Geopolitical instability, economic shocks, technology disruption, and evolving Environmental, Social and Governance (ESG) expectations are no longer isolated events, with many asking…is outsourcing in a permacrisis?

They are concurrent, overlapping, and constantly changing the rules for how outsourced work gets delivered. In this environment, sourcing leaders are being forced to rethink what makes a supplier truly valuable.

Cost, coverage, and capability still matter, but they are not enough. What now defines supplier value is something more fluid, responsiveness to disruption, adaptability to tech shifts (especially Artificial Intelligence (AI)), and reliability under pressure.

That does not mean only sticking with incumbents. In categories where the risk profile has shifted, or where capabilities like generative AI (gen AI) or nearshore coverage are now table stakes, adding new partners absolutely makes sense. The key difference is that these decisions are no longer driven by preference or history, they are made based on fit-for-purpose value, risk coverage, and responsiveness to change.

Reach out to discuss this topic in depth.

In a permacrisis environment, the best supplier isn’t necessarily the biggest or cheapest. It’s the one that can flex when it matters most, and increasingly, that may include both familiar names, specialists and strategic newcomers.

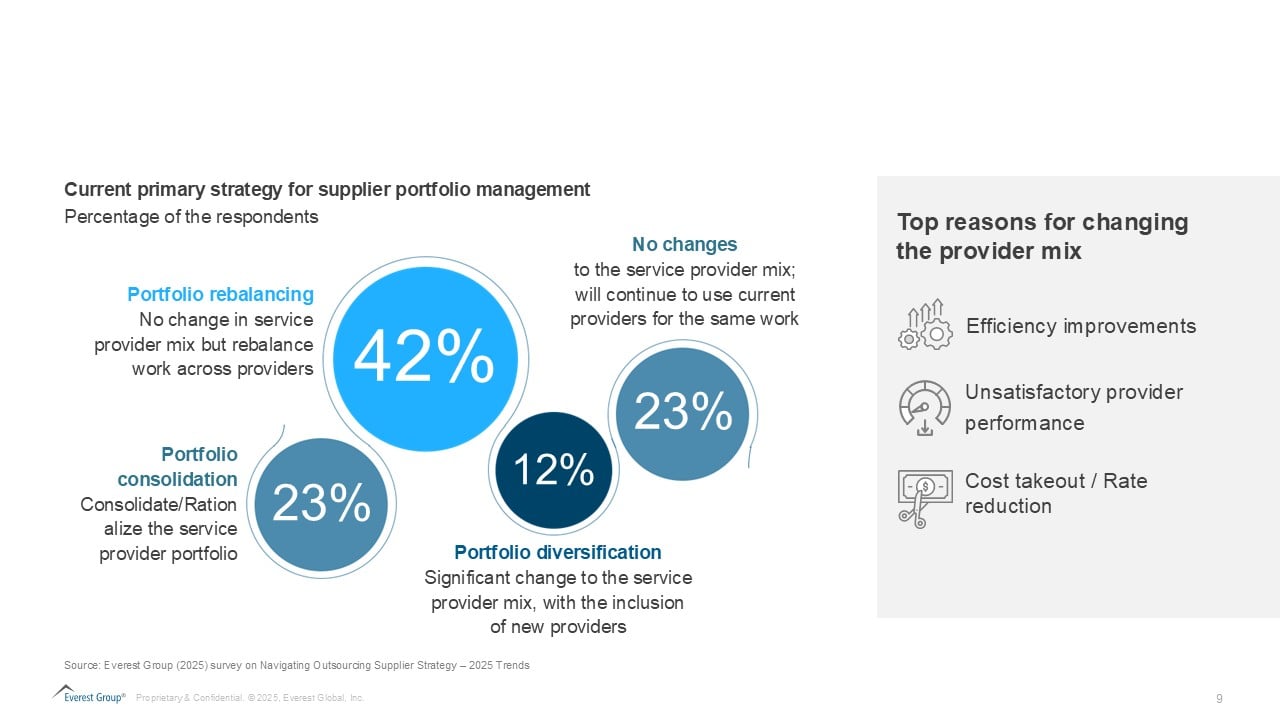

What we are seeing increasingly is that rather than replacing providers entirely, most organizations are shifting toward precision moves, rebalancing workloads, requalifying strategic vendors, and identifying performance gaps sooner. This is what we heard in one of the recent surveys conducted on Navigating Outsourcing Supplier Strategy:

- Leaders are not waiting for clarity, they are acting within ambiguity

One thing that stood out clearly in our recent research: the pressure to evolve is high, but the conditions are messy.

Decision-making is complicated by conflicting signals, gen AI opportunity vs. budget pressure, cost takeout vs. innovation, diversification vs. resilience.

And yet, action is happening. Most sourcing leaders are:

- Reviewing how their current supplier mix is distributed

- Mapping which partners are AI-ready (and which are not)

- Taking a harder stance on performance accountability

- Re-engaging governance models that had gone static

This is not transformation by design. It is optimization by necessity.

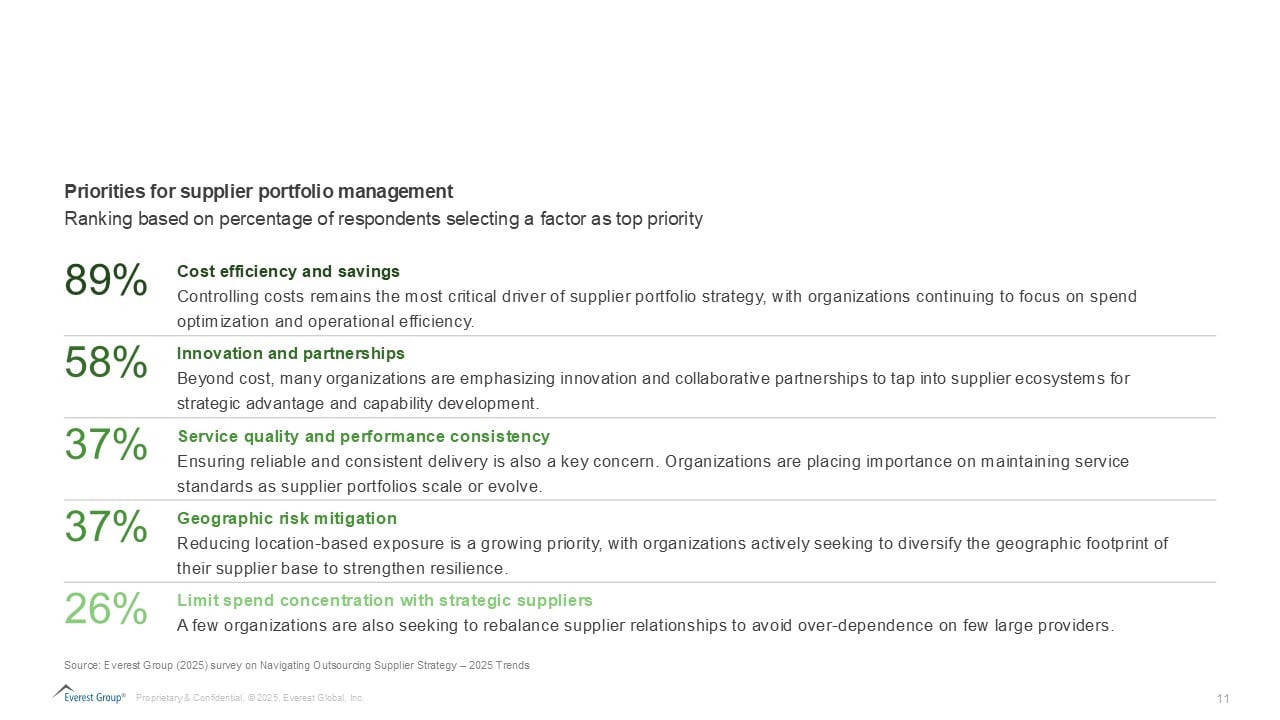

2. Cost still opens the door, but performance keeps it open

For years, supplier selection was driven by who could do the work cost-effectively. That hasn’t gone away. But today, the staying power of a partner depends on more than price. Sourcing leaders are holding providers to a higher bar on:

- Delivery consistency

- Innovation and digital maturity

- Flexibility in risk scenarios (e.g., location disruptions, resource shifts)

Providers are being retained not because they are cheaper, but because they can adapt when the context changes.

3. AI reinvention has made every sourcing conversation strategic

AI isn’t just a transformation layer; it’s a sourcing qualifier. Leaders are asking sharper questions:

- Are you embedding gen AI into delivery?

- Are we paying for capabilities you cannot yet execute?

- How are you validating outputs and managing Internet Protocol (IP) risk?

What we are seeing is a shift in what “strategic” means.

It’s no longer about multi-year roadmap alignment. It’s about how quickly a provider can plug into your AI stack, match your velocity, and stay audit-ready.

4. But blockers are real, and inside the organization

Despite good intentions, many sourcing teams are slowed by internal friction.

What is getting in the way:

- Resistance to shifting work away from legacy providers

- Lack of standardized, real-time performance data

- Governance models that do not scale across categories or geographies

Sourcing cannot move fast if it is arguing upstream. Without data-backed narratives, strategic moves get stalled in defensive conversations.

5. Scorecards are finally being taken seriously, and that is a good thing

Performance tracking is no longer a quarterly formality. It is becoming a live signal of who stays, who shifts, and who gets phased out.

Organizations are:

- Co-designing metrics with top-tier providers

- Using scorecards to inform real business decisions

- Creating feedback loops that influence retention and renewal cycles

In this way, governance is shifting from reporting to decision-making.

Smart suppliers mix strategy is no longer a transformation. It is a response system.

If there is one clear message from the data, it is this: the pace of supplier decision-making is accelerating, and the tolerance for low performers is shrinking.

Optimization is not a one-time event. It is a capability. And for sourcing leaders, that means building systems, scorecards, and stakeholder alignment that allow you to act when the moment demands it, not just plan when the conditions are perfect.

If you found this blog interesting, check out our The Rise Of Specialist Clinical Research Organizations (CROs) In Clinical Outsourcing | Blog – Everest Group, which delves deeper into the ever-evolving outsourcing landscape.

If you have more questions or want to discuss outsourcing in more depth, please contact Khushboo Hanjura ([email protected]).