Practitioners of global service delivery are continuously diversifying their delivery locations portfolio and looking beyond the traditional choice of offshore locations for expansion. In fact, onshore (source geographies) and nearshore locations witnessed aggressive market activity in 2014-2015, despite often offering higher operating costs than their offshore counterparts. Here are some highlights from Everest Group’s recently released Global Locations Annual Report 2015: Resurgence of Activity Amidst Evolving Propositions.

Nearshore locations

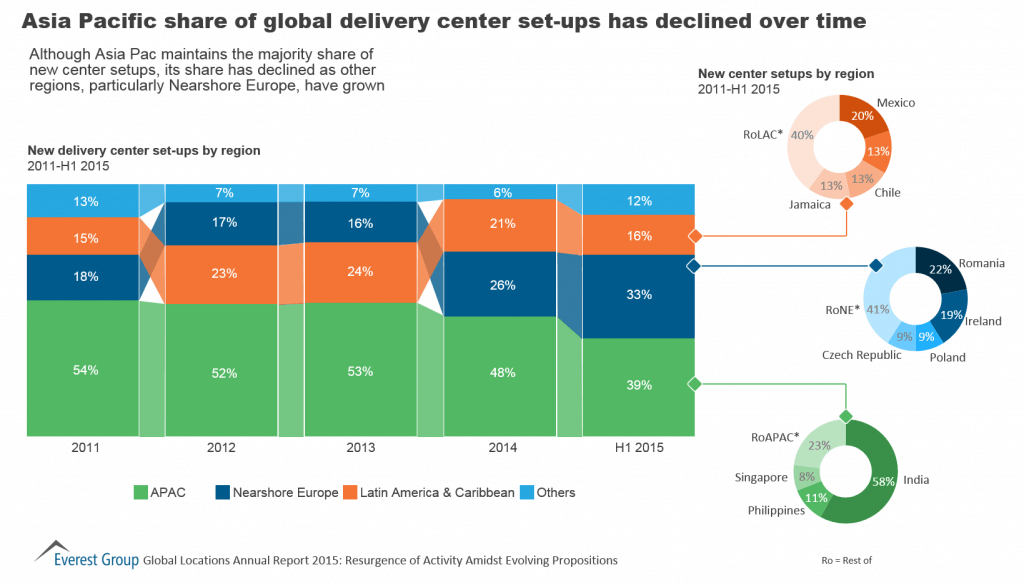

During 2014-1H2015, nearshore locations (in CEE, Ireland, Northern Ireland, and Scotland for Europe, and in Latin America and the Caribbean for the U.S. and Canada) witnessed growth in terms of new center setups and increasing headcount. This increase in market share was at the expense of the Asia-Pacific region in the global services delivery context.

One of the major drivers of significant growth in these markets is the changing value proposition of these locations. Companies are now looking at these areas for delivery of high-end work, such as analytics for knowledge-based services, judgement-oriented processes for both BFSI and non-BFSI sectors, and cloud and digital in the IT services domain.

Beyond an attractive talent profile, these locations are also enticing due to cultural affinity with source markets, as well as geographical and time zone proximity that makes managing the business easier.

Exhibit 1: Snapshot of market activity (new center set-ups) in major regions

Tier-1 and 2 locations in Chile, Costa Rica, Jamaica, and Mexico led growth in Latin American and the Caribbean.

In the nearshore Europe region, Ireland, Romania, and Poland accounted for the highest number of new center setups – due primarily to highly skilled talent, significant availability of a multilingual pool, and moderate-high savings – driving growth for the entire region.

Onshore locations

Onshore delivery experienced significant market activity in locations in the United States, United Kingdom, Western Europe, Australia, Japan, and New Zealand.

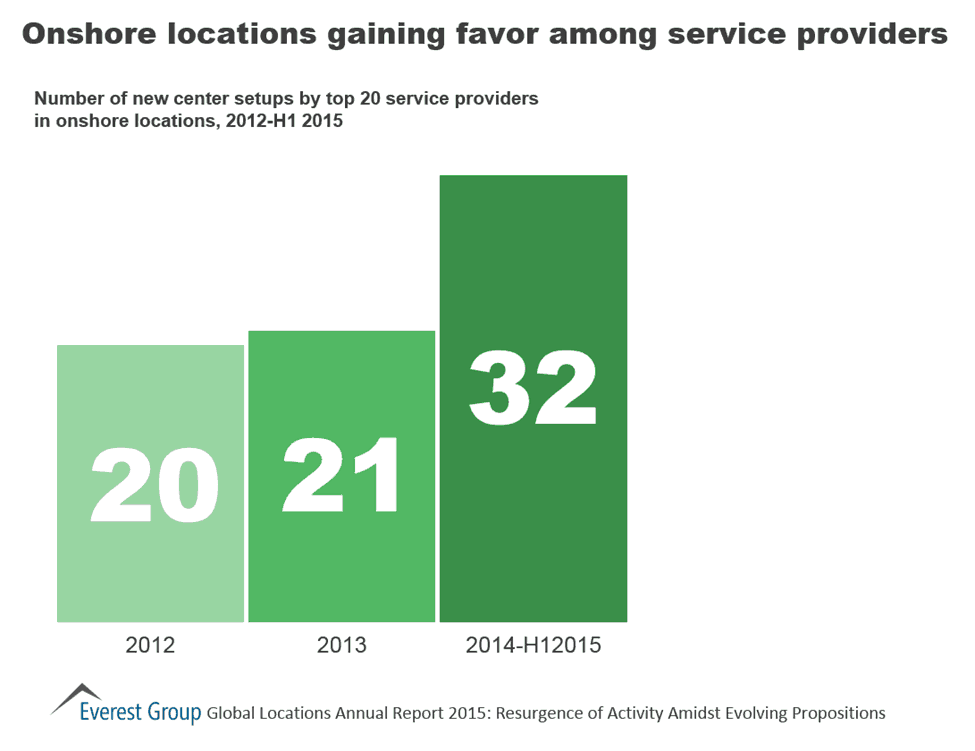

Exhibit 2: Number of new center setups by top 20 service providers in onshore locations

Providers have been increasing their presence in onshore locations, although the pace of setups appears to be stabilizing. Several factors have led to this increase:

- Increase in the complexity of services, and lack of adequate talent depth in offshore/nearshore locations

- Increased pressure from buyers to grow onshore presence to enable easier coordination, better alignment/training, etc.

- New regulations around data security, especially in the banking sector, making onshore delivery necessary, or at least preferred

- Willingness of service providers to explore newer models and newer tier-2 locations in onshore geographies

For detailed insights on key changes in the global services sector in terms of delivery and sourcing models, please refer to Everest Group’s Global Locations Annual Report 2015: Resurgence of Activity Amidst Evolving Propositions.