From core software vendors joining forces to InsurTech startups consolidating for scale and survival, deal activity reflects a move toward purposeful integration over sheer volume. In this blog, we examine three archetypes of deals shaping the market, geographic nuances and introduce frameworks to analyze these moves.

We also highlight notable examples from the InsurTech ecosystem such as Guidewire–HazardHub, Duck Creek–Imburse and CCC–Safekeep, as well as discussing strategic drivers (capability expansion, platform integration, and geographic entry), all whilst exploring emerging themes (private equity roll-ups, cross-border buys).

Finally, we will predict how these trends point to an industry shift toward intelligent, composable insurance platforms.

Reach out to discuss this topic in depth.

Insurance technology Merger & Acquisition (M&A) archetypes

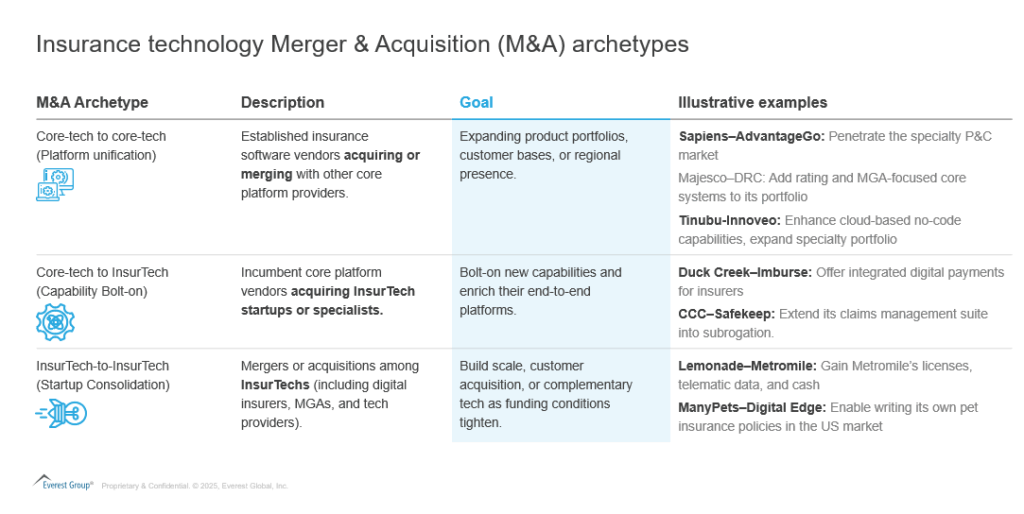

Industry M&A activity can be categorized into three core deal archetypes, each involving different players and strategic objectives, yet all contributing to the broader trend of ecosystem-building in insurance tech:

Each archetype reflects a different strategy:

- Core-tech marriages: Platform unification deals: Economies of scale & scope

These core-to-core deals align with a framework of horizontal integration, with providers aiming to become one-stop shops for insurers’ tech needs, a step toward the “composable platform” vision

- Core tech acquiring InsurTechs: Capability Bolt-Ons: Capability expansion

Incumbent providers leverage M&A to accelerate their roadmap: it’s faster to buy a proven tech than to build it. The end goal is often to build an integrated platform where additional capabilities (hazard scores, payment rails, subrogation artificial intelligence (AI), etc.) are embedded into the core workflow, delivering more value to customers and reducing the need for third-party integrations

- InsurTech-to-InsurTech: Consolidation for scale

The InsurTech-to-InsurTech deals are often about combining customer bases or capabilities to reach critical mass. Many later-stage startups faced a growth vs. profitability challenge, some, unable to secure new funding on favorable terms, opted to merge with peers or be acquired

M&A volume and value by region

- North America: Approximately 60–70% of insurance tech M&A deals have target companies based in North America. The US remains the largest hub for InsurTech activity, accounting for half of all InsurTech deals in Q1 2025. North American targets also represented the majority of disclosed deal value in this period, thanks to big-ticket transactions like Duck Creek (US$2.6 billion) and broker acquisitions in 2024

- UK and EU’s steady contribution: The UK and EU make up 30–40% of the deal volume. The UK is Europe’s leading InsurTech market, exemplified by deals like Sapiens–AdvantageGo (UK target) and ManyPets–Digital Edge (UK acquirer). Continental Europe saw fewer large deals, but notable ones include Verisk’s acquisition of Germany’s Rocket Software in 2024 and various Private Equirty (PE) investments in core tech firms (such as Europe’s Keylane was acquired by Pollen Street, a PE firm, in 2024). EMEA’s share of deal value fluctuated but included some significant transactions (such as Munich Re’s Digital Partners unit divesting Digital Edge to ManyPets)

- APAC and others: Asia-Pacific InsurTech M&A is growing from a small base, accounting for 1–3% of the global deal count in recent years. However, there are emerging signs of cross-border interest (e.g., an Indian Information Technology (IT) firm’s insurance software division might target SE Asian InsurTechs, or Japanese insurers investing in InsurTech firms). We anticipate the APAC’s share to rise as markets like India and Southeast Asia produce more scaled InsurTechs that attract global buyers

The following strategic imperatives consistently show up as motives across these deals:

- Capability expansion and innovation: Perhaps the strongest driver is the need to rapidly acquire new capabilities, be it advanced analytics, AI, digital engagement, or automation

- Product portfolio and composable platforms: Insurers are increasingly seeking composable platforms, modular solutions that can plug and play. M&A is enabling vendors to assemble these modular components under one roof and create a full-stack platform ecosystem. In doing so, they inch closer to providing the elusive end-to-end “one-stop” solution, while still allowing flexibility to clients

- Geographic and customer segment expansion: The following strategic moves reflect a buy vs. build vs. partner decision: to speed up entry into a market, buying a local player or a specialist often wins. Sapiens–AdvantageGo clearly helped it enter the Lloyd’s of London specialty sphere, Verisk’s acquisition of Rocket (a German InsurTech) for a deeper footprint in Europe, InsurTech ManyPets acquiring a US carrier is about geographic expansion (UK to US). On the customer segment side, Majesco–DRC was partly about going after smaller insurers/MGAs (a segment Majesco wanted to serve better)

- Scale and customer acquisition: Especially in the InsurTech-to-InsurTech consolidations, the motive is simply acquiring a competitor’s book of business or user base. With customer acquisition costs high in insurance, buying a competitor can be cheaper than organic growth in some cases. Lemonade essentially bought 100,000+ auto insurance customers from Metromile along with their data rather than spending years to acquire that many new customers outright. This driver ties into the long-term consolidation trend: as markets mature, a few platforms will accumulate the majority of clients

- Private Equity infusion: PE firms have been active acquirers of insurance tech companies, pursuing a roll-up strategy in many cases. For example, Vista’s Duck Creek buyout (2023) and Clearlake Capital’s string of acquisitions via Zywave and Advisen (creating an insurance distribution software powerhouse) are about financial sponsors building larger entities to realize value later. These PE roll-ups provide exit opportunities for founders/investors and often infuse the companies with capital for further acquisitions, continuing the cycle. Another theme is InsurTechs being acquired by insurers or reinsurers: e.g., Travelers acquiring cyber MGA Corvus in 2024 underscoring that traditional insurance players are also shopping for tech and digital capabilities, sometimes via their corporate venture or partnership arms

- Focus on Profitability and Core Business: By 2023, there was a noticeable shift in tone: InsurTech investors and boards pushed for sustainable growth and profitability. As a result, some non-core ventures were divested. For instance, Lemonade, right after buying Metromile, sold Metromile’s Enterprise SaaS platform to EIS (a core software firm), essentially shedding a non-insurance software business to focus on its main insurance operations. This indicates a rationalization where InsurTechs double down on what they do best and sell off or merge away the rest

Future outlook: Toward intelligent, composable platforms

As we look ahead, the trajectory of insurance tech M&A appears poised to continue, if not accelerate, under improving market conditions. Here are a few forward-looking predictions:

- Resurgence of deals in 2025: With valuations stabilizing, we expect more mid-sized strategic acquisitions as both insurers and tech vendors regain confidence to invest. The slight Year on Year (YoY) uptick in fintech M&A exits in 2024 hints at a broader recovery. In insurance tech, the pipeline of startups from the mid-2010s is now mature, they will either enter an Initial Public Offering (IPO) or seek acquisition

- Private Equity continues to hunt: Dry powder in private equity is abundant, and insurance software remains attractive for its recurring revenues. We will likely see more PE-led buyouts of both core tech vendors and larger InsurTechs, as well as bolt-ons by PE-owned platforms

- Cross-pollination of InsurTech and Fintech: The lines between InsurTech and fintech are blurring. Future M&A might bring in players from adjacent domains such as a banking software firm acquiring an InsurTech or vice versa, to create multi-vertical fintech platforms. Already, some insurance core vendors offer wealth or banking products and could seek acquisitions in those areas. On the flip side, insurance carriers might acquire fintech capabilities for embedded finance and insurance combos

- Rise of intelligent, composable Insurance platforms: The ultimate industry direction, and the overarching theme of these deals is convergence toward platforms that are both intelligent and modular. By intelligent, we mean leveraging AI, big data, and automation at their core; by modular (composable), we mean built as a set of interoperable services or Application Programming Interfaces (APIs). We expect acquirers to place even more emphasis on AI-powered InsurTechs to embed intelligence in their offerings

- Further consolidation – fewer, larger players: The market is moving from a fragmented set of point solution providers to a handful of ecosystem orchestrators. This could mirror other tech markets where giants emerge

In conclusion, the global insurance technology sector is undergoing a strategic realignment, with all signs pointing to an industry coalescing around more integrated and intelligent platforms. The message is clear, to deliver value to insurers in the next decade, vendors must offer solutions that are composable (modular and interoperable) yet comprehensive, and smart enough to automate complex insurance processes. Those who are leveraging M&A to assemble such end-to-end, AI-enabled ecosystems are likely to emerge as the powerhouses of the insurance IT market.

If you found this blog interesting, check out our AI Infusion In Private Equity: A $200 Billion+ Opportunity | Blog – Everest Group, which delves deeper into another topic regarding PE.

To learn more about Insurance technology, please contact Ronak Doshi, [email protected], Aurindum Mukherjee, [email protected], and Rugved Sawant, [email protected].