This blog kicks off a three-part series on one of the most dynamic segments in the sustainability tech market: carbon accounting platforms. If you’re looking to understand where the space is heading – from strategic use cases to market-shaping trends and what makes a platform enterprise-ready – this is a series to watch.

As corporate sustainability ambitions mature, carbon management is shifting from a compliance task to a strategic business driver. Companies representing two-thirds of global market capitalization now report environmental data through CDP, often achieving a 7–10% reduction in direct emissions within two years of investor engagement.

Everest Group’s ESG Data Management Platform PEAK Matrix® Assessment 2024 estimates the ESG software market at over US$15 billion, with adoption expanding across sectors and geographies.

At the center of this growth are carbon accounting platforms, which are rapidly advancing to deliver operational intelligence, risk mitigation, and enterprise value.

In this blog, we explore how carbon accounting platforms are adapting to meet growing enterprise needs, and how platform providers can align with emerging demands.

What defines a carbon accounting platform?

While most ESG platforms began as data repositories and reporting tools, carbon accounting platforms focus narrowly on enterprise-wide decarbonization planning and execution.

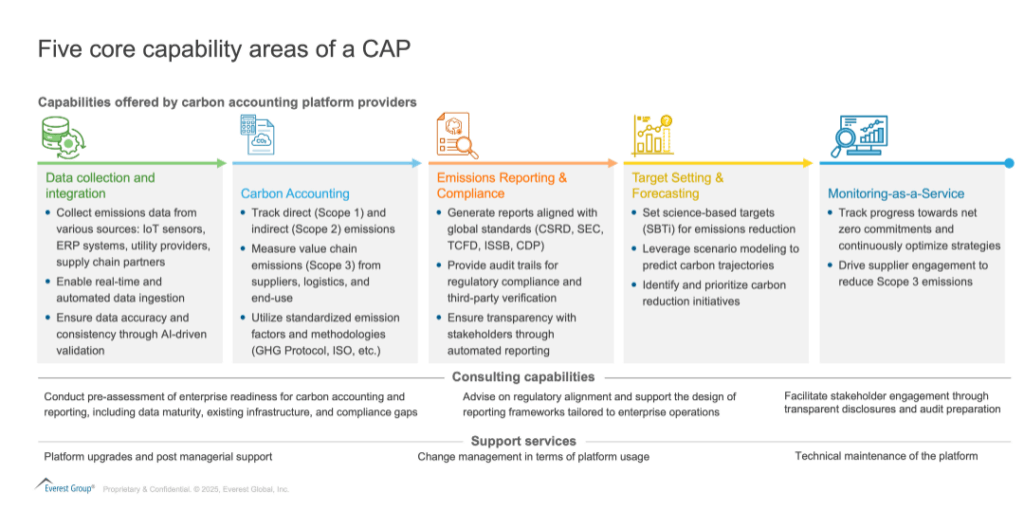

A carbon accounting platform encompasses five core capability areas:

As enterprises advance in their decarbonization journeys, carbon accounting platforms serve not merely as compliance enablers but as critical infrastructure to achieve net zero goals:

- Turn emissions data into actionable intelligence: carbon accounting platforms serve as the analytical backbone of decarbonization initiatives by:

- Linking carbon data with financial, operational, and procurement metrics, helping identify high-emission activities and predict the associated cost of reducing emissions

- Enabling scenario planning, allowing companies to simulate the impact of operational changes, supplier shifts, or procurement decisions on emissions pathways

- Supporting capital allocation, by evaluating ROI for decarbonization investments such as electrification, renewable energy procurement, or process redesign

This moves carbon accounting platforms from data repositories to business intelligence tools, helping companies optimize their path to net zero. For example, platforms like Emitwise embed AI-driven modeling and forecasting engines that allow enterprises to simulate multiple decarbonization scenarios based on granular Scope 1–3 data inputs.

- Operationalizing Scope 3 engagement: Scope 3 emissions typically account for 70–90% of an enterprise’s total footprint, yet they remain the most difficult to measure and reduce. Carbon accounting platforms are uniquely positioned to operationalize Scope 3 decarbonization by:

- Integrating supplier-specific data sources, enabling accurate attribution of emissions

- Segmenting supplier categories based on emissions intensity and enterprise’s ability to influence them

- Automating engagement workflows, including data requests, surveys, and mitigation nudges

Watershed, for example, uses a proprietary emissions database (CEDA) and supplier-specific emissions modeling to offer highly granular Scope 3 insights, empowering clients to prioritize reduction efforts where it matters most.

- Enabling regulatory-grade reporting and auditability: With frameworks such as CSRD, ISSB, and SEC climate disclosure rules coming into force, companies must ensure their carbon data is not only complete but assurable. Carbon accounting platforms enable this by:

- Providing automated audit trails, including methodology documentation and data lineage

- Aligning emissions data with reporting frameworks in real time

- Supporting gap filling and data confidence scoring to ensure readiness for limited and reasonable assurance requirements

SAP’s recently launched Green Ledger demonstrates how carbon data is being integrated into ERP systems, elevating emissions tracking to the level of financial record-keeping.

- Scaling and localizing decarbonization efforts: carbon accounting platforms also enable large, global enterprises to tailor their decarbonization strategies to regional policies, energy markets, and supplier ecosystems, helping them:

- Model decarbonization pathways across business units or geographies

- Account for regional differences in grid intensity, carbon pricing, and policy incentives

- Align emissions reduction with localized stakeholder priorities, such as regulatory mandates or investor expectations

This scalability makes carbon accounting platforms especially valuable for multinationals operating across heterogeneous regulatory landscapes.

“We’re dealing with some real challenges when it comes to compiling all that carbon data. It’s like trying to find our way through a maze with all this information. But we’re committed to using this data to steer us toward a more responsible organization, making transparency and innovation our key tools in this journey.”

– Sustainability head, global petrochemical company

The evolution of carbon accounting platforms: a 5-stage maturity model

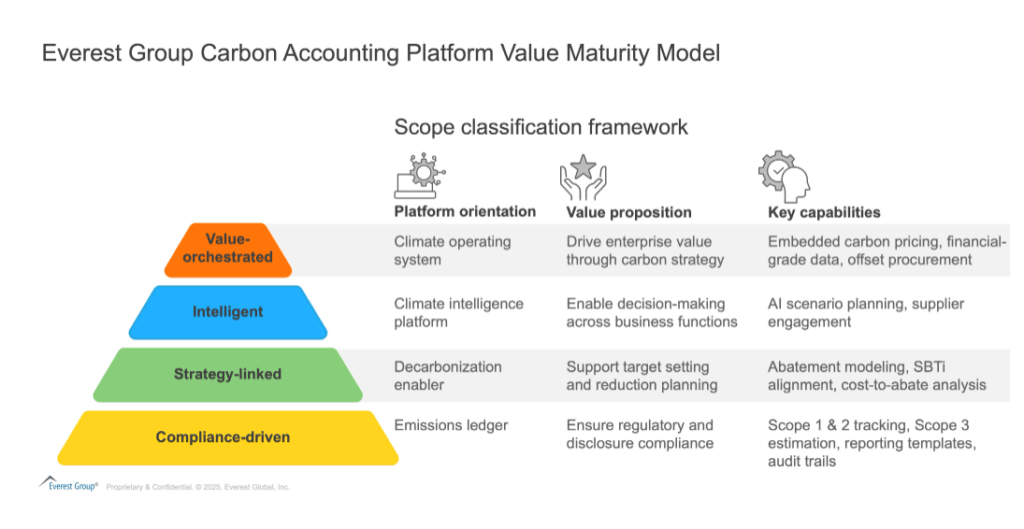

As regulatory, operational, and investor expectations escalate, carbon accounting platforms are evolving from standalone tools for emissions reporting to enterprise operating systems for carbon and climate performance.

This evolution can be summarized by Everest Group’s Carbon Accounting Platform Value Maturity Model:

Everest Group Carbon Accounting Platform Value Maturity Model

As enterprises advance their net zero strategies, the value they derive from carbon accounting platforms increasingly depends on the platform’s ability to move beyond compliance and reporting toward forecasting, supplier engagement, and capital planning.

Final thoughts

Carbon accounting platforms are no longer optional. They are becoming the digital nervous system for net zero execution.

For tech providers, this is a moment to redefine the value proposition from “we help you measure emissions” to “we help you manage carbon as a business lever.”

For enterprises, the key question is no longer “Do we have carbon data?,” rather “Can we act on it with confidence?”

This blog kicks off our three-part series on the future of carbon accounting platforms. Next, we’ll explore the key trends reshaping the carbon accounting platform landscape, followed by what it takes for a platform to be enterprise-ready in today’s rapidly evolving environment. Stay tuned.

If you have any questions regarding this blog or would like to discuss any of the topics discussed in more depth, please contact Ambika Kini ([email protected]) and Arpita Dwivedi ([email protected]).