Capital markets BPO (Business Process Outsourcing) is one of the fastest growing industry-specific verticals within the BFSI segment, with a market size of over $2 billion in 2016. Investment banking is the largest line of business within the capital markets BPO. Asset management, custody and fund administration, and brokerage are the other key lines of business in this space.

Enterprises typically look to partner with third-party pureplay service providers such as Cognizant, EXL, Genpact, Infosys, and TCS to remain competitive in the marketplace, and simultaneously manage their regulatory, risk, and cost concerns. But the BPO majors are facing stiff competition from specialist capital markets BPO providers such as Avaloq, eClerx, and Xchanging, which are more focused and have deeper domain expertise.

Against this backdrop, what pricing considerations should enterprises take into account when selecting a specialist or a pureplay Business Process Outsourcing provider?

What to consider when selecting a Business Process Outsourcing provider

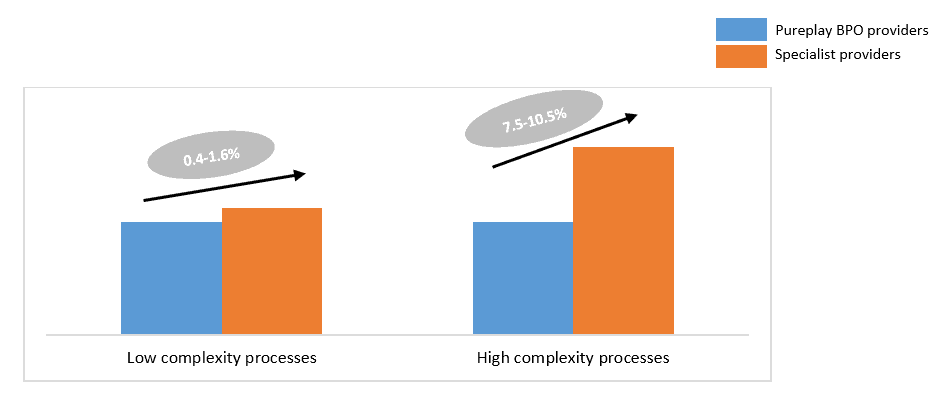

- Specialists come at a premium: Specialist providers typically charge a premium price. The premium is nominal for low complexity processes such as static and dynamic data management, client onboarding, low value reconciliations, trade capture, and exception matching. Yet, it rises considerably for high complexity capital markets BPO processes such as OTC derivatives, syndicated loans, and alternative investments. Specialist capitalist providers’ expertise in niche and complex services gives them significant pricing power leverage over pureplay BPO providers.

- Pureplay BPO providers on the move: However, pureplay BPO providers over the last couple of years have moved swiftly, and gained meaningful ground in terms of building competence in high value services. This increased, more head-on competition has reduced the pricing differential to some extent.

- Pricing model induced rate differential: FTE-based pricing is most common in capital markets BPO contracts, closely followed by the transaction-based model. Typically, contracts with transaction pricing have a higher Annual Contract Value (ACV) per FTE, as the service provider agrees to share some of the buyer’s risk, and thus bakes the risk premium into the pricing. Additionally, the scope of work for capital markets BPO deals with transaction-based pricing is usually higher value and more complex, pushing up the average ACV per FTE further.

Pureplay BPO providers VS. specialists

Net-net, specialist providers, which at least as of today handle more high-value services, come at a higher price than their pureplay BPO peers. And, at least as of today, buyers appear ready and willing to pay this premium.

Enterprises in this space typically tend to value and favor specialists when it comes to finding a partner for their capital markets BPO operations. And they tend to be particularly selective, as most service providers – both pureplay and specialist— do not play in all the segments, but instead focus on building deep capabilities around one or two of the four key business lines.

Are you working with a pureplay or specialist provider in the capital markets BPO space? To what extent did pricing play into your provider selection? Do you think specialists have an edge over pureplay BPO providers in terms of capabilities?