The global services space is complex and dynamic, impacted on a daily basis by developments and challenges – both natural and man-made – economic blips, corporate mergers, acquisitions, and divestitures, and so much more. Given this changeable nature, global services leaders are hard pressed to keep up with, much less make sense of, the global service delivery landscape.

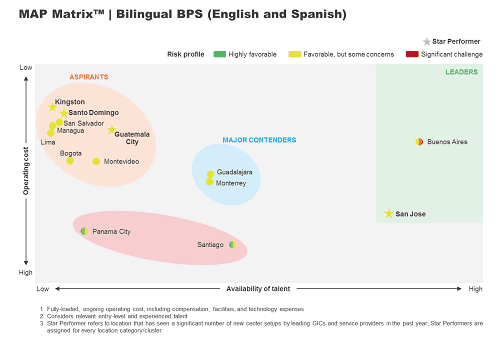

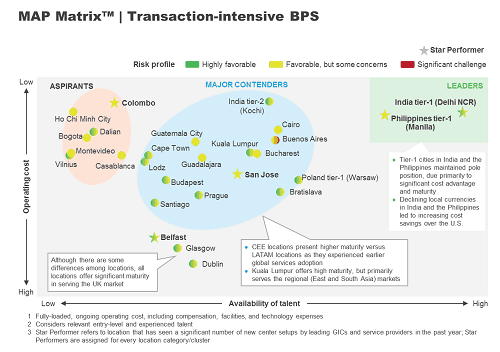

Everest Group’s MAP MatrixTM cuts through the clutter and helps guide decision-making. This framework categorizes service delivery locations based on operating cost, talent availability, and relative risk into three clusters, plus a bonus category:

Leaders: The most attractive locations, Leader locations are characterized by significant talent availability at comparatively low cost, but also high levels of competitive intensity.

Major Contenders: These locations offer an attractive mix of talent availability and cost efficiency, but not quite at the level of Leader locations.

Aspirants: Aspirant locations generally have low talent potential due to limited market activity and/or a constrained entry-level pool. They may offer relatively lower costs but also may require higher investment to develop talent.

Star Performer: This is the bonus category. A Star Performer is a location that has experienced significant new center set-up activity in the past year; Star Performers can fall into any one of the three clusters.

How does an understudy qualify as a star?

Given those definitions, people are often confused when we rate a location as both an Aspirant and a Star Performer; “how,” they ask, “can a low-potential location possibly perform at a ‘Star’ level?”

Here’s how. First, remember a Star Performer is not a location that shines brighter than all other locations; it is, simply, a location that has seen significant activity in recent years.

In 2015, in fact, three Aspirant locations (Kingston, Santo Domingo, and Colombo) also performed at the Star level.

Exhibit 1: MAP Matrix – Business Process Services (BPS) (English and Spanish)

There are many things about the Aspirant locations that make them attractive:

- They are compelling for companies that are primarily planning to establish small-scale delivery centers (<300 FTEs)

- These locations offer access to a significant bi-lingual, entry-level talent pool, enhanced by low competitive intensity for various business processes

- These cities provide comparatively low cost of operations

- They offer potential as “spoke” locations to complement nearby “hub” locations

- Their geographical and time zone-driven ease of business management may be attractive

Service providers are the growth engine in these locations as they try to drive lower overall cost of operations at the same time that they diversify their talent base in a relatively less competitive market.

Colombo, specifically, emerged as a Star Performer in the Aspirants cluster for delivery of transaction-intensive BPS, with significant new center set-ups in the past year.

Exhibit 2: MAP Matrix – Transaction-intensive BPS

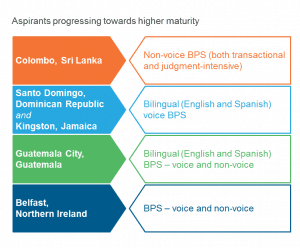

These locations’ talent profiles – as well as that of Guatemala City and Belfast – also fundamentally shifted, as they are moving up the value chain, especially for BPS delivery for both voice and non-voice processes and, in some cases, judgment-intensive processes (such as financial planning and analysis, analytics, and banking middle-office).

Exhibit 3: Aspirants progressing towards higher maturity

Given the dynamic nature of the global services market, not to mention the overall global economy, it is truly possible for Aspirants to perform at Star level.

For more insights on the global service delivery landscape, please see Everest Group’s Global Locations Annual Report 2015: Resurgence of Activity Amidst Evolving Propositions.