How old is technology in Business Process Services (BPS)? How did it grow? These are difficult questions to answer. So, I turned to a technique beyond reproach – carbon dating!

How does one carbon date or, to use its technically correct name, radiocarbon date? The principle, shorn of all gobbledygook, is pretty straightforward. All plants and animals take in radiocarbon from the atmosphere through the food chain, making them storehouses of radiocarbon while they live. When an animal or plant dies, it stops taking in radiocarbon, and starts losing it. Thus, measuring the amount of radiocarbon left in the remains of a plant or animal gives one an estimate of its age.

The process, simplified enough to make any archeologist cry sacrilege, is as follows:

1. Find the bone

2. Clean it and powder a sample

3. Treat the powder to convert the carbon to benzene

4. Put it in a spectrometer to count the decay

5. Analyze the data from the spectrometer

6. Voila! You know the bone’s age and much more!

An astute mind would guess, my first big challenge was finding the bone…in this case, the data. I had to know what technologies were launched over the years, and what those technologies did. The second and no less daunting challenge was to get my hands on a spectrometer – a framework to classify and understand these technologies in the context of BPS delivery. With these obstacles looming large, my carbon dating dream seemed like a pipe dream.

How I Got the Bone and the Spectrometer

Thankfully, being an Everest Group analyst driving research into technology in BPS has its advantages. Our comprehensive outreach program covering nearly 20 major service providers proved a positive goldmine. It handed me detailed information on more than 900 technologies being leveraged to deliver BPS. That was my bone right there.

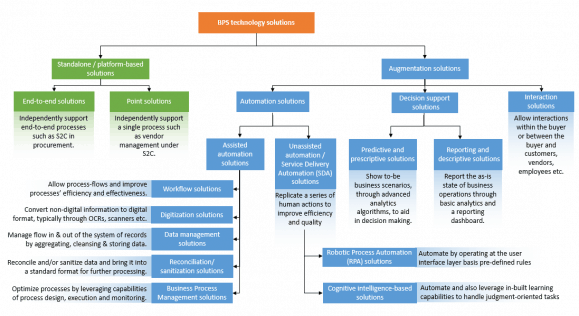

What’s more, we had developed a robust framework – my spectrometer! –to make sense of these technologies. Here’s the snapshot version of the framework (for the full-blown version, go here):

With the wind at my back, I crunched some bone, and out came its age and much more!

The Bone’s Age, and Much More!

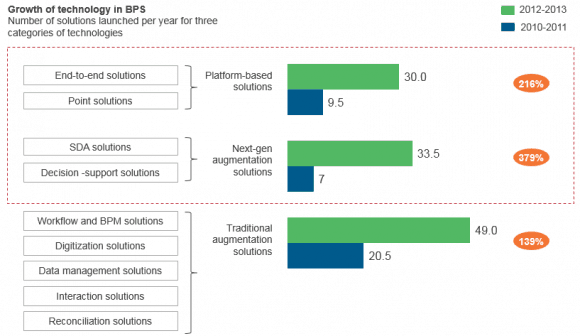

My little experiment enabled some very interesting observations. Here’s my first output:

First, the chart seems to suggest that BPS technology is not very old! In fact, the 2000s were its infancy, when service providers and buyers looked at technology only as a support for a business model that was essentially based on labor arbitrage and economies of scale. The tools used were primarily augmentations such as workflow, digitization, interaction (in the form of basic portals), simple reporting (typically, data dumps in the form of rows and columns), and reconciliation solutions.

Of course, there were the ERPs – the earliest of the platforms. These were mostly large and complex systems, spanning multiple business functions, such as HR, F&A and procurement. While they did deliver results for some large and mature buyer organizations, these platforms were too expensive and too unwieldy for most.

In the meantime, technology in the wider world was breaking new horizons in the form of smartphones, social media, big data, e-commerce etc. There was no way the BPS market could stay isolated. The increasing maturity of the labor arbitrage model coincided with the rising possibilities of leveraging cutting-edge technology in BPS. And thus, in 2012-2013, a remarkable phenomenon happened – there was a startling spike in the number of technologies launched. To use Malcolm Gladwell’s famous term, BPS technology well and truly tipped!

Now, I was intrigued by this! The archeologist that I am (sorry, real archeologists!), I decided to dig deeper. That gave me my second output:

What is interesting is that not all technologies tipped equally in 2012-2013. Two bunches of technologies – the platform-based solutions and the next-gen augmentation solutions – actually broke away from the traditional augmentation solutions to redefine the technology landscape.

Of course, this is not to say that the traditional augmentations are not important. They did grow fast those two years, and they will continue to exist. But, increasingly, as a quick glance at the latest data also confirmed, they are table stakes in the market now – tools that support the traditional drivers of cost reduction and process efficiency. The next-gen augmentations and platforms are the differentiators. They are the heralds of the next wave of transformation in the BPS market, one that focuses on impacting strategic aspects of business, rather than merely cost.

One experiment is just not enough!

With a fair bit of luck at getting the bone and the spectrometer, the carbon dating experiment did not disappoint. I got what I set out to do – BPS technology’s age and its growth pattern. In the process, I stumbled upon a fundamental distinction among the technologies at play in the BPS market as well. A morning well-spent, I would say!

But this experiment really whet my appetite for more on BPS technology. Questions abound. How are these trends holding up now? While this experiment painted a supply picture, what is the state of the demand? Who are buying these technologies? Why are they buying them? How best can buyers squeeze value from them?

Suffice it to say that multiple experiments are on, and one of them is more or less done. Indeed, within a week Everest Group will publish a comprehensive report on technology in BPS. Keep an eye out for that here. And of course, don’t forget to come back to Sherpas in Blue Shirts for more!