Accounting firms have long focused on their traditional roles – auditing financial statements, helping organizations meet tax and financial reporting requirements, and advising CFOs on finance operations. But there is a shift underway. Accounting firms are moving further along the value chain to run finance and accounting (F&A) as managed services. CFOs now expect advisors who also execute, seeking partners who design the target state and then run it day to day with clear accountability for results. Grant Thornton’s acquisition of Auxis is the latest example of this shift, signaling how accounting firms are investing in managed services and developing operational F&A capabilities. Learn what’s driving this shift and how it’s reshaping the delivery landscape.

Reach out to discuss this topic in depth

About the acquisition

Grant Thornton has acquired Auxis, an F&A provider known for delivering end-to-end managed services through a nearshore model in Latin America. The deal sits within Grant Thornton Advisors LLC, which provides business advisory and managed services, and operates alongside Grant Thornton LLP, the licensed CPA firm for attest work, under an alternative practice structure (APS) that separates attest from non-attest or managed services. This structure is widely used and supports growth in managed services while helping preserve auditor independence. Combined with the firm’s brand and CFO relationships, the acquisition provides a delivery backbone that complements advisory work and enables managed F&A services.

This deal reflects a broader shift: accounting firms are moving from short, project-based engagements to long-term managed services. This is not about adding capacity – it is a deliberate step to make managed services a key part of their finance offering.

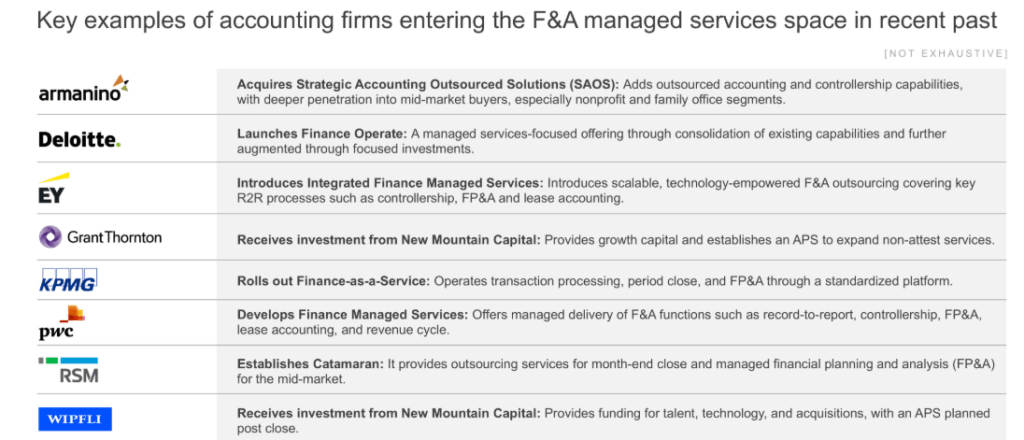

Before this deal, several accounting firms had already moved into managed F&A by buying providers, launching standardized operate offerings, and raising growth capital. Exhibit 1 shows representative examples.

EXHIBIT 1

Source: Everest Group (2025)

Why accounting firms are expanding into managed services

- Shift toward recurring, scalable revenue

Traditional accounting offerings, such as audit and tax, remain cyclical and fee-regulated. Advisory services have seen growth but remain largely project-based. Managed services introduce long-term margin accretive revenue streams that are scalable and offer stronger cross-selling potential.

- White space in the mid-market

While traditional finance and accounting outsourcing deals have been led by large enterprises, demand from mid-market buyers is growing. These enterprises value domain depth and governance rigor – areas where accounting firms excel. This shift opens a segment of the market that has historically been underserved by large BPOs.

- Advisors must execute and own outcomes

CFOs now expect advisors to run finance and be accountable for results. That requires an operating backbone. Providers are building balanced shoring models: offshore centers for scale and cost, with nearshore or onshore teams for controls, collaboration, and final steps of delivery. Standard methods and automation connect the work, so managed services run reliably with clear ownership and lower unit cost.

- Embedded access to the CFO organization

Accounting firms already sit close to the CFO’s office through audit relationships, risk advisory, and controllership support. Extending into managed services in controllership, reporting, and FP&A builds on this trusted position – making them natural partners for outcome-driven finance operations.

What does this mean for the ecosystem?

As traditional accounting firms move into operational delivery, competitive dynamics in FAO are shifting. Here is what is changing and what CFOs and providers should watch.

- Buyers have more options and more choices to weigh

CFOs can now choose from three broad provider types:

– Traditional BPOs (Accenture, Genpact, Infosys) offering transformational delivery

– Niche FAO specialists with depth in specific industries or processes

– Accounting firms now offering advisory and managed services in one package

This expands choice but also complicates evaluation. CFOs must weigh scale, domain depth, transformation capability, and trusted relationships.

- Capability convergence is intensifying competition

Advisory and managed delivery are converging. Accounting firms are adding run operations, and BPOs are building consulting and industry depth. As portfolios overlap, competition will intensify, especially in mid-market and transformation-led deals. BPOs should re-evaluate partnerships with software vendors and systems integrators to close gaps and defend share

- Independence and vendor management

When an accounting firm provides both audit and managed F&A, enterprises should require the provider to set clear scope and boundaries, maintain legal separation between the attest and manages service work, and document conflict checks. Providers should implement and evidence these controls with governance, role-based access, and defined escalation so delivery does not compromise independence.

Accounting firms moving into managed F&A is not a passing experiment – it is becoming the new normal. What began as project-based advisory is now shifting toward long-term delivery under service-level commitments. Advisory and execution are converging as CFOs increasingly buy outcomes and not just recommendations. Scale and consistency remain the test.

Winners in this space will be enterprises that are tech-native, using AI, automation, and analytics to change business outcomes. They will differentiate through specialization, either by industry or processes. They will also run scaled nearshore and offshore centers and tightly link consulting with daily execution to outcomes.

This shift will reward disciplined buyers and committed providers. For CFOs, the test is clear: probe proposals on delivery depth, governance rigor, and outcome commitments.

If you have any questions or want to discuss the details of this acquisition or the broader shift in F&A delivery in more depth, please contact Vignesh K ([email protected]), Smarajeet Das ([email protected]), and Fahad Ahmad ([email protected]).

See the latest Finance and Accounting Outsourcing (FAO) PEAK Matrix® Assessment 2025 to discover the leading service providers that these accounting firms will face as competition as they expand into the F&A managed services market.