A colleague of mine recently had an interesting discussion with a senior stakeholder from a large buyer organization. The buyer had engaged multiple partners to benchmark the company’s contracted ADM prices every year since 2009 and had difficulty understanding why the actual pricing trend was opposite what the benchmarks suggested each year. After some probing, it emerged that the buyer was using the benchmarks to interpret likely future pricing, rather than assess current pricing.

Let’s look at the difference between the two via a weather example.

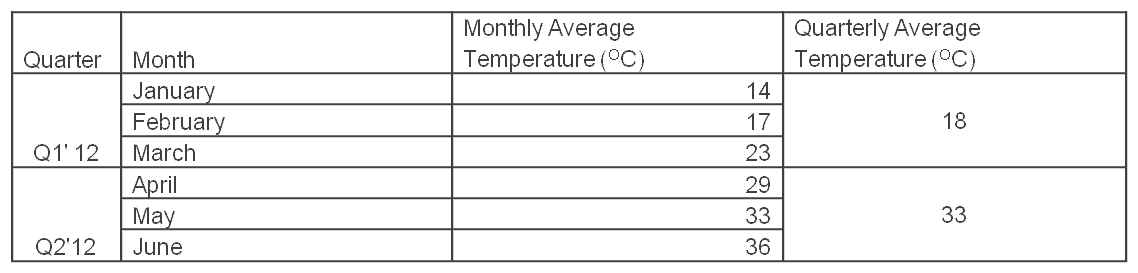

The average temperatures in Delhi in Q1 and Q2 2012 are summarized below.

Clearly, temperatures increased consistently during Q1 and Q2. Based on that information, a tourist planning an August 2012 trip to the region could have concluded that it would be even warmer during that month and added more sunscreen to his or her list of pre-travel purchases.

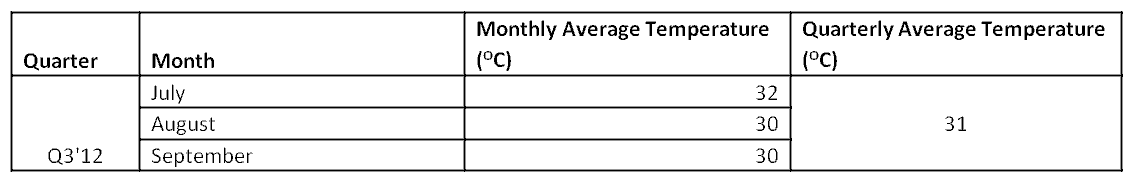

In reality, as shown below, Delhi was cooler in Q3 (and it was rainy). If the tourist incorrectly surmised that past weather trends meant that August temperatures would be higher, he or she would have packed an extra pair of sunglasses, rather than an umbrella…and gotten wet.

Note: for those who use the Fahrenheit scale and are itching to know what Delhi’s temperatures were last Q1-Q3, an easy – but not quite precise – conversion is to multiply the Celsius number by two, and then add 30. (The actual formula is to multiply by 1.8, and then add 32.)

Similarly, although price benchmarks represent current market pricing, they may, or may not, indicate the future trend. Thus, they are not particularly useful for buyers trying to negotiate future prices with their service providers. Rather, proper pricing negotiations require having a pulse on multiple drivers broadly classified as demand-side, supply-side and macro-economic. Equally important is understanding the relevance of these drivers in the deal-specific context of a particular buyer. For example, in Everest Group’s PricePoint: Q4 2012 analysis of ADM services, we noted that prices were at the same level as 12 months prior. Looking ahead, supply-side cues indicated stability in operating costs, potentially indicating status-quo on pricing. However the recovery in demand for transformation projects is expected to materialize in more ERP deals. Thus, buyers with significant ERP initiatives could witness higher prices in 2013.

So how can benchmarking exercises work to a buyer’s benefit?

Here is Everest Group’s take:

- Price benchmarks typically represent current market (or sometimes past) pricing. They can help identify whether a service provider has been, or is, over-charging. In many situations, buyers can realize more than 5-7 percent savings simply by calibrating their contracted prices per the benchmarks

- Where pricing is currently in line with the benchmarks but is due for revision, understanding the pricing outlook is most beneficial. However, this involves accurate assessment of multiple pricing drivers without which any forward-looking pricing discussion will be incomplete (and could leave the buyer out in the rain, sans umbrella.)