The clinical outsourcing market is undergoing a transition with the emergence of specialist-focused Clinical Research Organizations (CROs). A specialist CRO concentrates its expertise in a defined area, such as a therapeutic focus, trial phase or technology, or geographic niche, rather than offering broad, end-to-end services. These enterprises combine deep therapeutic expertise with enhanced operational capabilities, enabling life sciences enterprises to better manage growing trial complexity and expanding data volumes. As clinical outsourcing development evolves, enterprises are increasingly turning to these niche partners to strengthen execution and address specialized scientific and operational needs.

Reach out to discuss this topic in depth.

Why the need for specialist firms?

Clinical outsourcing development today faces heightened scientific, regulatory, and operational challenges that generalist CROs often struggle to meet. Trials are expanding globally, focusing on more complex therapeutic areas including gene therapy and rare diseases, and generating massive data volumes, while digital and decentralized approaches are reshaping study execution. These dynamics are fueling demand for CROs with targeted strengths. Key drivers include:

- Growing therapeutic complexity: Pharma enterprises prioritizing emerging therapeutic areas such as CNS and rare diseases face increasing complexity in early-phase programs, which demand advanced biomarker strategies and adaptive trial designs. Specialist CROs provide domain-specific expertise to minimize protocol amendments, shorten cycle times, and accelerate first-patient-in

- Rising data volumes: Biomarker-driven studies, genomics, and decentralized trials have increased adverse event (AE) data volume by 3-5 times. Legacy study data management workflows struggle to keep pace, causing costly delays in interim analyses and regulatory submissions. Specialist CROs leverage advanced data platforms and biostatistics to manage this complexity and deliver timely insights

- Regional trial execution: As multi-regional trials expand, patient recruitment timelines are extending by several months, delaying time-to-market. Specialist CROs that combine strong local site access with operational consistency across geographies enable faster enrollment and shorter overall development timelines

- Stringent regulatory scrutiny: With regulatory oversight intensifying across major markets, enterprises face higher risks of compliance gaps and approval delays. Specialist CROs with strong regulatory intelligence help reduce submission rejections, avoid costly resubmissions, and facilitate smoother interactions with health authorities

How are specialist firms building capabilities at scale?

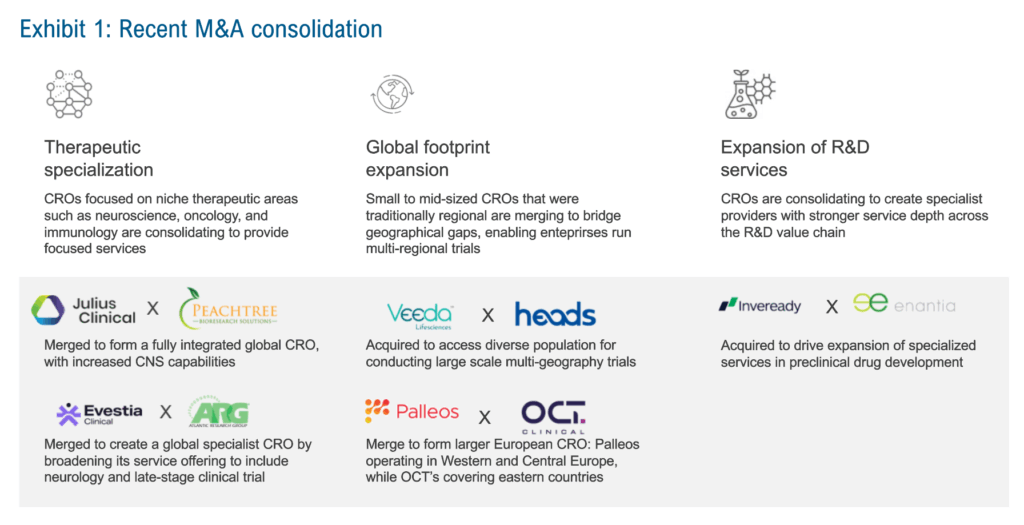

To expand capabilities, specialist CROs are engaging in mergers and acquisitions to integrate specialized players into more focused, scaled firms. This consolidation has created larger CROs that combine niche therapeutic knowledge with global operational reach, evolving into “specialists at scale.” These firms can deliver precision in therapeutic areas while executing complex, multi-regional studies. Exhibit 1 highlights recent M&A activity by specialist firms across three areas: therapeutic specialization, geographic footprint, and expansion of R&D services.

Exhibit 1: Recent M&A consolidation

Source: Everest Group

Looking ahead: What does it mean for sponsors?

For sponsors, CRO consolidation brings both depth in specialized capabilities and the advantage of operating at scale. This translates into stronger therapeutic alignment, broader site networks, and accelerated patient recruitment.

- Hybrid sourcing models: Sponsors will increasingly adopt blended approaches, partnering with specialist CROs for scientific design and strategy, while leveraging scaled FSP models for monitoring and data operations

- Data modernization: The rise of RWD/RWE and device-generated data will necessitate adaptive biostatistics and greater automation to enable real-time insights

- Increased localization: Geopolitical uncertainties and supply chain pressures will push enterprises to diversify and strengthen their geographic footprints

- Operationalizing gen AI and agentic AI: Sponsors will need to embed AI copilots and autonomous agents into trial design, monitoring, and regulatory workflows to outpace peers in speed and readiness

Going forward, sponsors that can combine the scale of CROs with specialized expertise will set the pace for the next era of clinical development.

If you found this blog interesting, check out our outsourcing perspective in life sciences: Cracking the Code: FSO vs FSP in the New Clinical Frontier| Viewpoint – Everest Group

To discuss clinical outsourcing trends in life sciences or other developments in clinical operations space, contact [email protected], [email protected], [email protected].