends for outsourcing services, one of the senior stakeholders commented, “I see that you have a chart showing a quarterly trend in FTE rates. But do rates really change that frequently on a like-to-like basis? I think it is a long-term phenomenon.”

I could very well understand where he was coming from. Most outsourcing deals have an annual price adjustment clause that implicitly suggests it takes a year for pricing to change materially. And if you listen to service providers’ quarterly results, their standard reply to any question on pricing variations is that “pricing has remained stable in this quarter.”

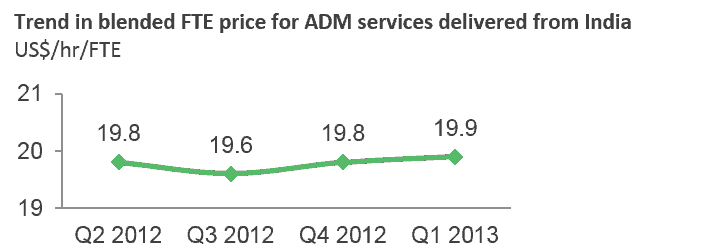

I also agree that in most situations pricing shifts are a long-term phenomenon. But prices do move up/down on a quarterly basis, as demonstrated in the chart below, extracted from Everest Group’s PricePoint: Q4 2012 report.

There are three drivers of this nominal pricing fluctuation: demand-side, supply-side, and macro-economic factors. So, for example, if buy-side demand is suppressed in a particular quarter, service providers might choose to go soft on pricing while bidding for fresh work to win more deals.

The real value in knowing quarterly pricing trends comes from understanding how you can benefit from them:

- These insights help you become aware of any fundamental market changes that should trigger premature negotiation of existing rates. Being up-to-date on a regular basis can reduce the lag time of gaining from favorable market developments. For example, between Q3 2011 to Q4 2011, the Indian currency (INR) depreciated by ~10 percent against the U.S. dollar, and this trend continued in 2012 and 2013. An informed buyer would have promptly reacted to this trend by demanding price discounts. However, in most deal situations, these forex-based price adjustments came into effect only in late 2012 or early 2013

- Understanding the underlying pricing drivers (the buy-side, supply-side, and macro-economic factors) will enable you to have informed discussions in those tricky price (re)negotiation meetings

- Service providers, while bidding for new work, can tweak their short-term (or even long-term) pricing strategies to resonate with currently prevalent market trends

Net-net, as a buyer it is always better to know how hard you can negotiate. And as a provider, it is always better to know how you can tweak pricing to balance profit margin with win-rate aspirations. Knowledge of quarterly movements in pricing of outsourcing services helps buyers and service providers achieve these prime objectives.