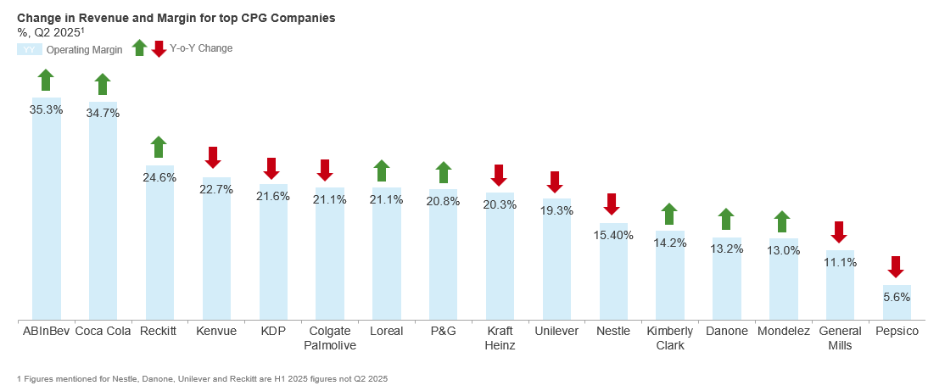

The latest earnings season for leading Consumer Packaged Goods (CPG) companies underscores a familiar reality: volume growth remains pressured, while value growth continues to hold.

Reach out to discuss this topic in depth.

As illustrated in the recent “Volume vs. Value Growth” scatter, many CPG majors are clustered in the “value up, volume down” quadrant, highlighting the resilience of pricing and mix strategies even as consumer volumes soften.

The consistent message across earnings calls is that CPG companies are not chasing volume at any cost. Instead, they are prioritizing margin protection, brand equity, and value creation. This deliberate trade-off reflects a clear strategic shift: profitability over sheer scale.

Tariffs have dominated boardroom conversations of CPG firms throughout 2025 as well, as shown below.

- Q1 2025: Companies flagged tariffs as a fresh and material cost headwind, especially on packaging and certain cross-border inputs. Colgate estimated a $200M impact on Cost of Goods Sold (COGS), Kimberly-Clark highlighted ~$300M in gross exposure, and beverages players like Coca-Cola and PepsiCo called out aluminum inflation

- Q2 2025: With exemptions and sourcing shifts, many firms adjusted expectations but stayed wary of ongoing uncertainties

The impact of tariffs is lower than initially estimated, but enterprises remain cautious going forward. However, enterprises are proactively deploying strategies to soften the blow.

Moreover, recent structural moves have stood out in the CPG industry this year, with notable highlights including:

- Kraft Heinz split: By separating growth-oriented businesses from cash-generative ones, Kraft Heinz is embracing the dual-speed nature of its portfolio. This restructuring mirrors its quarterly performance – volume softness alongside stable value capture – and signals sharper capital allocation

- KDP’s acquisition of JDE Peet: The partnership strengthens coffee, one of the most resilient and value-accretive categories. Coffee remains an “affordable luxury” for consumers, and this deal highlights where companies see durable growth

- Nestlé, PepsiCo, and Reckitt’s portfolio restructuring: Nestlé spun off its Waters business in 2025 as part of a broader portfolio streamlining strategy. PepsiCo exited Rockstar Energy in North America in 2025, five years after acquiring it in 2020, to realign focus on stronger growth categories. In July 2025, Reckitt announced plans to divest its Essential Home business along with its listed nutrition (Mead Johnson) as it marked it “non-core” after a strategic review

Companies are actively streamlining their brand portfolio, driven by the dual need to sharpen strategic focus and improve operational efficiency. They are exiting low-margin or non-core categories and geographies while doubling down on brands with stronger growth and profitability profiles.

Firms are not only defending margins, but they are also investing to reshape their future competitiveness. Key themes include:

- Product and innovation – generative AI for product ideation, virtual testing, and packaging optimization

- Consumer engagement and marketing – Hyper-personalized campaigns, automated creative, and AI agents for real-time interactions

- Revenue Growth Management (RGM) – Price Pack Architecture and Trade Promotion Optimization (TPO) for Artificial Intelligence (AI)-driven analytics to target elasticity effectively

Considering macroeconomic factors and industry churn, the following outlook captures the key shifts for the CPG industry in 2026:

- Expect continued Mergers & Acquisition (M&A) and divestitures as companies streamline portfolios, exit non-core brands, and double down on high-growth categories

- Increased investments on AI-led Revenue Growth Management (RGM) to navigate margin pressures, tariff risks, and changing consumer behaviors

This provides service providers an opportunity to pitch in their transformation journey by aligning with CPG priorities.

- Showcase AI-powered RGM solutions as CPGs seek partners to balance short-term margin protection with long-term digital transformation

- Adjust to demands for blended sourcing strategies that integrate Information Technology (IT), digital, and operational services under a unified roadmap

- Display strong AI-based use cases that are most relevant to enterprises such as demand forecasting, customer engagement, and supply chain management that boost brand loyalty and efficiency

If you found this blog interesting, check out our recent blog focusing on The Power of Pricing in the Success of CPG Brands: 2025 and Beyond, which delves deeper into a similar topic relating to CPGs.

We are actively tracking the evolution of revenue growth management solutions and will be publishing a Tech provider Spotlight report analyzing the capabilities of the leading providers in the market.

To discuss the latest trends and their implications for CPG brands, retailers, technology vendors, and service providers, feel free to reach out to Abhilasha Sharma ([email protected]), Abhishek A.K ([email protected]) and Nabeel Bhattacharya ([email protected]).